California Ranks Among Top 5 States for OB/GYNs

California had the second-highest number of practicing OB/GYNs in the U.S. in 2022, according to the U.S. Bureau of Labor Statistics (BLS). But as California’s population continues to increase – and more California OB/GYNs approach retirement age – the BLS predicts that the state could experience a shortage of OB/GYNs by 2030.

While providing steady demand for OB/GYNs, California is also a highly litigious state with approximately 16.9 medical malpractice lawsuits brought for every 100,000 residents (Source: National Practitioner Data Bank).

That’s why California OB/GYNs need robust medical malpractice insurance.

As your only trusted broker, MEDPLI will help you find the right coverage at the best rate in California.

Get A Quote

If you are a California OB/GYN in private practice, or planning to open a new practice in California, use this guide prepared by independent MEDPLI insurance brokers to give you a concise overview of medical malpractice insurance. Then contact a MEDPLI insurance broker to discuss your coverage needs and get a quote.

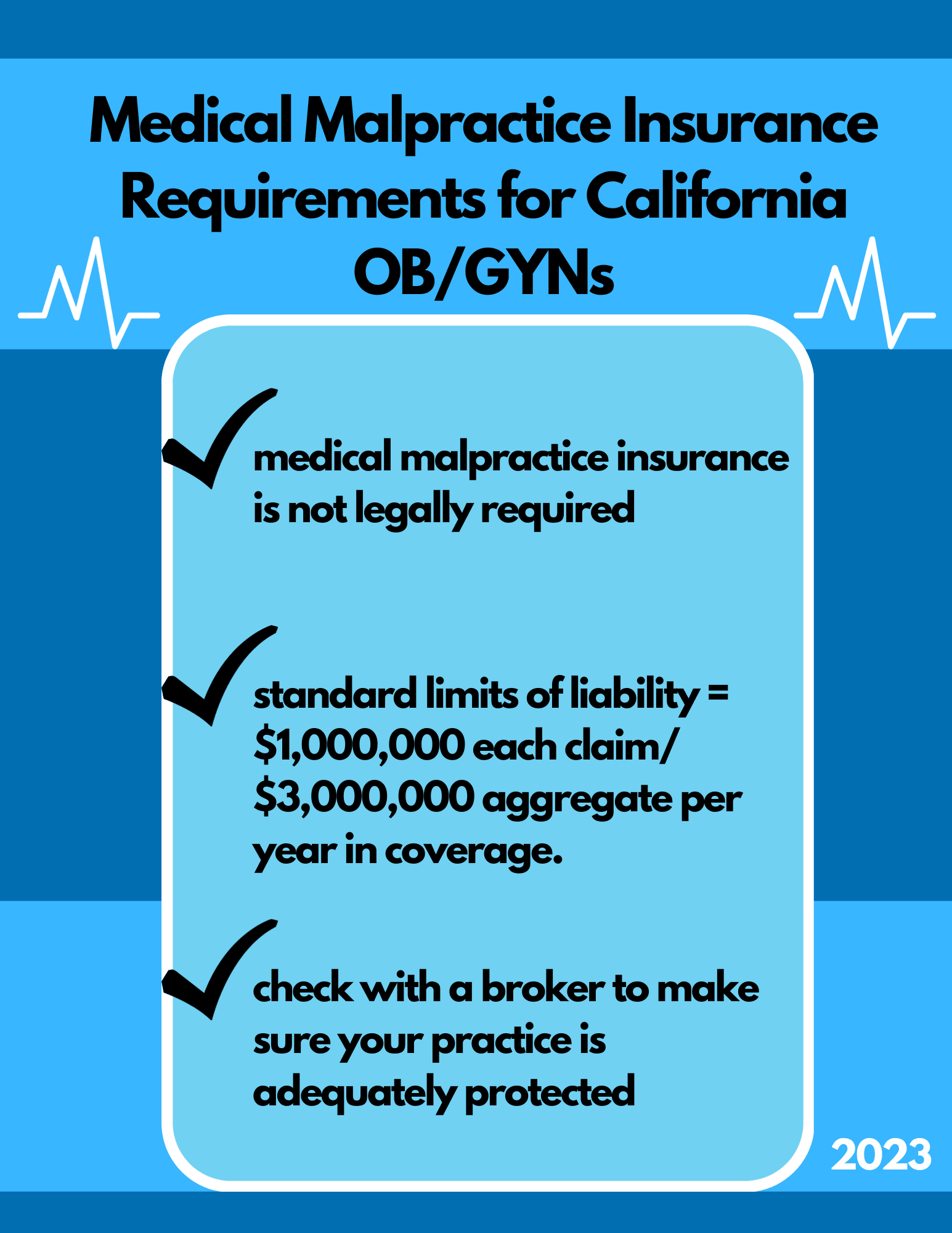

Medical Malpractice Insurance Requirements for California OB/GYNs

California OB/GYNs are not legally required to carry medical malpractice insurance. However, many California hospitals and health centers require physicians and surgeons to carry medical malpractice insurance if they want admitting privileges. The standard limits of liability in California are $1,000,000 Each Claim / $3,000,000 Aggregate per year in coverage.

MEDPLI strongly recommends securing coverage from an A-rated carrier as the most cost-effective way to protect against devastating financial loss if you are sued for malpractice in California. As an independent broker, we specialize in medical malpractice insurance for OB/GYNs. We can help you find the best coverage at a great price.

Cost of Medical Malpractice Insurance for California OB/GYNs

Each insurance carrier uses its own proprietary methods of setting the cost of medical malpractice insurance for OB/GYNs. Carriers consider factors such as practice location, surgical specialty, and past claims history.

The following are approximate medical malpractice insurance premium rates for OB/GYNs across all California areas:

| Specialty | Approximate Claims Made Rate | Approximate Tail Rate | Approximate Occurrence Rate |

|---|---|---|---|

| OB/GYN | $50,000 | $100,000 | $65,000 |

*Using the CA standard limits of $1,000,000 Each Claim / $3,000,000 Aggregate per year in coverage

Types of Professional Liability Insurance for California OB/GYNs

Here is a brief overview of the most common types of medical malpractice insurance for OB/GYNs in California:

1. Claims Made Insurance

Claims-made malpractice insurance provides coverage if the policy is in effect both when the incident took place AND when the claim is filed. If a claim is filed after the end of the policy date, the claim is NOT covered. With a claims-made policy you need tail malpractice insurance, which is a separately purchased insurance policy or endorsement, to make sure you have full protection. Learn more about claims-made insurance here.

2. Occurrence Insurance

Occurrence malpractice insurance provides coverage for incidents that occurred during the policy year, regardless of when a claim is reported to the carrier. Occurrence policies are more costly at the start of the policy, but the rate stays the same for the length of the policy, and there is no need for tail coverage when the policy ends. Read more about occurrence insurance.

3. Tail Insurance

Since most malpractice insurance policies are underwritten on a claims-made basis, you will be exposed to a lawsuit if a former patient files a claim against you and you do not secure tail coverage. When you are preparing to leave your employer, you should seek tail coverage options with an independent broker like MEDPLI. Tail insurance covers you for a specific time period. The new employer’s policy is not going to cover you for prior acts of a former practice, hence tail coverage is needed. Read more about tail malpractice insurance.

Reach out to an experienced MEDPLI insurance broker who will get to work for you to find a tail policy at a great price.

Let a MEDPLI Broker Help You Choose the Best Policy for Your Practice

Every OB/GYN’s situation is unique, so we recommend a conversation with a MEDPLI insurance broker to discuss the unique needs of your California practice. Your MEDPLI insurance broker will explain the benefits and limitations of each type of medical malpractice insurance to ensure you get the right type and amount of coverage for your OB/GYN specialty.

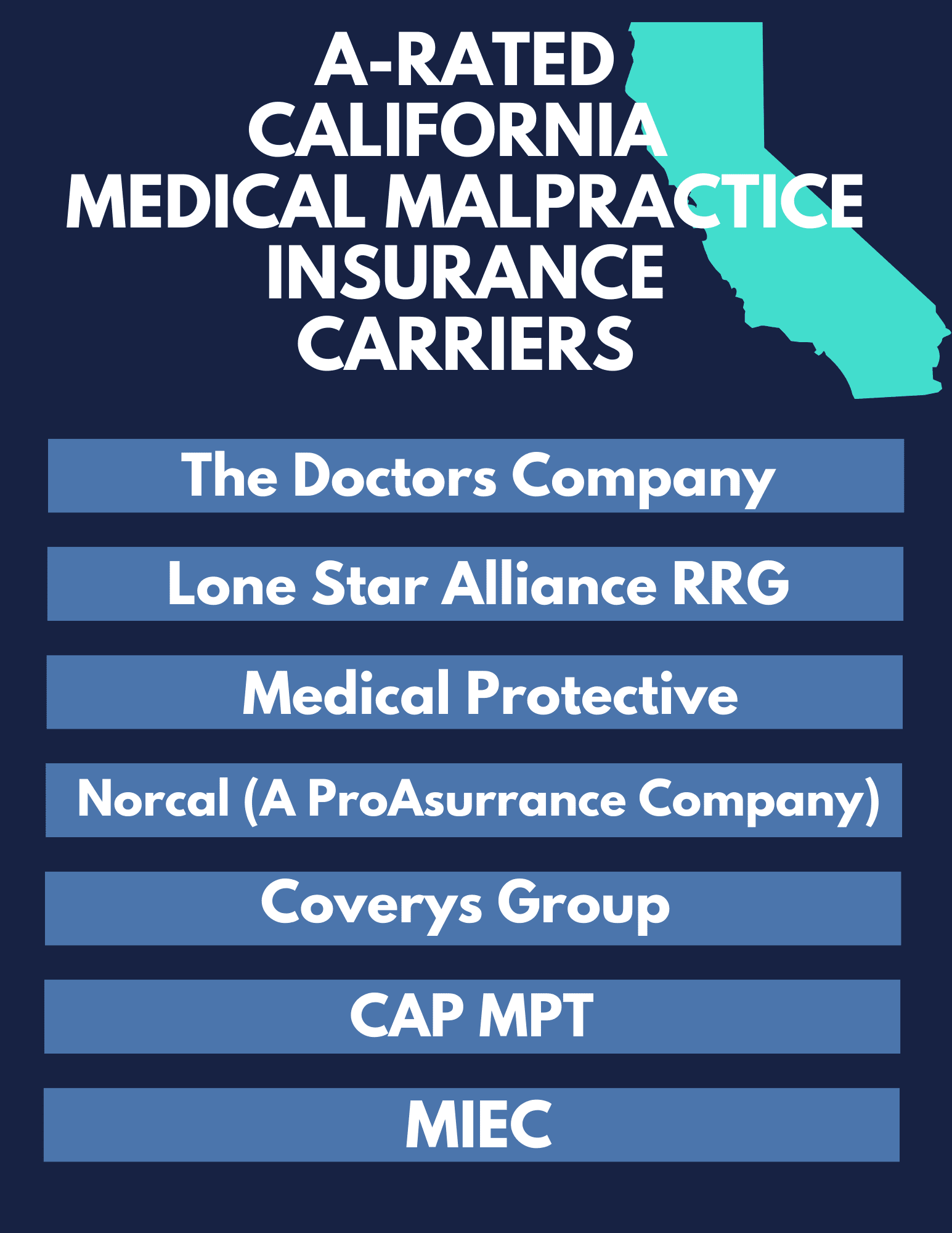

Get Quotes from A-rated Carriers Serving California OB/GYNs

MEDPLI insurance brokers will obtain quotes from medical malpractice insurance from carriers rated “A” by A.M. Best for their long-term financial solvency and robust legal support of policyholders. Some of the top carriers include:

Why OB/GYNs Are Classified as High Risk by Medical Malpractice Insurance Companies

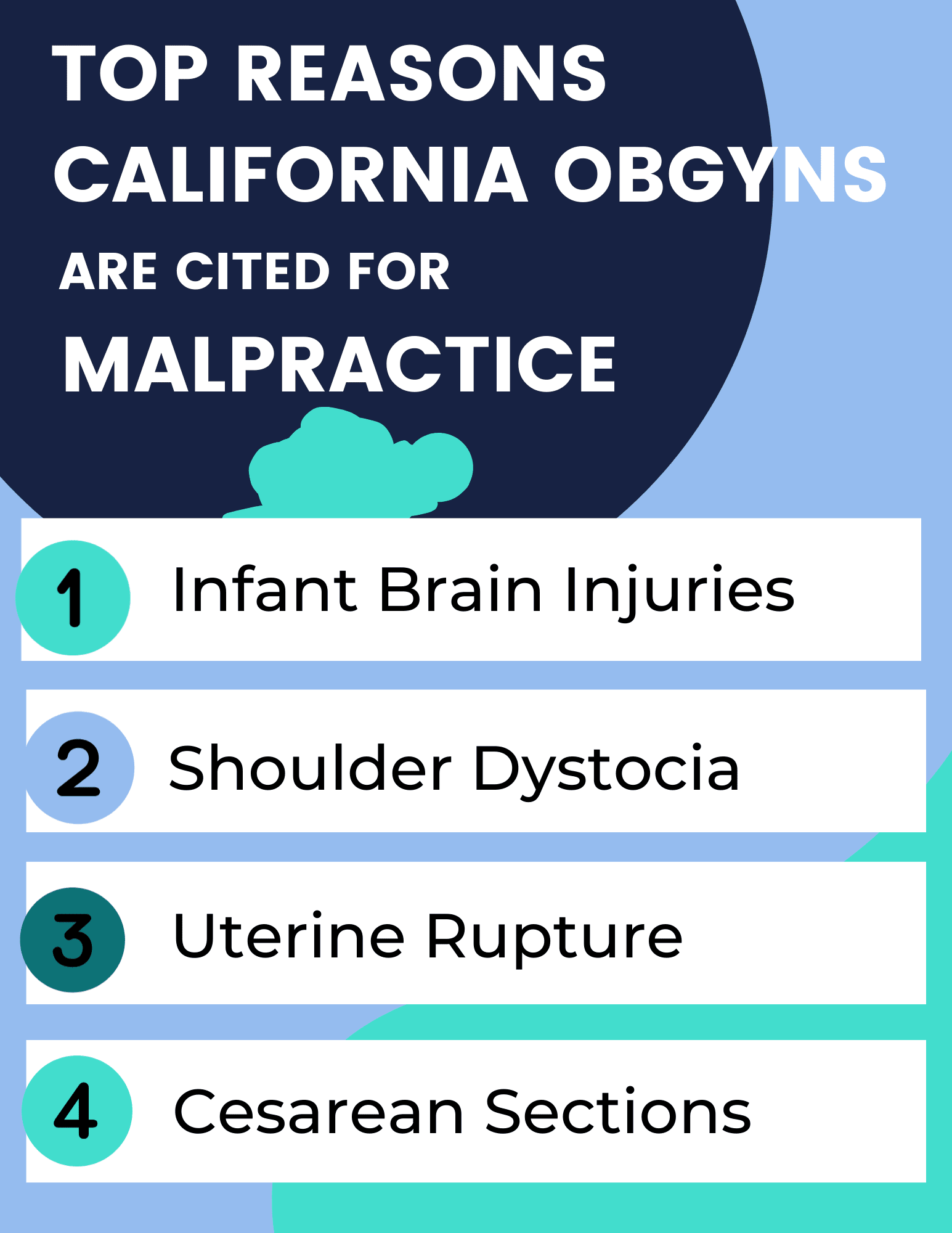

Medical malpractice insurance underwriters classify OB/GYN as a high risk because of the potential severe birth injuries, gynecologic surgical errors, and complications that commonly lead to allegations of malpractice. Therefore, the cost of medical malpractice insurance will be higher for OB/GYNs compared to other lower-risk specialties.

Top Reasons Why California OB/GYNs Are Sued

Delay in treating fetal distress was the major allegation in the highest proportion of OB/GYN medical malpractice cases found in favor of the plaintiff, according to a review of claims data by “A” rated malpractice insurance carrier MedPro Group . Additional major allegations and contributing factors to claims included:

In addition to untreated complications leading to maternal or infant death, some of the most often cited allegations in California OB/GYN medical malpractice cases include:

OB/GYNs can reduce their risk of a malpractice lawsuit by implementing a comprehensive risk management strategy. For tips on fine-tuning your risk management strategy, check out our OB/GYN’s Guide To Managing Malpractice Risk.

California’s Medical Malpractice Insurance Legislation

Consulting with a MEDPLI insurance broker who understands the complexities of California’s medical malpractice laws will ensure that your OB/GYN practice is protected with the right amount of coverage.

California’s Damage Caps on Medical Malpractice Lawsuits

The 2023 passing of Assembly Bill 35 (AB35) modified California’s Medical Injury Compensation Reform Act (MICRA) and mandated the state’s first cap adjustments for non-economic medical malpractice damages since 1975:

- As of January 1, 2023, AB35 raised the previous limit of $250,000 on non-economic damages for non-death cases to $350,000. Incremental increases over the next 10 years will raise the cap to $750,000, followed by a 2% annual adjustment for inflation in subsequent years.

- The limit for malpractice cases involving wrongful deaths has increased to $500,000 and will rise incrementally to $1 million over the next 10 years. The subsequent 2% annual adjustment for inflation will also apply.

- Additional mandates in AB35 now allow patients to sue and collect compensation for economic damages from three separate sources – doctors, hospitals, and “separate, unaffiliated” providers such as specialty surgeons in private practice.

In California there is no limit on the amount of compensation a plaintiff can recover for economic damages, such as actual costs of the medical care necessitated by the malpractice, lost income, lost future earning capacity, and any other measurable economic losses attributable to the defendant’s malpractice.

California’s Statute of Limitations for Medical Malpractice Claims

The following are the major guidelines for California’s statute of limitations for medical malpractice claims:

OB/GYN Medical Malpractice Outcomes in California

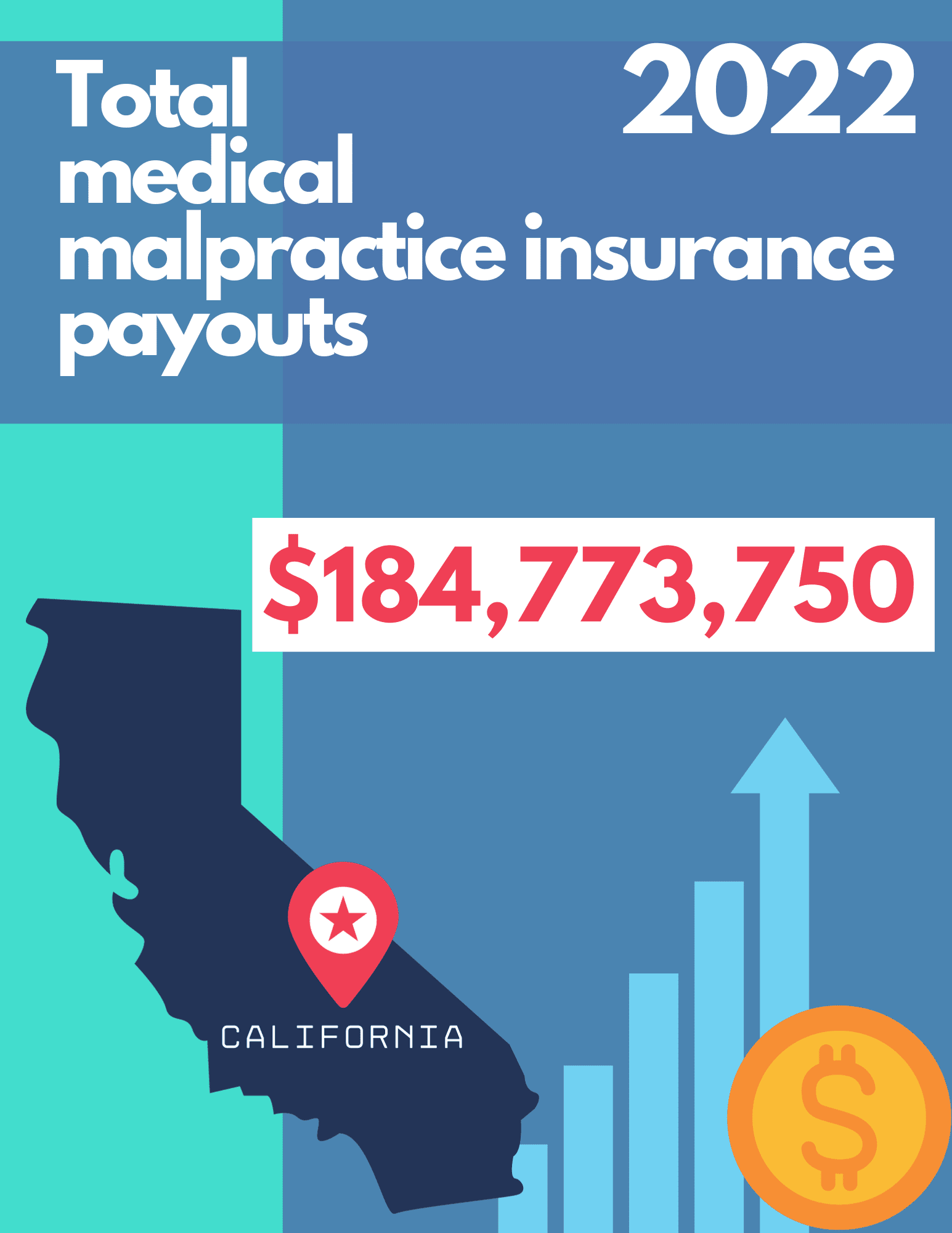

With no cap on economic damages, and incremental increases of the cap on non-economic damages over the next 10 years, OB/GYNs in California are more vulnerable to personal financial loss if they do not have robust medical malpractice coverage.

The total medical malpractice payout in California was $184,773,750 in 2022.

The following examples of California medical malpractice lawsuits found in favor of the plaintiff, or paid as a settlement, show the critical need for OB/GYNs to have strong liability coverage:

Jury Award for $7.1 Million

A jury found in favor of the plaintiff for the birth injuries of twin infants who both suffered brain damage. It was alleged that the infants were delivered unnecessarily at 30 weeks.

$4.3 Million Settlement

The lawsuit alleged negligent care caused by an unreasonable delay in delivery, resulting in a uterine rupture and the infant suffering brain injury and cerebral palsy.

$6.6 Million Settlement

The female plaintiff’s treatable form of breast cancer was misdiagnosed. She did not receive the proper treatment and medication, resulting in the cancer metastasizing.

How MEDPLI Brokers Help OB/GYNs Save time and Money on Medical Malpractice Insurance

Working with MEDPLI as your trusted broker takes the guesswork and effort out of trying to get the right coverage at the best rate on your own. We help OBGYNs save time and money by:

MEDPLI insurance brokers are ready to help you navigate the complexities of California’s MICRA medical malpractice tort reforms and secure the right amount of coverage for your OB/GYN practice. From submitting your application, obtaining the best rates for new policies and renewals from “A” rated carriers, and more, MEDPLI is the only medical malpractice insurance broker you’ll need.

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

See 2026 Tennessee medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

Read 2026 Colorado medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

See 2026 Maryland medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

Compare 2026 Florida medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.