Top 5 Medical Malpractice Insurance Carriers in Washington, D.C.

We recommend carriers with an AM Best “A” or higher rating. An A-rating indicates financial strength, long-term solvency, and an established history of protecting D.C. physicians.

2025 Washington D.C. Malpractice Insurance Rates by Specialty

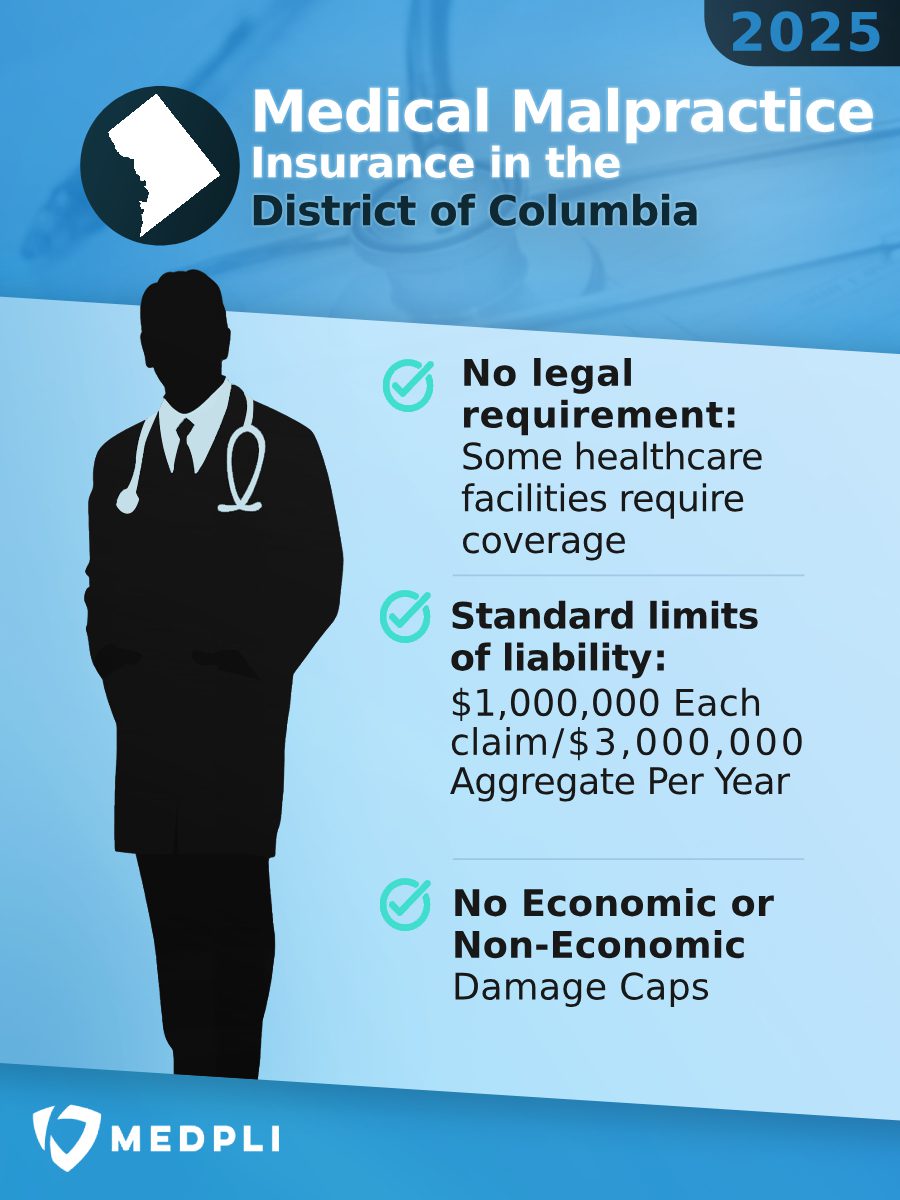

These rate estimates are for informational purposes only and are based on the D.C. standard limits of $1,000,000 per claim / $3,000,000 aggregate per year in coverage.

Quotes require a completed application and approval from the underwriter. Contact us for a custom estimate if you don’t see your specialty.

| Specialty | 2025 Annual Premium |

2025 Tail Premium |

|---|---|---|

| Anesthesiology | $32,000 | $64,000 |

| Cardiovascular Disease– Minor Surgery | $33,000 | $66,000 |

| Dermatology– No Surgery | $15,000 | $30,000 |

| Emergency Medicine | $55,000 | $110,000 |

| Family Practice– No Surgery | $19,000 | $38,000 |

| Gastroenterology– No Surgery | $29,000 | $58,000 |

| General Practice– No Surgery | $19,000 | $38,000 |

| General Surgery | $72,000 | $144,000 |

| Internal Medicine– No Surgery | $19,000 | $38,000 |

| Neurology– No Surgery | $22,000 | $44,000 |

| Obstetrics and Gynecology– Major Surgery | $140,000 | $280,000 |

| Occupational Medicine | $14,000 | $28,000 |

| Ophthalmology– No Surgery | $15,000 | $30,000 |

| Orthopedic Surgery– No Spine | $65,000 | $130,000 |

| Pathology– No Surgery | $18,000 | $36,000 |

| Pediatrics– No Surgery | $19,000 | $38,000 |

| Pulmonary Disease– No Surgery | $32,000 | $64,000 |

| Psychiatry | $14,000 | $28,000 |

| Radiology – Diagnostic | $33,000 | $66,000 |

Washington D.C. Medical Malpractice Payouts From 2015-2024

The Hidden Link Between Weather Disasters and Rising Malpractice Insurance Rates

When tropical storms, winter storms, and other severe weather events hit, the damage isn’t just physical; it drives up insurance costs nationwide. As extreme weather events become more frequent, insurers raise rates to cover growing risks. But the impact goes beyond homeowners insurance; businesses, especially medical professionals, also feel the squeeze.

Why Are Insurance Rates Rising?

How the District of Columbia’s Medical Malpractice Rates Are Impacted

Reinsurance providers now charge higher premiums and impose stricter payout conditions. In response, primary insurers, including those offering medical malpractice coverage in the District of Columbia, have increased premiums.

Severe weather isn’t just a coastal problem; it’s reshaping insurance costs for everyone.

Types of Professional Liability Insurance for D.C. Physicians

Types of Professional Liability Insurance for D.C. Physicians

Doctors in the District of Columbia can choose between these two primary types of medical malpractice insurance:

- Provides coverage for incidents that occurred during the policy period, IF the claim is filed while the policy is still active. If a claim is filed after the policy has ended, that claim is NOT covered.

- Typically, it offers lower premiums at the start of the policy, but rates increase yearly as the policy matures.

- Physicians must obtain tail insurance coverage when a claims-made policy ends to ensure protection against future claims related to incidents that occurred during the policy period. Tail insurance premiums require a one-time cash payment equal to approximately 200% of the claims-made policy’s annual premium.

- Provides coverage for incidents that occurred during the policy period, regardless of when a claim is reported to the carrier.

- Typically, it offers more costly premiums at the start of the policy, but the rate stays constant throughout the policy’s duration.

- Physicians do not need tail coverage when an occurrence policy ends.

In 2024, D.C. physicians were held liable for 25 medical malpractice payouts.

- Average Payout: $1,145,730

- Total Payout: $28,643,250

(Source: National Practitioner Data Bank)

Does Washington, D.C. Have Damage Caps for Medical Malpractice Lawsuits?

Unlike in many states, D.C. legislation does not have economic or non-economic damage caps for medical malpractice cases.

Key Rules & Exceptions

-

-

-

-

- Excessive Verdict Rule: Though there is no official damage cap, a judge can deem a wrongful death verdict excessive and order a reduction in damages.

- Notice of Intent: Claimants must provide defendants at least 90 days’ notice before filing a medical malpractice claim in court. The notice must include a legal basis for the claim and the extent of the injury/loss.

- Initial Scheduling and Settlement Conference (ISSC): The first formal hearing, the ISSC, includes discussion of timelines and procedures before a judge. This is intended to provide parties with the opportunity to settle their case before further litigation.

- Mandatory Mediation: Within 30 days after the ISSC, and before full litigation, court-required mediation must be completed, with both parties present. This is another effort to bring early settlement. Unless otherwise agreed upon by both parties, discovery (interrogations, depositions, document requests, etc.) can’t take place before or during mediation.

- Inadmissibility of Benevolent Gestures: Expressions of sympathy or regret made by healthcare providers are inadmissible as evidence of liability in medical malpractice cases.

-

-

-

D.C. Statute of Limitations for Medical Malpractice Claims

The District of Columbia Code states that a medical malpractice claim must be filed within 3 years after the injury.

Exceptions:

- Minors: The statute begins when the plaintiff reaches the age of 18.

- Disablement or Imprisonment: If the plaintiff’s mental state/disability or imprisonment would prevent them from bringing forth the suit, the statute begins when the disability is removed.

- Notice of Intent: If you serve the required notice within 90 days before the statute of limitations expires, you get an extra 90 days from the notice date to file your lawsuit.

- Absence or Concealment: If the defendant leaves D.C. or intentionally conceals themselves, the period of absence or concealment is excluded from the statute of limitations.

Is D.C. a Physician-Friendly Place to Practice?

Washington D.C. offers some big advantages for physicians:

However, when it comes to medical malpractice, D.C. faces its own challenges. It doesn’t have damage caps and generally lacks tort reform, both of which can expose physicians to higher payouts and increased malpractice premiums.

Washington D.C. doctors can benefit from working with a knowledgeable malpractice insurance broker to stay protected and manage rising costs. MEDPLI helps physicians find the right coverage at the best possible rate, bringing peace of mind in an unstable legal environment.

Washington D.C. Doctors Partner with MEDPLI

We exclusively broker medical malpractice insurance, focusing daily on making the professional liability process less burdensome and expensive for doctors.

With MEDPLI, D.C. physicians:

MEDPLI helps doctors in every specialty.

Whether you’re a Bariatric Surgeon in Capital Hill or a Dermatologist in NW, MEDPLI will find you premier coverage at a competitive rate.

Call 800-969-1339 or Request a Quote.

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

Read 2026 Washington medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

See 2026 Massachusetts medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

GUIDE: Overview of Arizona medical malpractice insurance rates by specialty, top carriers, payout statistics & state regulations. Get a custom quote here.

See 2026 Virginia’s medical malpractice insurance guide for the latest rates by specialty, top carriers, payouts & state regulations. Get your quote today.