Top 6 Medical Malpractice Insurance Carriers in Nebraska

We recommend carriers with an AM Best “A” or higher rating. An A rating indicates financial strength, long-term solvency, and an established history of protecting Nebraska physicians.

- The Doctors Company

- MedPro Group

- Coverys Group

- COPIC Group

- CURI Group – MMIC Insurance

- ProAssurance Group

2025 Nebraska Malpractice Insurance Rates by Specialty

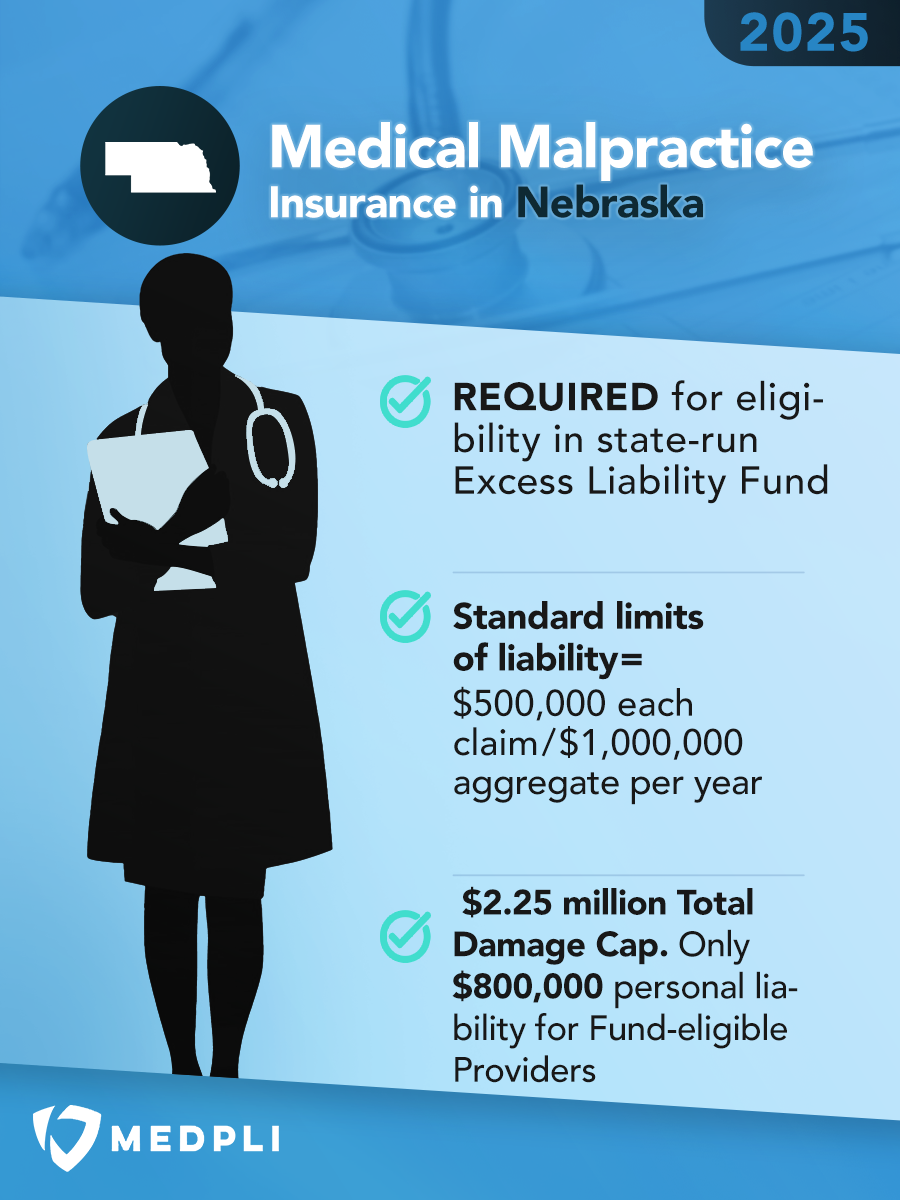

These rate estimates are for informational purposes only and are based on the NE standard limits of $500,000 each claim / $1,000,000 aggregate per year in coverage.

Quotes require a completed application and approval from the underwriter. Contact us for a custom estimate if you don’t see your specialty.

| Specialty | 2025 Annual Premium |

2025 Tail Premium |

|---|---|---|

| Anesthesiology | $7,000 | $14,000 |

| Cardiovascular Disease– Minor Surgery | $6,000 | $12,000 |

| Dermatology– No Surgery | $3,000 | $6,000 |

| Emergency Medicine | $11,000 | $22,000 |

| Family Practice– No Surgery | $4,000 | $8,000 |

| Gastroenterology– No Surgery | $6,000 | $12,000 |

| General Practice– No Surgery | $4,000 | $8,000 |

| General Surgery | $15,000 | $30,000 |

| Internal Medicine– No Surgery | $5,000 | $10,000 |

| Neurology– No Surgery | $6,000 | $12,000 |

| Obstetrics and Gynecology– Major Surgery | $20,000 | $40,000 |

| Occupational Medicine | $2,500 | $5,000 |

| Ophthalmology– No Surgery | $3,000 | $6,000 |

| Orthopedic Surgery– No Spine | $11,000 | $22,000 |

| Pathology– No Surgery | $3,500 | $7,000 |

| Pediatrics– No Surgery | $4,000 | $8,000 |

| Pulmonary Disease– No Surgery | $6,000 | $12,000 |

| Psychiatry | $3,000 | $6,000 |

| Radiology – Diagnostic | $6,000 | $12,000 |

Have a question? Get fast answers from a U.S.-based MEDPLI agent. Call or contact us here today.

Nebraska Medical Malpractice Payouts From 2015-2024

How Extreme Weather Is Driving Up Malpractice Insurance in Nebraska

When tornadoes, hailstorms, and other severe weather events strike Nebraska, the financial fallout extends beyond damaged homes and infrastructure. It drives up insurance costs statewide. As these events grow more frequent and intense, insurers face mounting losses and respond by raising premiums across the board – and not just for homeowners insurance. Medical malpractice insurance feels the hit, too, and healthcare professionals must shoulder the cost of a destabilized market.

What’s Causing Insurance Rates to Climb?

How Nebraska’s Medical Malpractice Rates Are Impacted

Medical malpractice insurers are now grappling with surging reinsurance premiums and tougher payout conditions. To offset their rising costs, they’ve raised premiums for physicians nationwide.

Between 2023 and 2024, Nebraska saw one of the highest rates of malpractice premium increases in the nation – with over one third of policies increasing by 10% or more.

Severe weather isn’t just a coastal problem; it’s reshaping insurance costs for everyone.

Types of Professional Liability Insurance for Nebraska Physicians

Types of Professional Liability Insurance for Nebraska Physicians

Doctors in Nebraska can choose between these two primary types of medical malpractice insurance:

- Provides coverage for incidents that occurred during the policy period, IF the claim is filed while the policy is still active. If a claim is filed after the policy has ended, that claim is NOT covered.

- Typically, it offers lower premiums at the start of the policy, but rates increase yearly as the policy matures.

- Physicians must obtain tail insurance coverage when a claims-made policy ends to ensure protection against future claims related to incidents that occurred during the policy period. Tail insurance premiums require a one-time cash payment to the expiring carrier equal to approximately 200% of the claims-made policy’s annual premium.

- Nebraska physicians may opt to purchase nose coverage, or prior acts coverage, instead of tail coverage. Nose coverage can be purchased through a new carrier to protect physicians from claims that occurred before the effective date of the new policy, back to a specified date.

- Provides coverage for incidents that occurred during the policy period, regardless of when a claim is reported to the carrier.

- Typically, it offers more costly premiums at the start of the policy, but the rate stays constant throughout the policy’s duration.

- Physicians do not need tail coverage when an occurrence policy ends.

In 2024, Nebraska physicians were held liable for 45 medical malpractice payouts.

- Average Payout: $321,605

- Total Payout: $14,472,250

(Source: National Practitioner Data Bank)

Does Nebraska Have Damage Caps for Medical Malpractice Lawsuits?

Yes. While many states cap only non-economic damage caps, the Nebraska Hospital-Medical Liability Act sets a $2.25 million total damage cap in medical malpractice cases.

Key Rules & Exceptions

- Maintain malpractice insurance coverage of at least $800,000 per occurrence and $3 million aggregate per year.

- Pay a surcharge to the Fund equal to 50% of their malpractice premium

- Post a sign in their waiting room or other appropriate location stating they are qualified under the Nebraska Hospital-Medical Liability Act.

- Excess Liability Fund – The total damage cap does not apply if the healthcare provider fails to qualify for the Excess Liability Fund. Qualified providers are personally liable for $800,000 of the $2.25 million; the rest is paid for by the Fund. To maintain eligibility for the Fund, health care providers must:

- IMPORTANT: Patients can opt out of the Hospital-Medical Liability Act. In these cases, the patient can sue under common law. To opt out, they must file with the Director of Insurance BEFORE receiving treatment and notify their health care provider of their election as soon as possible.

- Medical Reimbursement Insurance Benefits – Any amount paid to the plaintiff by medical reimbursement insurance (minus the premiums they paid) may be deducted from the damages in a separate hearing.

Nebraska Statute of Limitations for Medical Malpractice Claims

Nebraska Revised Statute 44-2828 states a medical malpractice claim must be filed within 2 years of the alleged act or omission. There are a few key exceptions:

- Discovery Rule: If the injury is not discovered and could not reasonably have been discovered within the 2 year period, the plaintiff has 1 year from the date of discovery (or the date they should have discovered it) to file.

- Statute of Repose – No claim can be filed more than 10 years after the alleged malpractice, regardless of discovery date.

- Disability Due to Age or Mental Condition – If the injured person was under age 21 or had a mental health disorder when the alleged malpractice occurred, the statute is tolled until the disability is removed.

- Fraudulent Concealment: If a health care provider fraudulently conceals the malpractice, the statute of limitations may be tolled until the plaintiff discovers – or reasonably should have discovered – the injury.

Is Nebraska a Physician-Friendly Place to Practice?

Nebraska consistently ranks among the best states to practice medicine, offering physicians several advantages:

However, Nebraska’s relatively low physician salaries, high homeowners insurance costs, and rapidly rising malpractice premiums threaten to offset the advantages of practicing in Nebraska.

Nebraska doctors can benefit from working with a knowledgeable malpractice insurance broker. MEDPLI helps physicians find the right coverage at the best possible rate, bringing peace of mind through malpractice market uncertainty.

Nebraska Doctors Partner with MEDPLI

We exclusively broker medical malpractice insurance, focusing daily on making the professional liability process less burdensome and expensive for doctors.

With MEDPLI, Nebraska physicians:

MEDPLI helps doctors in every specialty.

Whether you’re a Bariatric Surgeon in Omaha or a Dermatologist in Hastings, MEDPLI will find you premier coverage at a competitive rate.

Call 800-969-1339 or Request a Quote.

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

Protect Your MedSpa: 7 Expert Tips for Medical Malpractice Insurance Coverage. Learn what to look for and how to avoid costly claims.

GUIDE: Get tail insurance insights from MEDPLI's expert medical malpractice brokers. Find FAQs and tips for affordable, A-rated coverage. Learn more here.

GUIDE: Read here for New Hampshire’s medical malpractice insurance rates by specialty, top carriers, payout trends & state laws. Get a custom quote here.

Medical malpractice insurance specialist Max Schloemann recommends the top liability insurance companies for doctors in 2025. Learn how to compare carriers here.