Texas Needs More Plastic Surgeons

Texas is at risk of a severe shortage of surgical specialists – including plastic surgeons – by 2025, according to the U.S. Department of Health & Human Services.

While plastic surgeons may find new opportunities to practice in Texas, recent data from the National Practitioner Data Bank (U.S. Health & Human Services) revealed that nearly 3, 500 medical malpractice claims were filed in Texas in 2022. In fact, Texas ranked second among the top 10 U.S. states with the most medical malpractice claims that year.

Both cosmetic and restorative plastic surgeries carry a high risk of serious intraoperative patient injuries and post-operative complications.

That’s why Texas plastic surgeons need robust medical malpractice insurance.

As your only trusted broker, MEDPLI will help you find the right coverage at the best rate in Texas.

Get A Quote

If you are a Texas plastic surgeon in private practice, or planning to open a new practice in Texas, use this guide prepared by independent MEDPLI insurance brokers to give you a concise overview of medical malpractice insurance. Then contact a MEDPLI insurance broker to discuss your coverage needs and get a quote.

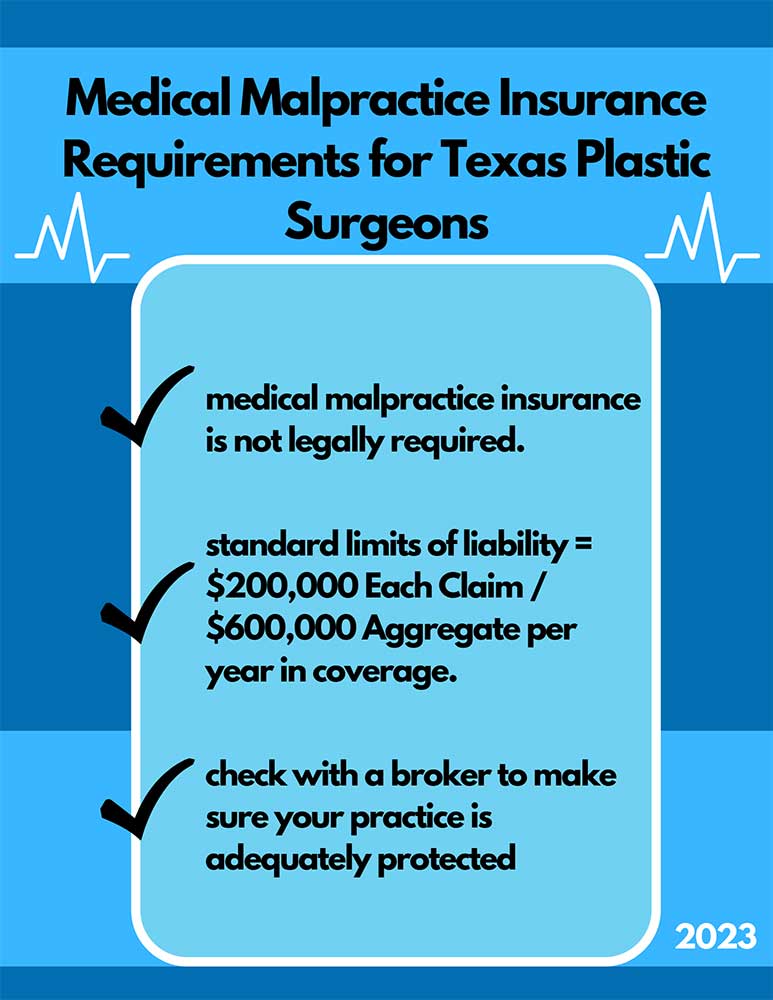

Medical Malpractice Insurance Requirements for Texas Plastic Surgeons

Texas does not legally require plastic surgeons to carry medical malpractice insurance in order to practice in the state. The standard limits of liability in Texas are $200,000 Each Claim / $600,000 Aggregate per year in coverage.

However, plastic surgery is considered a high-risk specialty, so you should consider more coverage to be adequately protected if sued for malpractice. Some Texas plastic surgeons carry $1,000,000/3,000,000 limits of liability.

MEDPLI strongly recommends securing coverage from an A-rated carrier as the most cost-effective way to protect against devastating financial loss if you are sued for malpractice in Texas. As an independent broker, we specialize in medical malpractice insurance for plastic surgeons. We work for you to find the best policy at a great price.

Cost of Medical Malpractice Insurance for Texas Plastic Surgeons

Each insurance carrier uses its own proprietary methods of setting the cost of medical malpractice insurance. Carriers consider factors such as practice location, surgical specialty, and past claims history.

In Texas, the areas that typically carry the highest rates are: Houston (Harris County), El Paso (El Paso County), Brownsville (Cameron County), McAllen (Hidalgo County), and Laredo (Webb).

The following are approximate medical malpractice insurance premium rates for plastic surgeons across all Texas areas:

| Specialty | Approximate Claims Made Rate | Approximate Tail Rate | Approximate Occurrence Rate |

|---|---|---|---|

| Plastic Surgery | $40,000 | $80,000 | $45,000 |

*Using the TX standard limits of $200,000 Each Claim / $600,000 Aggregate per year in coverage

Types of Professional Liability Insurance for Texas Plastic Surgeons

Here is an brief overview of the three most common types of medical malpractice insurance for plastic surgeons in Texas:

1. Claims Made Insurance

Claims-made malpractice insurance provides coverage if the policy is in effect both when the incident took place AND when the claim is filed. If a claim is filed after the end of the policy date, the claim is NOT covered. With a claims-made policy, you need tail malpractice insurance, which is a separately purchased insurance policy or endorsement, to make sure you have full protection.

2. Occurrence Insurance

Occurrence malpractice insurance provides coverage for incidents that occurred during the policy year, regardless of when a claim is reported to the carrier. Occurrence policies are more costly at the start of the policy, but the rate generally stays the same for the length of the policy, and there is no need for tail coverage when the policy ends.

3. Tail Insurance

Since most malpractice insurance policies are underwritten on a claims-made basis, you will be exposed to a lawsuit if a former patient files a claim against you and you do not secure tail coverage. When you are preparing to leave your employer, you should seek tail coverage options with an independent broker like MEDPLI. Tail insurance covers you for a specific time period. The new employer’s policy is not going to cover you for prior acts of a former practice, hence tail coverage is needed.

Reach out to an experienced MEDPLI insurance broker who will get to work for you to find a tail policy at a great price.

Let a MEDPLI Broker Help You Choose the Best Policy for Your Practice

Every surgeon’s situation is unique, so we recommend a conversation with a MEDPLI insurance broker to discuss the unique needs of your Texas practice. Your MEDPLI insurance broker will explain the benefits and limitations of each type of medical malpractice insurance to ensure you get the right type and amount of coverage for your plastic specialty.

Get Quotes from A-Rated Carriers Serving Texas Plastic Surgeons

MEDPLI insurance brokers will obtain quotes from medical malpractice insurance from carriers rated “A” by A.M. Best for their long-term financial solvency and robust legal support of policyholders. Some of the top carriers include:

Why Plastic Surgeons Are Classified as High Risk by Texas Medical Malpractice Insurance Companies

Medical malpractice insurance underwriters classify bariatric surgery as a high-risk specialty because of the surgical side-effects and complications that commonly lead to allegations of malpractice. Therefore, no matter what state you practice in, the cost of medical malpractice insurance will be higher for bariatric surgeons compared to other lower-risk specialties.

Top Reasons Why Texas Plastic Surgeons Are Sued

A review of malpractice claims data by “A” rated malpractice insurance carrier MedPro Group found that improper surgical performance and poor outcomes of higher-risk elective cosmetic surgeries, surgical errors, and negligence regarding post-operative infections contributed to the risks of plastic surgery, including these iatrogenic patient injuries:

According to a 2020 study by the American Society of Plastic Surgeons (ASPS), plastic surgeons in the East South Central region of the U.S., which includes Texas, performed 47% of all calf augmentations, 33% of all hair transplant procedures, and 32% of all lip reductions in the U.S. (more than any other U.S. region). Some of the common risk factors for malpractice claims related to these procedures include:

Other procedures often performed by Texas plastic surgeons include buttock lift (Brazilian Butt Lift), cheek implants, and eyelid surgery, which may carry a higher risk of medical malpractice claims. For example, a review of closed medical malpractice claims by “A” rated carrier The Doctors Company revealed that gluteal fat grafting or “Brazilian Butt Lift” has the highest death rate at 1 in 3,000 than for any other cosmetic or aesthetic surgery.

Plastic surgeons can reduce their risk of a malpractice lawsuit by implementing a comprehensive risk management strategy.

Texas Medical Malpractice Insurance Legislation

Consulting with a MEDPLI insurance broker who understands the complexities of Texas’ medical malpractice laws will ensure that your plastic practice is protected with the right amount of coverage.

Texas’ Damage Caps on Medical Malpractice Lawsuits

Non-economic damage caps for medical malpractice lawsuits in Texas are set at $250,000 for individual healthcare providers and $250,000 for each medical facility involved in their injury. There is an overall cap of $500,000 per plaintiff when it concerns how much they can collect from the total amount of medical facilities they sue.

There is no limit on the amount of compensation a plaintiff can recover for economic damages in Texas. Economic damages can include:

*Medical costs for surgeries, physicians’ appointments, prescription medications and medical equipment

*Lost wages due to the injury

*Lost earning capacity if the injury is permanently debilitating or makes it impossible for the plaintiff to continue working

Texas Statute of Limitations for Medical Malpractice Claims

According to state law, conditions for filing a medical malpractice lawsuit in Texas are:

Plastic Surgeon Medical Malpractice Outcomes in Texas

With no cap on economic damages and non-economic damages, plastic surgeons in Texas are more vulnerable to personal financial loss if sued.

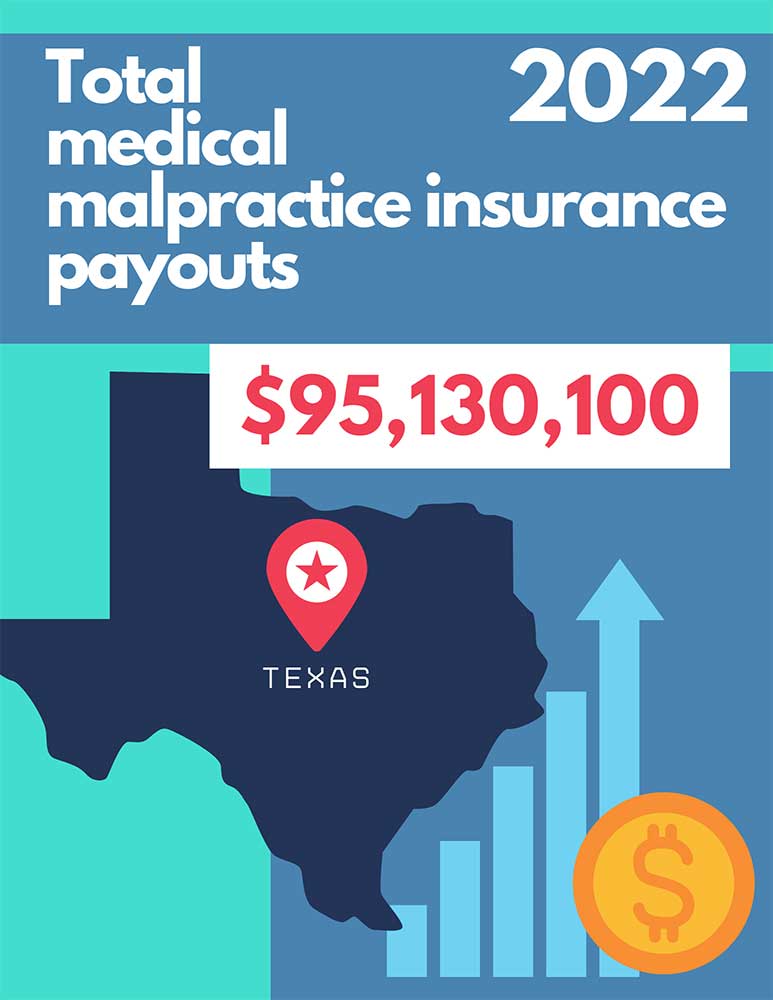

In 2022, the total medical malpractice payout in Texas was $95,130,100.

The following examples of Texas medical malpractice lawsuits found in favor of the plaintiff or settled shows the critical need for plastic surgeons to have more than adequate liability coverage:

$2,400,000 Plastic Surgery Settlement

A malpractice claim was made against members of a surgical team, which included a plastic surgeon, alleging improper performance of craniofacial surgery to correct Crouzon’s syndrome, a rare genetic condition that prevents a child’s skull from growing properly. The patient lost an eye as a complication of the surgery.

$1,100,000 Plastic Surgery Malpractice Settlement

A patient suffered brain damage as a result of mismanagement of anesthesia during a cosmetic plastic surgery procedure.

Even the Best Plastic Surgeons In Texas Need Protection From Malpractice Lawsuits

Most surgeons face at least one medical malpractice lawsuit brought forth by a patient throughout their career, so it’s essential to be covered when it happens to you. In addition to damages awarded to the plaintiff, having medical malpractice insurance assures that your legal costs will be covered regardless of whether the case is won or lost.

How MEDPLI Brokers Help Plastic Surgeons Save Time and Money on Medical Malpractice Insurance

Working with MEDPLI as your trusted broker takes the guesswork and effort out of trying to get the right coverage at the best rate on your own. We help you save time and money by:

MEDPLI insurance brokers are ready to help you navigate the complexities of Texas’ medical malpractice laws and secure the right amount of coverage for your plastic surgical practice. From submitting your application, obtaining the best rates for new policies and renewals from “A” rated carriers, and more, MEDPLI is the only medical malpractice insurance broker you’ll ever need.

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

See 2026 Virginia’s medical malpractice insurance guide for the latest rates by specialty, top carriers, payouts & state regulations. Get your quote today.

Read 2026 Pennsylvania’s medical malpractice insurance guide for the latest rates by specialty, top carriers, payouts & state regulations. Get your quote today.

View our 2026 Georgia medical malpractice insurance rates by specialty, carriers, payouts & state regulations. Get your custom MEDPLI quote today.

Explore 2026 Illinois medical malpractice insurance costs, top A-rated insurers, payout trends & the latest state regulations. Get your free quote today.