Top 5 Malpractice Insurance Carriers in Massachusetts

We recommend carriers with an AM Best “A” or higher rating. An A-rating indicates financial strength, long-term solvency, and an established history of protecting Massachusetts physicians.

2025 Massachusetts Malpractice Insurance Rates by Specialty

These rate estimates are for informational purposes only and are based on the MA standard limits of $1,000,000 for Each Claim / $3,000,000 Aggregate per year in coverage.

Quotes require a completed application and underwriter approval. Contact us for a custom estimate if you don’t see your specialty.

| Specialty | 2025 Annual Premium |

2025 Tail Premium |

|---|---|---|

| Anesthesiology | $20,000 | $40,000 |

| Cardiovascular Disease– Minor Surgery | $20,000 | $40,000 |

| Dermatology– No Surgery | $7,000 | $14,000 |

| Emergency Medicine | $29,000 |

$58,000 |

| Family Practice– No Surgery | $14,000 | $28,000 |

| Gastroenterology– No Surgery | $16,000 | $32,000 |

| General Practice– No Surgery | $14,000 | $28,000 |

| General Surgery | $42,000 | $84,000 |

| Internal Medicine– No Surgery | $14,000 | $28,000 |

| Neurology– No Surgery | $17,000 |

$34,000 |

| Obstetrics and Gynecology– Major Surgery | $75,000 | $150,000 |

| Occupational Medicine | $7,000 | $14,000 |

| Ophthalmology– No Surgery | $8,000 | $16,000 |

| Orthopedic Surgery– No Spine | $39,000 | $78,000 |

| Pathology– No Surgery | $11,000 |

$22,000 |

| Pediatrics– No Surgery | $10,000 | $20,000 |

| Pulmonary Disease– No Surgery | $17,000 | $34,000 |

| Psychiatry | $8,000 | $16,000 |

| Radiology – Diagnostic | $17,000 | $34,000 |

Massachusetts Medical Malpractice Payouts From 2015-2023

Types of Professional Liability Insurance for Massachusetts Physicians

Physicians in Massachusetts can choose between these two primary types of medical malpractice insurance:

- Provides coverage for incidents that occurred during the policy period IF the claim is filed while the policy is still active. If a claim is filed after the policy ends, that claim is NOT covered.

- Typically, it offers lower premiums at the start of the policy, but rates increase yearly as the policy matures.

- Physicians must obtain tail insurance coverage when a claims-made policy ends to ensure protection against future claims related to incidents that occurred during the policy period. Tail insurance premiums require a one-time cash payment equal to approximately 200% of the claims-made policy’s annual premium.

- Provides coverage for incidents that occurred during the policy period, regardless of when a claim is reported to the carrier.

- Typically, it offers more costly premiums at the start of the policy, but the rate stays constant throughout the policy’s duration.

- Physicians do not need tail coverage when an occurrence policy ends.

In 2023, Massachusetts physicians were held liable for 190 medical malpractice payouts.

- Average Payout: $772,084

- Total Payout: $146,696,000

(Source: National Practitioner Data Bank)

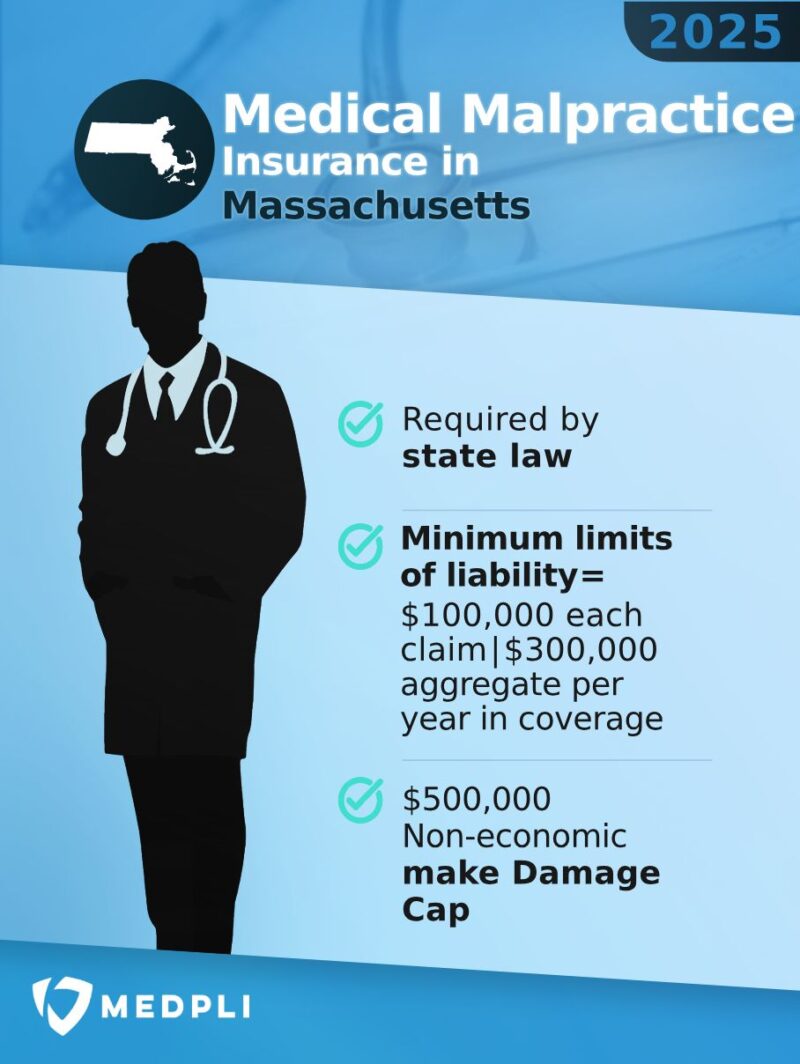

Does Massachusetts Have Damage Caps for Medical Malpractice Lawsuits?

While Massachusetts does not cap economic damages, medical malpractice cases are subject to a non-economic damage cap of $500,000 unless the case involves permanent loss of bodily function, disfigurement, or special circumstances as determined by the court.

Massachusetts Statute of Limitations for Medical Malpractice Claims

According to Massachusetts General Law, the statute of limitations for medical malpractice claims is three years from the date of injury, wrongful death, or discovery of the injury.

Exceptions:

- Medical malpractice claims cannot be filed more than 7 years after the injury unless the cause of harm is leaving a foreign object inside the plaintiff’s body.

- For minors younger than age 6, the limitations are extended until age 9.

Why Massachusetts Doctors Partner with MEDPLI

We exclusively broker medical malpractice insurance, focusing daily on making the professional liability process less burdensome and expensive for doctors.

With MEDPLI, Massachusetts physicians:

MEDPLI helps doctors in every specialty.

Whether you’re a General Surgeon in Boston or a Pediatrician out on the Cape, MEDPLI will provide you with premier coverage at a competitive rate. Call 800-969-1339 or Request a Quote.