Top 6 Medical Malpractice Insurance Carriers in Nevada

We recommend carriers with an AM Best “A” or higher rating. An A rating indicates financial strength, long-term solvency, and an established history of protecting Nevada physicians.

- ProAssurance

- MedPro Group

- MagMutual

- Coverys Group

- COPIC Group

2025 Nevada Malpractice Insurance Rates by Specialty

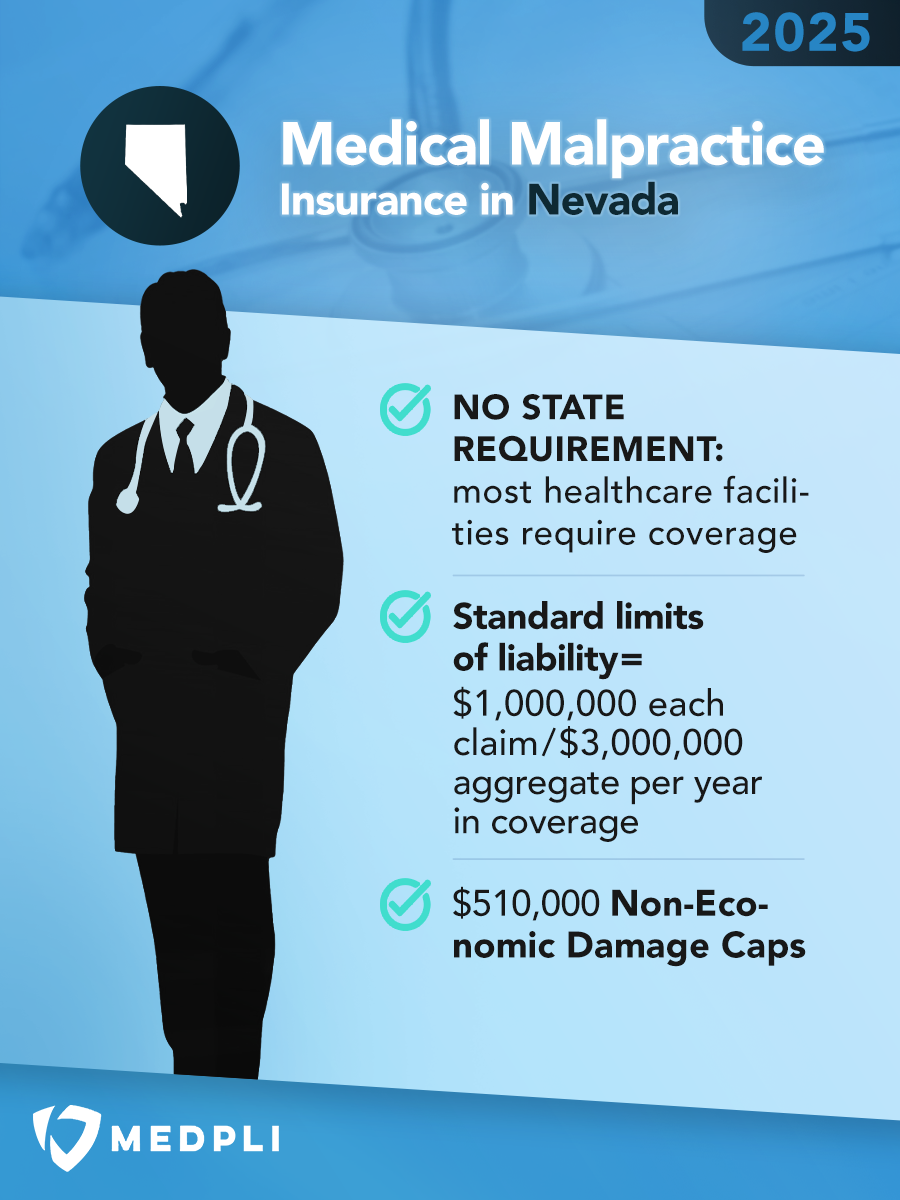

These rate estimates are for informational purposes only and are based on the NV standard limits of $1,000,000 each claim / $3,000,000 aggregate per year in coverage.

Quotes require a completed application and approval from the underwriter. Contact us for a custom estimate if you don’t see your specialty.

| Specialty | 2025 Annual Premium |

2025 Tail Premium |

|---|---|---|

| Anesthesiology | $45,000 | $90,000 |

| Cardiovascular Disease– Minor Surgery | $34,000 | $68,000 |

| Dermatology– No Surgery | $14,000 | $28,000 |

| Emergency Medicine | $70,000 | $140,000 |

| Family Practice– No Surgery | $28,000 | $56,000 |

| Gastroenterology– No Surgery | $29,000 | $58,000 |

| General Practice– No Surgery | $28,000 | $56,000 |

| General Surgery | $67,000 | $134,000 |

| Internal Medicine– No Surgery | $28,000 | $56,000 |

| Neurology– No Surgery | $31,000 | $62,000 |

| Obstetrics and Gynecology– Major Surgery | $140,000 | $280,000 |

| Occupational Medicine | $14,000 | $28,000 |

| Ophthalmology– No Surgery | $14,000 | $28,000 |

| Orthopedic Surgery– No Spine | $65,000 | $130,000 |

| Pathology– No Surgery | $14,000 | $28,000 |

| Pediatrics– No Surgery | $25,000 | $50,000 |

| Pulmonary Disease– No Surgery | $27,000 | $54,000 |

| Psychiatry | $14,000 | $28,000 |

| Radiology – Diagnostic | $47,000 | $94,000 |

Have a question? Get fast answers from a U.S.-based MEDPLI agent. Call or contact us here today.

Nevada Medical Malpractice Payouts From 2015-2024

How Extreme Weather Is Driving Up Malpractice Insurance in Nevada

When wildfires, floods, and other severe weather events hit Nevada, the financial impact extends far beyond the cost of replacing homes and infrastructure. It drives up insurance costs statewide. As these events grow more frequent and intense, insurers face mounting losses and respond by raising premiums across the board – and not just for homeowners insurance. Medical malpractice insurance feels the hit, too, and healthcare professionals must shoulder the cost of a destabilized market.

What’s Causing Insurance Rates to Climb?

How Nevada’s Medical Malpractice Rates Are Impacted

Medical malpractice insurers are now grappling with surging reinsurance premiums and tougher payout conditions. To offset their rising costs, they’ve raised premiums for physicians nationwide.

Although Nevada saw fewer large malpractice premium spikes in 2024 compared to other states, 5.6% of its doctors saw double-digit increases in 2023. With severe weather events becoming more frequent, Nevada physicians should prepare for future premium increases.

Severe weather isn’t just a coastal problem; it’s reshaping insurance costs for everyone.

Types of Professional Liability Insurance for Nevada Physicians

Types of Professional Liability Insurance for Nevada Physicians

Doctors in Nevada can choose between these two primary types of medical malpractice insurance:

- Provides coverage for incidents that occurred during the policy period, IF the claim is filed while the policy is still active. If a claim is filed after the policy has ended, that claim is NOT covered.

- Typically, it offers lower premiums at the start of the policy, but rates increase yearly as the policy matures.

- Physicians must obtain tail insurance coverage when a claims-made policy ends to ensure protection against future claims related to incidents that occurred during the policy period. Tail insurance premiums require a one-time cash payment to the expiring carrier equal to approximately 200% of the claims-made policy’s annual premium.

- Nevada physicians may opt to purchase nose coverage, or prior acts coverage, instead of tail coverage. Nose coverage can be purchased through a new carrier to protect physicians from claims that occurred before the effective date of the new policy, back to a specified date.

- Provides coverage for incidents that occurred during the policy period, regardless of when a claim is reported to the carrier.

- Typically, it offers more costly premiums at the start of the policy, but the rate stays constant throughout the policy’s duration.

- Physicians do not need tail coverage when an occurrence policy ends.

In 2024, Nevada physicians were held liable for 128 medical malpractice payouts.

- Average Payout: $361,756

- Total Payout: $45,024,800

(Source: National Practitioner Data Bank)

Does Nevada Have Damage Caps for Medical Malpractice Lawsuits?

Nevada Revised Statute 41A.035, passed in 2023, set a non-economic damage cap at $350,000, with annual increases of $80,000 until it reaches $750,000 in January 2028. After that, the cap will increase by 2.1% annually. The non-economic damage cap is currently $510,000.

Key Rules & Exceptions

- Non-Economic Damages Definition: Non-economic damages include pain, suffering, inconvenience, physical impairment, disfigurement, and other nonpecuniary damages.

- No Cap on Economic Damages: Nevada does not limit the amount a jury can award for economic damages, including medical expenses, care and custody, loss of earning, and loss of earning capacity.

- Several Liability: Nevada applies several liability in medical malpractice cases, meaning each health care provider is only liable for the share of damages that matches their percentage of fault.

- Affidavit of Medical Expert: In most medical malpractice cases, the plaintiff must file an affidavit of a medical expert at the same time they file their lawsuit. Failure to file the affidavit results in case dismissal. The affidavit must:

-

- Be submitted by a medical expert in a field related to the alleged negligence

-

- Identify or describe each accused health care provider

-

- Support the plaintiff’s allegations of malpractice

-

- Clearly and concisely describe the specific act(s) of negligence in factual terms

- Pre-Trial Settlement Conference: Before a medical malpractice case can proceed to trial, it must first go through a settlement conference to determine if it can be settled beforehand. Both parties, their insurers, and their attorneys must attend. The conference judge can:

-

- Waive any party’s required attendance

- Decide what information can be presented at the conference

- Impose sanctions, including monetary sanctions, on any party that fails to participate in good faith

- Recommend a settlement for the amount of the defendant’s insurance policy limits

Nevada Statute of Limitations for Medical Malpractice Claims

Under Nevada Revised Statute 41A.097, for injuries or wrongful death occurring on or after October 1, 2023, plaintiffs must file an action no more than 3 years after the date of injury. There are a few key exceptions:

- Discovery Rule: If the injury is not discovered and could not reasonably have been discovered within the 2-year period, the plaintiff has 1 year from the date of discovery (or the date they should have discovered it) to file.

- Minors: A parent or guardian must file an action on behalf of their child within the statute of limitations period. If they fail to do so, the child cannot sue upon reaching adulthood. Exceptions include:

- Brain Damage or Birth Defects: The statute period is extended until the child’s 10th birthday.

- Sterility: The statute is extended until 2 years after the child discovers the injury.

- Fraudulent Concealment: The statute of limitations is tolled for any period during which a health care provider knowingly conceals an act, error, or omission.

- Failure to Bring to Trial: Unless good cause for delay is shown, any medical malpractice case not brought to trial within 3 years after it is filed will be automatically dismissed. Once dismissed, the plaintiff cannot refile the same claim against the same defendant.

Is Nevada a Physician-Friendly Place to Practice?

Nevada typically ranks in the middle of the pack for best states to practice medicine. It offers physicians several advantages:

However, Nevada’s rising homeowners insurance and malpractice premium costs threaten to offset the advantages of practicing in Nevada.

Nevada doctors can benefit from working with a knowledgeable malpractice insurance broker. MEDPLI helps physicians find the right coverage at the best possible rate, bringing peace of mind through malpractice market uncertainty.

Nevada Doctors Partner with MEDPLI

We exclusively broker medical malpractice insurance, focusing daily on making the professional liability process less burdensome and expensive for doctors.

With MEDPLI, Nevada physicians:

MEDPLI helps physicians in every specialty.

Whether you’re an Emergency Medicine Physician in Las Vegas or a Psychiatrist in Carson City, MEDPLI will find you premier coverage at a competitive rate.

Call 800-969-1339 or Request a Quote.

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

View our 2026 Georgia medical malpractice insurance rates by specialty, carriers, payouts & state regulations. Get your custom MEDPLI quote today.

Explore 2026 Illinois medical malpractice insurance costs, top A-rated insurers, payout trends & the latest state regulations. Get your free quote today.

GUIDE: Overview of New York medical malpractice insurance rates by specialty, top carriers, payout statistics, and state regulations. Get a custom quote here.

See 2026 California medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.