Georgia is a Top “Destination” for Plastic Surgery

Georgia is among the South Atlantic U.S. states in which 3.8 million or 25% of all plastic surgeries in the U.S. were performed, according to 2020 statistics from the American Society of Plastic Surgeons (ASPS). Atlanta, GA, in particular, continues to rank in the Top 10 among the top 50 “destination” cities for cosmetic plastic surgery with the second highest concentration of plastic surgeons per 100,000 residents over the age of 18.

Clearly, Georgia plastic surgeons are in constant demand. However, cosmetic and restorative plastic surgeries alike carry a high risk of serious intraoperative patient injuries and post-operative complications.

That’s why Georgia plastic surgeons need robust medical malpractice insurance.

As your only trusted broker, MEDPLI will help you find the right coverage at the best rate in Georgia.

Get A Quote

If you are a Georgia plastic surgeon in private practice, or planning to open a new practice in Georgia, use this guide prepared by independent MEDPLI insurance brokers to give you a concise overview of medical malpractice insurance. Then contact a MEDPLI insurance broker to discuss your coverage needs and get a quote.

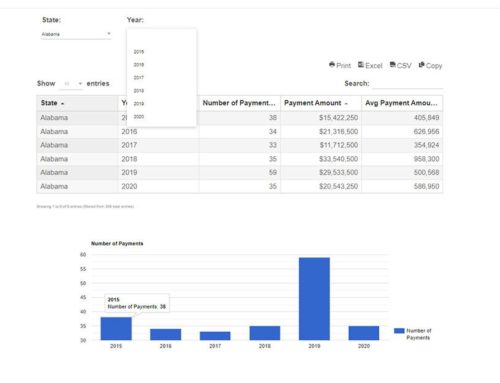

Medical Malpractice Insurance Requirements for Georgia Plastic Surgeons

Georgia plastic surgeons are not legally required to carry medical malpractice insurance. The standard limits of liability in Georgia are $1,000,000 Each Claim / $3,000,000 Aggregate per year in coverage.

Plastic surgery is considered a high-risk specialty, so you should make sure your coverage features are favorable to be adequately protected if sued for malpractice.

MEDPLI strongly recommends securing coverage from an A-rated carrier as the most cost-effective way to protect against devastating financial loss if you are sued for malpractice in Georgia. As an independent broker, we specialize in medical malpractice insurance for plastic surgeons. We can help you find the best coverage at a great price.

Cost of Medical Malpractice Insurance for Georgia Plastic Surgeons

Each insurance carrier uses its own proprietary methods of setting the cost of medical malpractice insurance for plastic surgeons. Carriers consider factors such as practice location, surgical specialty, and past claims history.

The following are approximate medical malpractice insurance premium rates for plastic surgeons across all Georgia areas:

| Specialty | Approximate Claims Made Rate | Approximate Tail Rate | Approximate Occurrence Rate |

|---|---|---|---|

| Plastic Surgery | $80,000 | $160,000 | $90,000 |

*Using the GA standard limits of $1,000,000 Each Claim / $3,000,000 Aggregate per year in coverage

Actual pricing will vary depending on your experience, claims history, and overall risk profile. The above estimates do not include discounts. Be sure to ask your MEDPLI insurance broker to seek all possible discounts you might qualify for.

Types of Professional Liability Insurance for Georgia Plastic Surgeons

Here is an brief overview of the three most common types of medical malpractice insurance for plastic surgeons in Georgia:

1. Claims Made Insurance

Claims-made malpractice insurance provides coverage if the policy is in effect both when the incident took place AND when the claim is filed. If a claim is filed after the end of the policy date, the claim is NOT covered. With a claims-made policy, you need tail malpractice insurance, which is a separately purchased insurance policy or endorsement, to make sure you have full protection.

2. Occurrence Insurance

Occurrence malpractice insurance provides coverage for incidents that occurred during the policy year, regardless of when a claim is reported to the carrier. Occurrence policies are more costly at the start of the policy, but the rate generally stays the same for the length of the policy, and there is no need for tail coverage when the policy ends.

3. Tail Insurance

Since most malpractice insurance policies are underwritten on a claims-made basis, you will be exposed to a lawsuit if a former patient files a claim against you and you do not secure tail coverage. When you are preparing to leave your employer, you should seek tail coverage options with an independent broker like MEDPLI. Tail insurance covers you for a specific time period. The new employer’s policy is not going to cover you for prior acts of a former practice, hence tail coverage is needed.

Reach out to an experienced MEDPLI insurance broker who will get to work for you to find a tail policy at a great price.

Let a MEDPLI Broker Help You Choose the Best Policy for Your Practice

Every surgeon’s situation is unique, so we recommend a conversation with a MEDPLI insurance broker to discuss the unique needs of your Georgia practice. Your MEDPLI insurance broker will explain the benefits and limitations of each type of medical malpractice insurance plan to ensure you get the right type and amount of coverage for your plastic surgery practice.

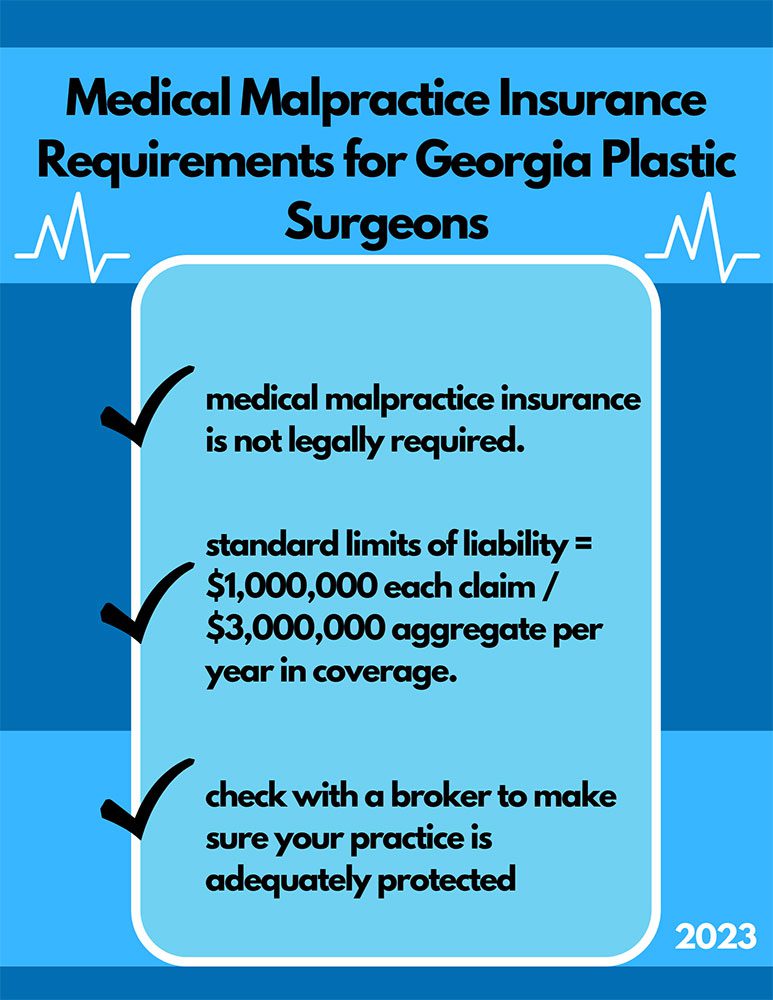

Get Quotes from A-Rated Carriers Serving Georgia Plastic Surgeons

MEDPLI insurance brokers will obtain quotes from medical malpractice insurance from carriers rated “A” by A.M. Best for their long-term financial solvency and robust legal support of policyholders. The top carriers in New Jersey include:

Why Plastic Surgeons Are Classified as High Risk by Georgia Medical Malpractice Insurance Companies

Medical malpractice insurance underwriters classify bariatric surgery as a high-risk specialty because of the surgical side-effects and complications that commonly lead to allegations of malpractice. Therefore, no matter what state you practice in, the cost of medical malpractice insurance will be higher for bariatric surgeons compared to other lower-risk specialties.

Top Reasons Why Georgia Plastic Surgeons Are Sued

A review of malpractice claims data by “A” rated malpractice insurance carrier MedPro Group found that improper surgical performance and poor outcomes of higher-risk elective cosmetic surgeries, surgical errors, and negligence regarding post-operative infections contributed to the risks of plastic surgery, including these iatrogenic patient injuries:

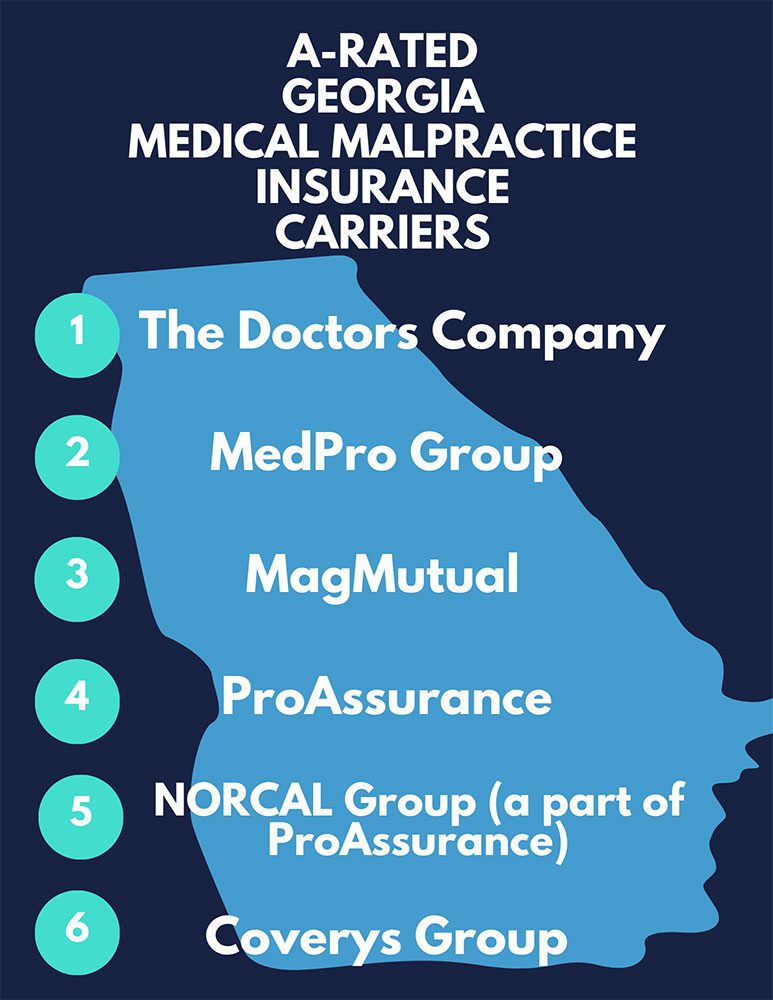

According to a 2020 study by the American Society of Plastic Surgeons (ASPS), plastic surgeons in the South Atlantic region of the U.S., which includes Georgia, performed 32% of all neck lift procedures, 30% of all facelift procedures, 28% of eyelid surgeries, and 26% of all aesthetic breast reduction procedures in the U.S.

In addition to general surgical risks and claims of patient dissatisfaction with the results, most of these procedures carry a higher risk of medical malpractice claims citing specific injuries or complications, including:

Plastic surgeons can reduce their risk of a malpractice lawsuit by implementing a comprehensive risk management strategy.

Georgia’s Medical Malpractice Insurance Legislation

Consulting with a MEDPLI insurance broker who understands the complexities of Georgia’s medical malpractice laws will ensure that your plastic surgery practice is protected with the right amount of coverage.

Georgia’s Damage Caps on Medical Malpractice Lawsuits

Georgia law does not place a limit on economic damages recoverable from a medical malpractice claim, including compensation for healthcare costs, rehabilitation, ongoing medical care, lost wages, lost earning capacity, and other economic losses.

However, Georgia law still caps non-economic damages in medical malpractice cases at $250,000. In rare cases, if the claimant can show that the medical professional “acted with egregious negligence or intentional malice”, the court has the ability to raise the non-economic damage limit.

Georgia’s Statute of Limitations for Medical Malpractice Claims

Generally, the amount of time a person has to file a medical malpractice lawsuit is two years. In some instances, that time can be extended:

Plastic Surgeon Medical Malpractice Outcomes in Georgia

With no cap on economic damages, and a $250,000 cap on non-economic damages, plastic surgeons in Georgia are more vulnerable to personal financial loss if they don’t have adequate medical malpractice coverage.

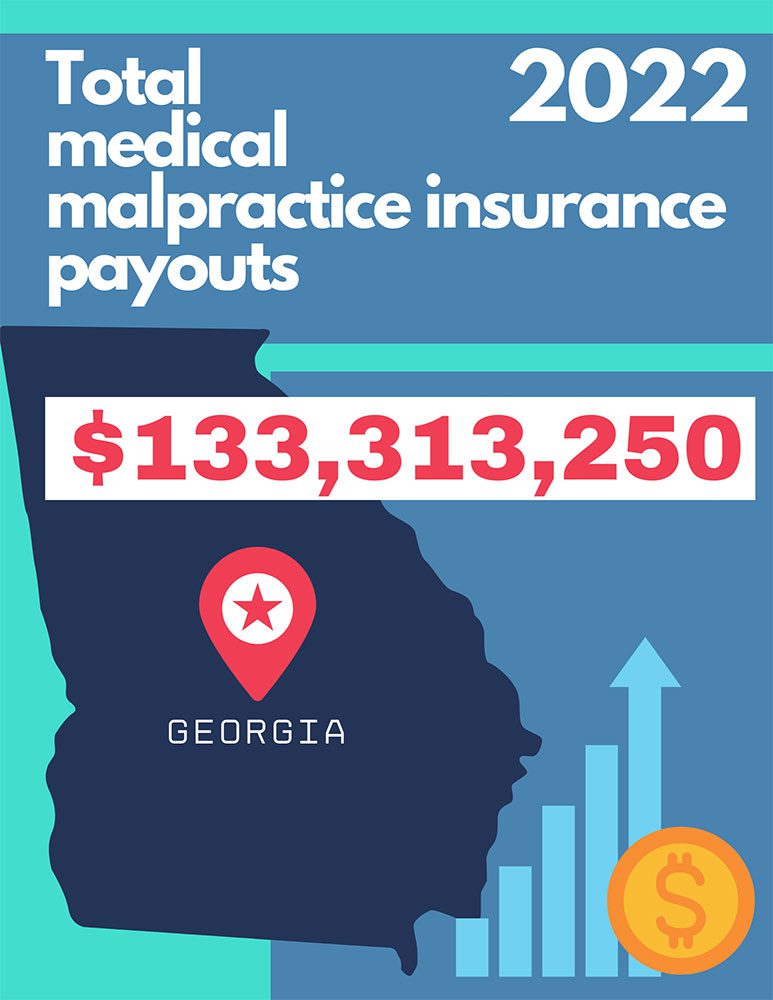

In 2022, the total medical malpractice payout in Georgia was $133,313,250.

The following examples of Georgia medical malpractice lawsuits found in favor of the plaintiff, or paid as a settlement, show the critical need for plastic surgeons to have more than adequate liability coverage:

Jury Awards Plastic Surgery Patient $1.1 Million

A female patient who was a cancer survivor suffered permanent deformities and scarring due to an open wound following breast augmentation surgery. The claim alleged that the surgeon had failed to inform the patient that her risk of complications was higher because she had previously undergone radiation after a breast lumpectomy.

Jury Awards Plastic Surgery Patient $1.3 Million

After an elective cosmetic tummy tuck procedure, a female patient suffered pain and burning sensation from a staph infection. The claim alleged negligence in that the surgeon misdiagnosed the post-op wound and did not provide proper treatment for several weeks. The patient eventually sought care at an ER and was sent to a wound care clinic. She has permanent scarring, deformed tissue, and chronic pain.

Even the Best Plastic Surgeons In Georgia Need Protection From Malpractice Lawsuits

Most surgeons face at least one medical malpractice lawsuit brought forth by a patient throughout their career, so it’s essential to be covered when it happens to you. In addition to damages awarded to the plaintiff, having medical malpractice insurance assures that your legal costs will be covered regardless of whether the case is won or lost.

How MEDPLI Brokers Help Plastic Surgeons Save Time and Money on Medical Malpractice Insurance

Working with MEDPLI as your trusted broker takes the guesswork and effort out of trying to get the right coverage at the best rate on your own. We help you save time and money by:

MEDPLI insurance brokers are ready to help you navigate the complexities of Georgia’s medical malpractice laws and secure the right amount of coverage for your plastic surgical practice. From submitting your application, obtaining the best rates for new policies and renewals from “A” rated carriers, and more, MEDPLI is the only medical malpractice insurance broker you’ll need.