Florida is a Destination for World-Class Neurosurgery

Seventeen neurosurgery programs in Florida are ranked by U.S. News & World Report as being among the best in the United States. Florida’s world-class neurosurgeons are pioneering advanced techniques, such as 3D inter-operative imaging, deep brain stimulation systems, and awake craniotomies. These highly delicate and complex surgeries can be lifesaving, but also heighten the risk of iatrogenic surgical errors and post-operative complications.

Florida is among the top three U.S. states with the most medical malpractice payouts on record, totaling nearly $10.6 billion over the last 20 years, according to statistics from the National Practitioner Data Bank.

That’s why even the best Florida neurosurgeons need robust medical malpractice insurance.

As your only trusted broker, MEDPLI will help you find the right coverage at the best rate in Florida.

Get A Quote

If you are a Florida neurosurgeon in private practice, or planning to open a new practice in Florida, use this guide prepared by independent MEDPLI insurance brokers to give you a concise overview of medical malpractice insurance. Then contact a MEDPLI insurance broker to discuss your coverage needs and get a quote.

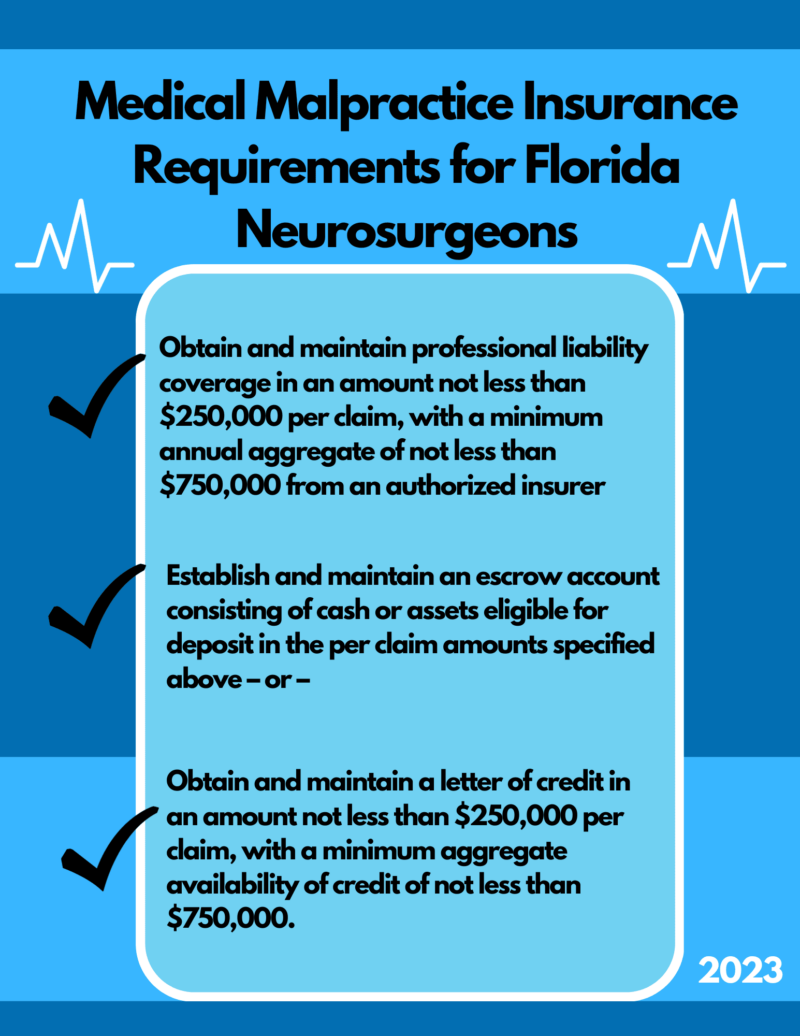

Medical Malpractice Insurance Requirements for Florida Neurosurgeons

Florida does not legally require neurosurgeons, and physicians in general, to carry medical malpractice insurance. However, in order to be licensed to practice in Florida, the Florida Board of Medicine requires physicians to establish financial responsibility in one of the following ways:

- Obtain and maintain professional liability coverage in an amount not less than $250,000 per claim, with a minimum annual aggregate of not less than $750,000 from an authorized insurer – or –

- Establish and maintain an escrow account consisting of cash or assets eligible for deposit in the per claim amounts specified above – or –

- Obtain and maintain a letter of credit in an amount not less than $250,000 per claim, with a minimum aggregate availability of credit of not less than $750,000.

The standard limits of liability in Florida are $250,000 Each Claim / $750,000 Aggregate per year in coverage.

MEDPLI strongly recommends securing coverage from an A-rated carrier as the most cost-effective way to protect against devastating financial loss if you are sued for malpractice in Florida. As an independent broker, we specialize in medical malpractice insurance for neurosurgeons. We can help you find the best coverage at a great price.

Types of Professional Liability Insurance for Florida Neurosurgeons

Here is an brief overview of the most common types of medical malpractice insurance for neurosurgeons in Florida:

1. Claims Made Insurance

Claims-made malpractice insurance provides coverage if the policy is in effect both when the incident took place AND when the claim is filed. If a claim is filed after the end of the policy date, the claim is NOT covered. With a claims-made policy you need tail malpractice insurance, which is a separately purchased insurance policy or endorsement, to make sure you have full protection. Learn more about claims-made insurance here.

2. Occurrence Insurance

Occurrence malpractice insurance provides coverage for incidents that occurred during the policy year, regardless of when a claim is reported to the carrier. Occurrence policies are more costly at the start of the policy, but the rate stays the same for the length of the policy, and there is no need for tail coverage when the policy ends. Read more about occurrence insurance.

3. Tail Insurance

Since most malpractice insurance policies are underwritten on a claims-made basis, you will be exposed to a lawsuit if a former patient files a claim against you and you do not secure tail coverage. When you are preparing to leave your employer, you should seek tail coverage options with an independent broker like MEDPLI. Tail insurance covers you for a specific time period. The new employer’s policy is not going to cover you for prior acts of a former practice, hence tail coverage is needed. Read more about tail malpractice insurance.

Reach out to an experienced MEDPLI insurance broker who will do all of the work for you to find a tail policy at a great price.

Let a MEDPLI Broker Help You Choose the Best Policy for Your Practice

Every medical specialist’s situation is unique, so we recommend a conversation with a MEDPLI insurance broker to the discuss the unique needs of your Florida neurosurgery practice.

Your MEDPLI insurance broker will explain the benefits and limitations of each type of medical malpractice insurance to ensure you get the right type and amount of coverage for your neurosurgery specialty.

Get Quotes from A-rated Carriers Serving Florida Neurosurgeons

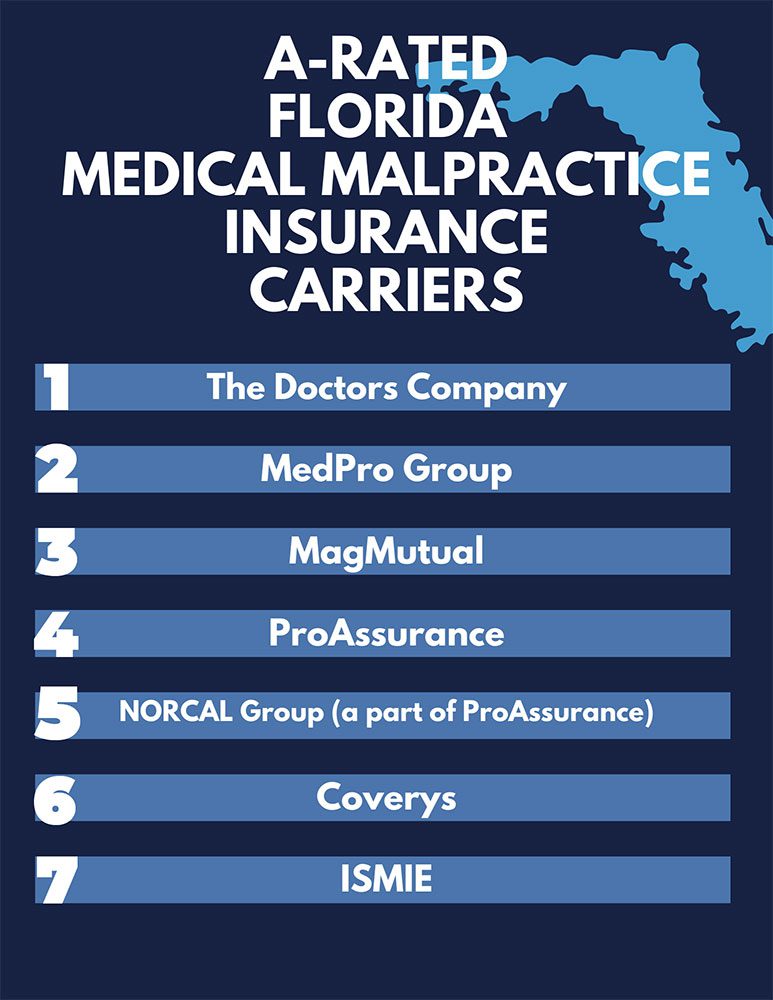

MEDPLI insurance brokers will obtain quotes from medical malpractice insurance from carriers rated “A” by A.M. Best for their long-term financial solvency and robust legal support of policyholders. The top carriers include:

Why Neurosurgeons Are Classified as High Risk by Medical Malpractice Insurance Companies

Medical malpractice insurance underwriters classify neurosurgery as a high-risk because of the potential for patient outcomes with severe permanent injury or death. Statistics published in an article in The Journal of Neurosurgery indicate that nearly 20% of all practicing neurosurgeons in the U.S. are named as defendants in malpractice lawsuits each year.

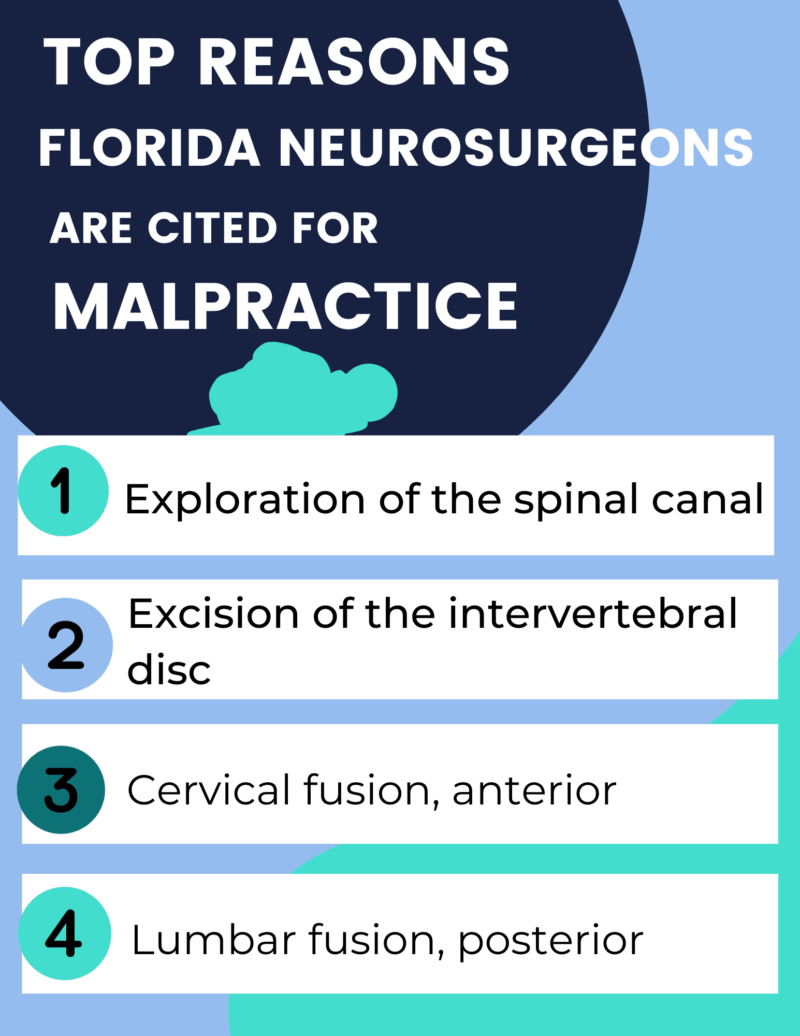

Top Reasons Why Florida Neurosurgeons Are Sued

According to a review of neurosurgery medical malpractice claims data by “A” rated malpractice insurance carrier MedPro Group , more than half of the cases cited allegations of patient injuries including pain, nerve damage, mobility loss, and the need for additional surgery related to these specific procedures:

In addition, some of the most often cited allegations in Florida’s neurosurgery medical malpractice cases include:

Neurosurgeons can reduce their risk of a malpractice lawsuit by implementing a comprehensive risk management strategy.

Florida’s Medical Malpractice Insurance Legislation

Consulting with a MEDPLI insurance broker who understands the complexities of Florida’s medical malpractice laws will ensure that your OB/GYN practice is protected with the right amount of coverage.

Florida’s Damage Caps on Medical Malpractice Lawsuits

There is no cap on non-economic damages in Florida medical malpractice lawsuits. Also, there is no limit on the amount of compensation a plaintiff can recover for past and future economic damages, such as medical care necessitated by the malpractice, lost income, lost future earning capacity, and any other measurable economic losses attributable to the defendant’s malpractice.

Florida’s Statute of Limitations for Medical Malpractice Claims

The statute of limitations in Florida for medical malpractice claims in general/ordinary negligence cases have been reduced from four years to two years as a result of the tort reforms passed in 2023:

Neurosurgery Medical Malpractice Outcomes in Florida

With no caps on economic and non-economic damages in Florida, neurosurgeons are more vulnerable to personal financial loss if they do not have robust medical malpractice coverage.

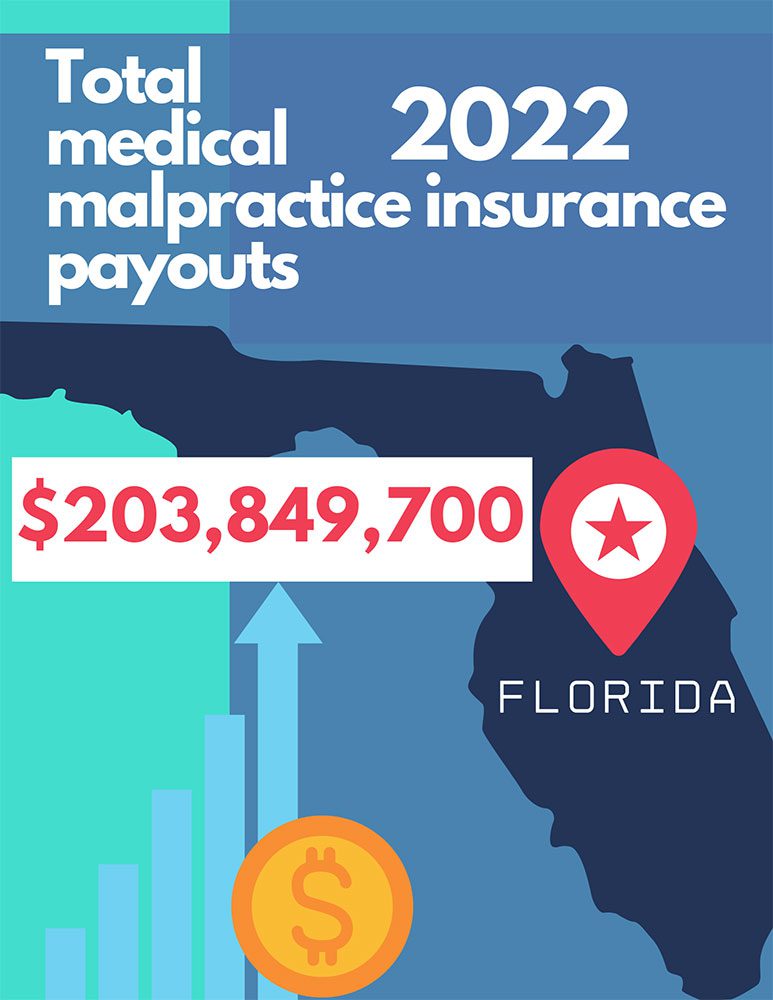

In 2022, the total medical malpractice payout in Florida was $203,849,700.

The following examples of Florida medical malpractice lawsuits found in favor of the plaintiff, or paid as a settlement, show the critical need for neurosurgeons to have strong liability coverage:

Jury Awards $15.5 Million

A Florida jury found a neurosurgeon negligent in misinterpreting the patient’s post-operative CT scan and failing to diagnose and treat a condition that resulted in the patient’s permanent paralysis. The jury also found the radiologist negligent for failing to properly flag an epidural hematoma in the patient’s spine.

$1 Million Settlement

The plaintiff alleged improper performance of spinal surgery, which resulted in permanent drop foot to the teenage patient.

How MEDPLI Brokers Help Neurosurgeons Save Time and Money on Medical Malpractice Insurance

Even the best and most innovative neurosurgeons in Florida need protection from medical malpractice lawsuits. Working with MEDPLI as your trusted broker takes the guesswork and effort out of trying to get the right coverage at the best rate on your own. We help you save time and money by:

MEDPLI insurance brokers are ready to help you navigate the complexities of Florida’s malpractice laws and secure the right amount of coverage for your Florida practice. From submitting your application, obtaining the best rates for new policies and renewals from “A” rated carriers, and more, MEDPLI is the only medical malpractice insurance broker you’ll need.