Top 5 Medical Malpractice Insurance Carriers in Delaware

We recommend carriers with an AM Best “A” or higher rating. An A-rating indicates financial strength, long-term solvency, and an established history of protecting Delaware physicians.

2025 Delaware Malpractice Insurance Rates by Specialty

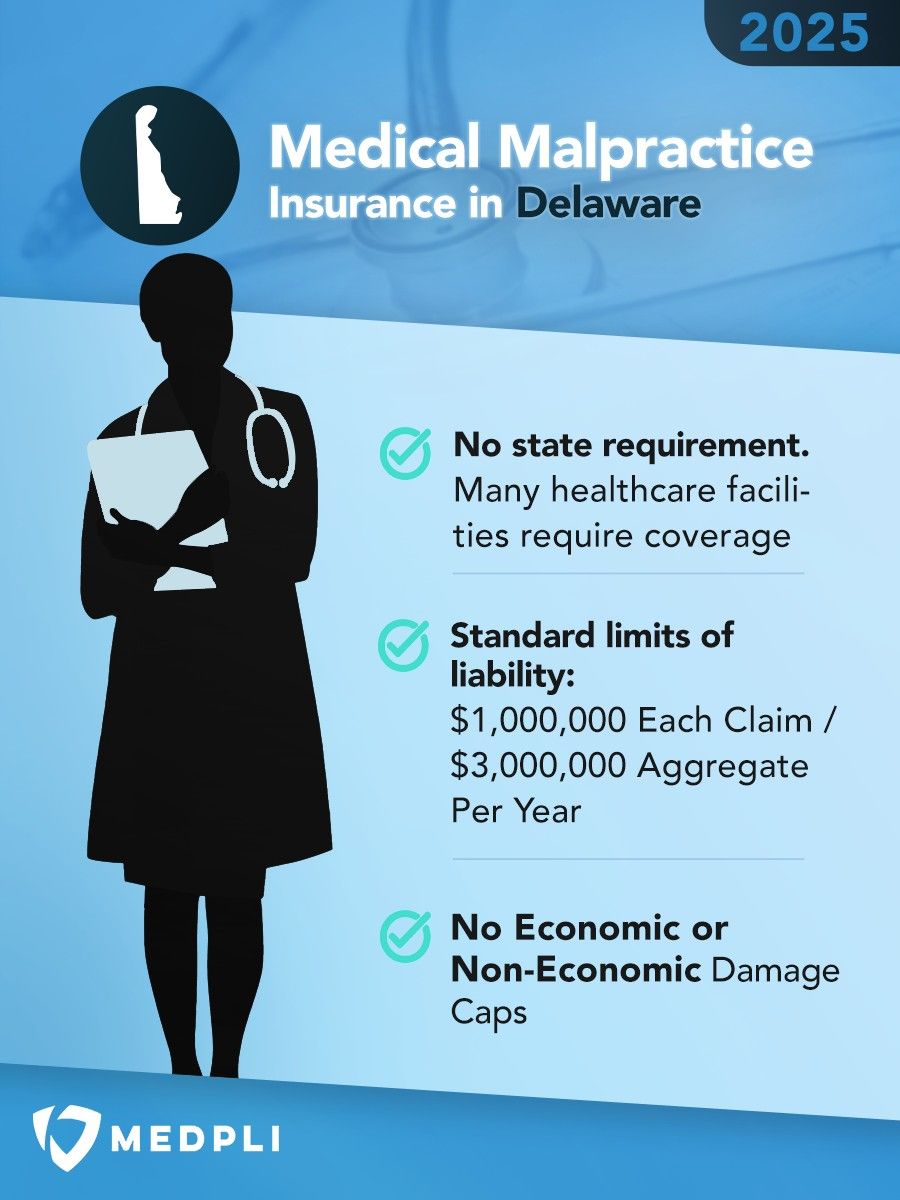

These rate estimates are for informational purposes only and are based on the DE standard limits of $1,000,000 per claim / $3,000,000 aggregate per year in coverage.

Quotes require a completed application and underwriter approval. Contact us for a custom estimate if you don’t see your specialty.

| Specialty | 2025 Annual Premium |

2025 Tail Premium |

|---|---|---|

| Anesthesiology | $21,000 | $42,000 |

| Cardiovascular Disease– Minor Surgery | $21,000 | $42,000 |

| Dermatology– No Surgery | $11,000 | $22,000 |

| Emergency Medicine | $32,000 | $64,000 |

| Family Practice– No Surgery | $14,000 | $28,000 |

| Gastroenterology– No Surgery | $17,000 | $34,000 |

| General Practice– No Surgery | $14,000 | $28,000 |

| General Surgery | $49,000 | $98,000 |

| Internal Medicine– No Surgery | $14,000 | $28,000 |

| Neurology– No Surgery | $18,000 | $$36,000 |

| Obstetrics and Gynecology– Major Surgery | $78,000 | $156,000 |

| Occupational Medicine | $8,000 | $16,000 |

| Ophthalmology– No Surgery | $11,000 | $22,000 |

| Orthopedic Surgery– No Spine | $48,000 | $96,000 |

| Pathology– No Surgery | $10,000 | $20,000 |

| Pediatrics– No Surgery | $14,000 | $28,000 |

| Pulmonary Disease– No Surgery | $19,000 | $38,000 |

| Psychiatry | $11,000 | $22,000 |

| Radiology – Diagnostic | $22,000 | $44,000 |

Delaware Medical Malpractice Payouts From 2015-2024

The Surprising Connection Between Climate Disasters and Medical Malpractice Premiums

When coastal storms, flooding, and other severe weather events hit, the damage isn’t just physical – it drives up insurance costs nationwide. As extreme weather events become more frequent, insurers raise rates to cover growing risks. And the impact goes beyond homeowners insurance – businesses, including medical professionals, also feel the squeeze.

Why Are Insurance Rates Rising?

How are Delaware’s Medical Malpractice Rates Impacted?

Reinsurance providers now charge higher premiums and impose stricter payout conditions. In response, primary insurers, including those offering medical malpractice coverage nationwide, have increased premiums.

While homeowners insurance premiums and malpractice premiums are increasing at a slower rate in Delaware than nationwide, Delaware is not immune to the impact of climate change, and physicians should prepare for additional premium increases as extreme weather events become more frequent.

Severe weather isn’t just a coastal problem—it’s reshaping insurance costs for everyone.

Types of Professional Liability Insurance for Delaware Physicians

Types of Professional Liability Insurance for Delaware Physicians

Doctors in Delaware can choose between these two primary types of medical malpractice insurance:

- Provides coverage for incidents that occurred during the policy period, IF the claim is filed while the policy is still active. If a claim is filed after the policy ends, that claim is NOT covered.

- Typically, it offers lower premiums at the start of the policy, but rates increase yearly as the policy matures.

- Physicians must obtain tail insurance coverage when a claims-made policy ends to ensure protection against future claims related to incidents that occurred during the policy period. Tail insurance premiums require a one-time cash payment equal to approximately 200% of the claims-made policy’s annual premium.

- Provides coverage for incidents that occurred during the policy period, regardless of when a claim is reported to the carrier.

- Typically, it offers more costly premiums at the start of the policy, but the rate stays constant throughout the policy’s duration.

- Physicians do not need tail coverage when an occurrence policy ends.

In 2024, Delaware physicians were held liable for 35 medical malpractice payouts.

- Average Payout: $416,928

- Total Payout: $14,592,500

(Source: National Practitioner Data Bank)

Does Delaware Have Damage Caps for Medical Malpractice Lawsuits?

Unlike many states, Delaware does not impose economic or non-economic damage caps in medical malpractice cases.

Key Rules & Exceptions

-

- Informed Consent: Claimants can’t sue for damages based on lack of informed consent in emergency treatments unless they prove the healthcare provider failed to provide information appropriate to the scenario, according to custom and the injured party’s statements during the event.

- Affidavit of Merit & Expert Witness: A lawsuit can’t be filed in Delaware unless it’s accompanied by an affidavit of merit signed by an expert witness confirming the claim has merit.

- Punitive Damages: Must be awarded separately and only if malicious intent or willful misconduct is proven.

Delaware Statute of Limitations for Medical Malpractice Claims

Delaware Code Title 18, Chapter 68 states that malpractice actions must be filed within 2 years of when the injury occurred.

Exceptions:

- Discovery Rule: If the injury was not known to the injured party, and they could not have reasonably discovered the injury, the statute can be extended one additional year.

- Minors: Minors under the age of 6 have until their 6th birthday to bring action, even if it’s more than 2 years from the date of injury.

- Notice of Intent: Submitting a notice of intent extends the statute for 90 days.

Is Delaware a Physician-Friendly State?

Delaware offers some big advantages for physicians:

- No state-level sales tax or Social Security tax

- Property taxes are low

- Delaware is home to nationally recognized hospitals

But when it comes to medical malpractice, Delaware has its challenges. The state doesn’t have damage caps or tort reform; it uses joint and several liability. These factors can lead to higher payouts and increased malpractice premiums.

In addition, Delaware is removing its medical review panel requirement for malpractice cases starting May 11, 2025. These panels often help screen out meritless lawsuits, so their absence could lead to more early-stage litigation and added pressure on physicians.

Delaware doctors can benefit from working with a knowledgeable malpractice insurance broker to stay protected and manage rising costs. MEDPLI helps physicians find the right coverage at the best possible rate, bringing peace of mind in a changing legal environment.

Why Delaware Doctors Partner with MEDPLI

We exclusively broker medical malpractice insurance, focusing daily on making the professional liability process less burdensome and expensive for doctors.

With MEDPLI, Delaware physicians:

MEDPLI helps doctors in every specialty.

Whether you’re a plastic surgeon in Dover or an OB/GYN in Newark, MEDPLI will provide you with premier coverage at a competitive rate.

Call 800-969-1339 or Request a Quote.

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

See 2026 California medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

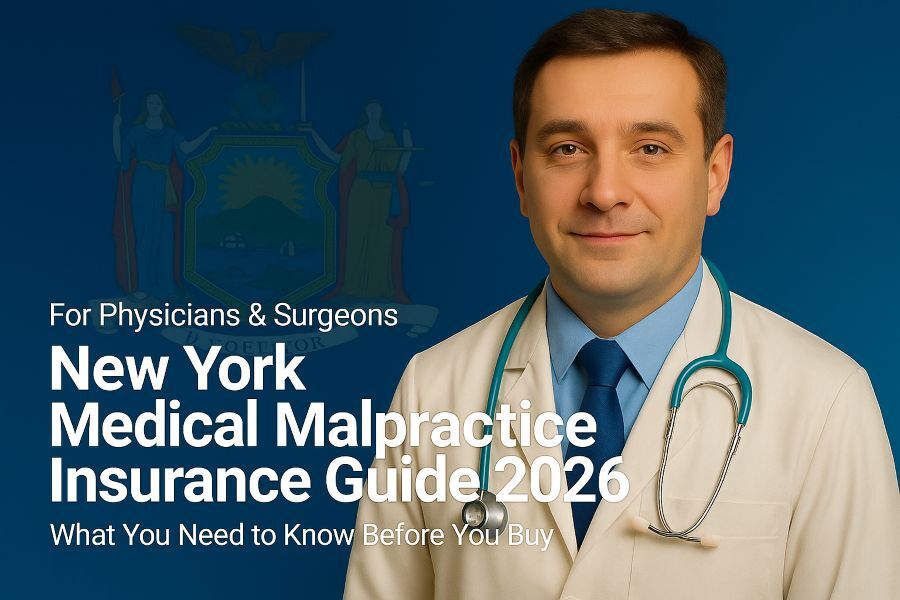

GUIDE: Overview of New York medical malpractice insurance rates by specialty, top carriers, payout statistics, and state regulations. Get a custom quote here.

Medical malpractice insurance specialist Max Schloemann recommends the top liability insurance companies for doctors in 2026. Learn how to compare carriers here.

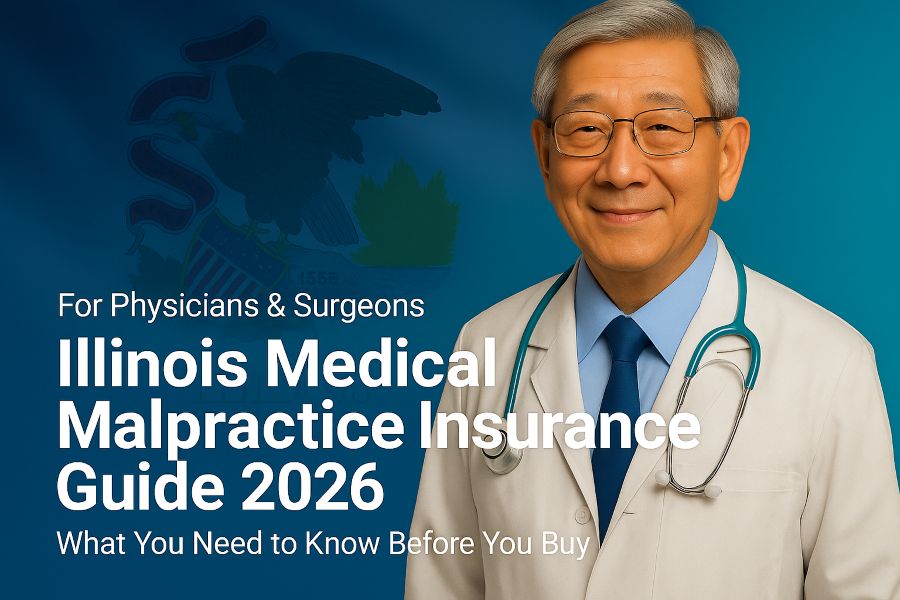

Explore 2026 Illinois medical malpractice insurance costs, top A-rated insurers, payout trends & the latest state regulations. Get your free quote today.