Table of Contents

- Virginia Medical Malpractice Insurance: 2026 Buyer’s Guide

- Top 5 Medical Malpractice Insurance Carriers in Virginia

- What is the Cost of Medical Liability and Malpractice Insurance in Virginia?

- Average Medical Malpractice Payouts in Virginia From 2015-2024

- Professional Liability Insurance Options for Virginia Physicians

- What Is the Medical Malpractice Cap in Virginia?

- What Is the Statute of Limitations in Virginia for Medical Malpractice?

- Virginia Physicians & Surgeons Partner with MEDPLI

- Virginia Medical Malpractice Insurance FAQ

- Get Your Quote for Medical Malpractice Insurance in Virginia

What is the Cost of Medical Liability and Malpractice Insurance in Virginia?

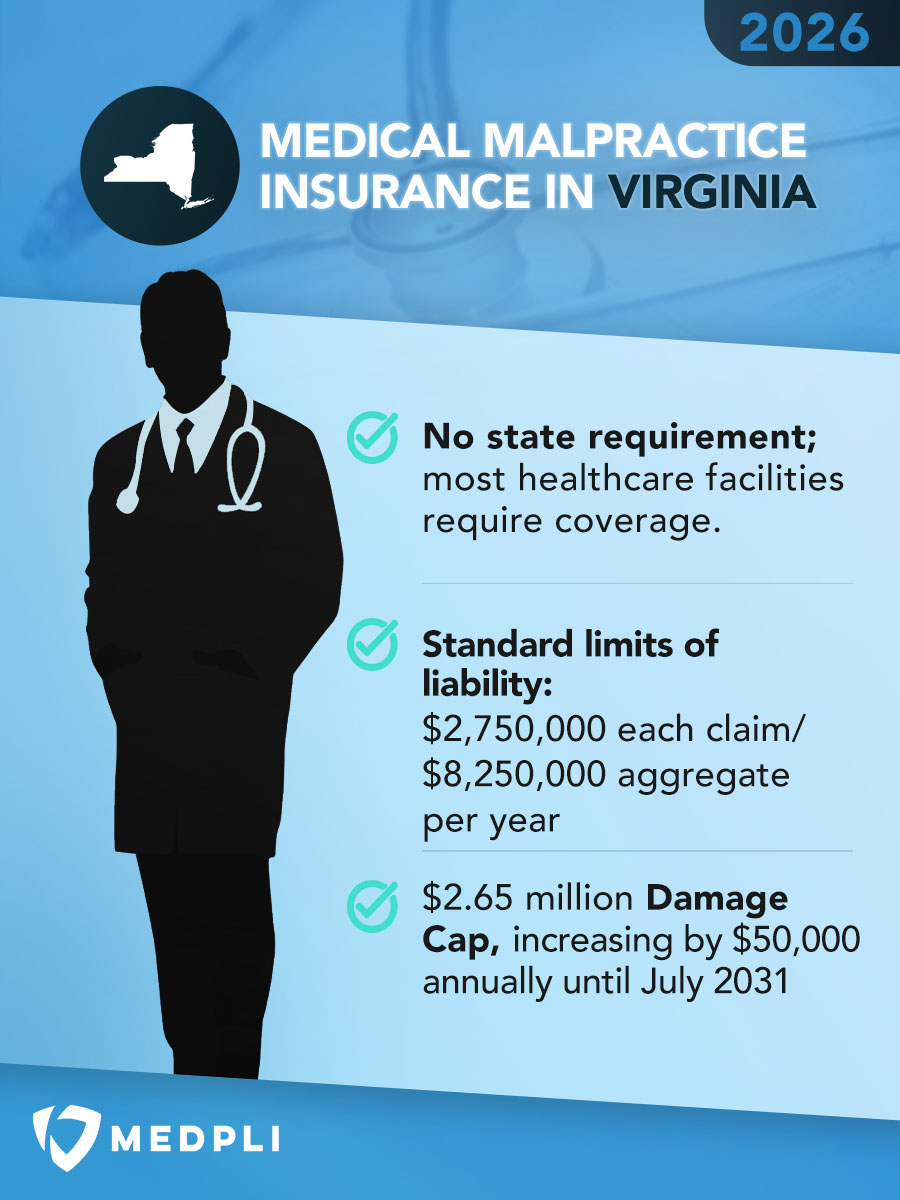

These rate estimates are for informational purposes only and are based on the VA standard limits of $2,750,000 per claim and $8,250,000 aggregate per year in coverage.

Quotes require a completed application and underwriter approval. Contact us for a custom estimate if you don’t see your specialty.

Average Cost of Medical Malpractice Insurance

by Specialty in Virginia

(2026 data, $2.75M/$8.25M coverage)

| Specialty | 2026 Annual Premium |

2026 Tail Premium |

|---|---|---|

| Anesthesiology | $33,660 | $67,320 |

| Cardiovascular Disease– Minor Surgery | $32,640 | $65,280 |

| Dermatology– No Surgery | $13,260 | $26,520 |

| Emergency Medicine | $47,940 | $95,880 |

| Family Practice– No Surgery | $17,340 | $34,680 |

| Gastroenterology– No Surgery | $29,580 | $59,160 |

| General Practice– No Surgery | $17,340 | $34,680 |

| General Surgery | $90,780 | $181,560 |

| Internal Medicine– No Surgery | $17,340 | $34,680 |

| Neurology– No Surgery | $36,720 | $73,440 |

| Obstetrics and Gynecology– Major Surgery | $97,920 | $195,840 |

| Occupational Medicine | $10,200 | $20,400 |

| Ophthalmology– No Surgery | $8,160 | $16,320 |

| Orthopedic Surgery– No Spine | $55,080 | $110,160 |

| Pathology– No Surgery | $19,380 | $38,760 |

| Pediatrics– No Surgery | $15,300 | $30,600 |

| Pulmonary Disease– No Surgery | $28,560 | $57,120 |

| Psychiatry | $11,220 | $22,440 |

| Radiology – Diagnostic | $41,820 | $83,640 |

*Note: These rates are approximate, and each individual has unique factors that can affect their premium.

Have a question? Get fast answers from a U.S.-based MEDPLI agent. Call 1-800-969-1339 or email info@medpli.com.

Average Medical Malpractice Payouts in Virginia From 2015-2024

In 2024, Virginia physicians were held liable for 155 medical malpractice payouts.

- Average Payout: $498,243

- Total Payout: $77,227,750

(Source: National Practitioner Data Bank)

Professional Liability Insurance Options for Virginia Physicians

Physicians in Virginia can choose between these two primary types of medical malpractice insurance:

- Provides coverage for incidents that occurred during the policy period IF the claim is filed while the policy is still active. If a claim is filed after the policy ends, that claim is NOT covered.

- Typically, it offers lower premiums at the start of the policy, but rates increase yearly as the policy matures.

- Physicians must obtain tail insurance coverage when a claims-made policy ends to ensure protection against future claims related to incidents that occurred during the policy period. Tail insurance premiums require a one-time cash payment equal to approximately 200% of the claims-made policy’s annual premium.

- Provides coverage for incidents that occurred during the policy period, regardless of when a claim is reported to the carrier.

- Typically, it offers more costly premiums at the start of the policy, but the rate stays constant throughout the policy’s duration.

- Physicians do not need tail coverage when an occurrence policy ends.

Rising Home Insurance Rates: The Hidden Impact on Medical Malpractice Costs

When hurricanes and other severe storms hit Virginia, the damage isn’t just physical—it drives up insurance costs statewide. As extreme weather events become more frequent, insurers must raise rates to cover growing risks. As a result, Virginia’s home and auto insurance industries are seeing increased costs. But the impact goes beyond Virginia homeowners—businesses, including medical professionals, also feel the squeeze.

Why Are Insurance Rates Rising?

What Affects Medical Malpractice Insurance Costs in Virginia?

Reinsurance providers now charge higher premiums and impose stricter payout conditions. In response, primary insurers increase premiums, including for medical malpractice coverage in Virginia.

Severe weather isn’t just a coastal problem—it’s reshaping insurance costs for everyone.

What Is the Medical Malpractice Cap in Virginia?

Unlike most states, Virginia caps both economic and non-economic damages in malpractice cases.

Virginia Damage Caps breakdown

- Economic and Non-economic Damages: The current total cap for combined damages is $2.65 million, increasing on July 1st of each year until it reaches $3 million in July 2031.

- Punitive Damages: This total cap includes punitive damages, which cannot exceed $350,000.

- Wrongful Death Cases: There is no exception for wrongful death cases.

Notable Legislation for Virginia’s Damage Caps

- 1976: In response to the surge in medical malpractice cases and costs in the mid-1970s, Virginia passed a $750,000 damage cap for medical malpractice cases.

- 1999: Damage cap increased to $1 million.

- 2011: Current damage cap plan enacted. Damage cap increases $50,000 annually until it reaches $3 million in July 2031.

What Is the Statute of Limitations in Virginia for Medical Malpractice?

The Code of Virginia states that malpractice actions must be filed within two years from injury discovery—or when the plaintiff should have discovered the injury—but cannot exceed ten years after the alleged malpractice.

Key Rules & Exceptions

- Minors: The two-year statute of limitation remains in effect for suits brought on behalf of a minor unless the minor involved was younger than eight years old at the time of alleged malpractice, in which case the action must be filed by the minor’s tenth birthday.

- Wrongful Death: A wrongful death suit must be filed by a personal representative of the patient within two years of the death.

- Foreign object(s): If a foreign object was left in the plaintiff’s body, the statute of limitations starts one year from when the patient discovers, or should have discovered, the object.

- Negligent Failure: If negligence by the physician prevented the diagnosis of certain conditions, such as malignant tumors and cancer, the statute of limitations starts one year from the date of diagnosis.

- Other Scenarios: Title 8.01, Chapter 4, Article 1 of the Code of Virginia provides a complete list of exceptions to the statute of limitations.

Canceled or Non-Renewed?

MEDPLI Is Your Best Ally.

Virginia Physicians & Surgeons Partner with MEDPLI

We exclusively broker medical malpractice insurance, focusing daily on making the professional liability process less burdensome and expensive for doctors.

With MEDPLI, Virginia physicians:

Virginia Medical Malpractice Insurance FAQ

Virginia doesn’t have a state law that forces physicians to carry their own malpractice insurance. Even so, most doctors still do. Hospitals, surgical centers, and many private practices require coverage for privileges, and insurers may require it for network participation. Without coverage, a single claim could be financially devastating, so having a solid policy is the safest way to protect yourself and your practice.

Virginia does not set required malpractice insurance limits, so coverage amounts vary based on specialty, employer requirements, and practice setting. Many Virginia physicians carry coverage levels that align with the state’s medical malpractice damage cap, while others select lower or higher limits depending on risk exposure and credentialing requirements.

Higher-risk specialties such as OB-GYN or neurosurgery often carry higher limits than lower-risk specialties. The right coverage depends on how and where you practice.

Virginia has a statewide cap on total damages in medical malpractice cases, and that cap goes up slightly every year. Even with a cap in place, physicians are still exposed to large defense costs and settlement demands, which is why solid coverage is important. The cap doesn’t replace good insurance; it just gives you a clearer ceiling on potential awards.

MEDPLI can walk you through the current cap amount and what limits make sense for your situation.

Get Your Quote for Medical Malpractice Insurance in Virginia

Whether you’re a General Surgeon in Virginia Beach or an OBGYN in Staunton, MEDPLI will find you premier coverage at a competitive rate.

Call 800-969-1339 or Request a Quote.

GET QUOTE

Get a fast quote for medical malpractice insurance.

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

Compare claims-made vs. claims-paid medical malpractice insurance for doctors. Learn differences, risks, costs & which policy best protects your practice here.

Read 2026 Ohio medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

Read 2026 Washington medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

GUIDE: Overview of Arizona medical malpractice insurance rates by specialty, top carriers, payout statistics & state regulations. Get a custom quote here.