Top 6 Insurance Companies

We recommend carriers with an AM Best “A” or higher rating. An A-rating indicates financial strength, long-term solvency, and an established history of protecting Ohio physicians.

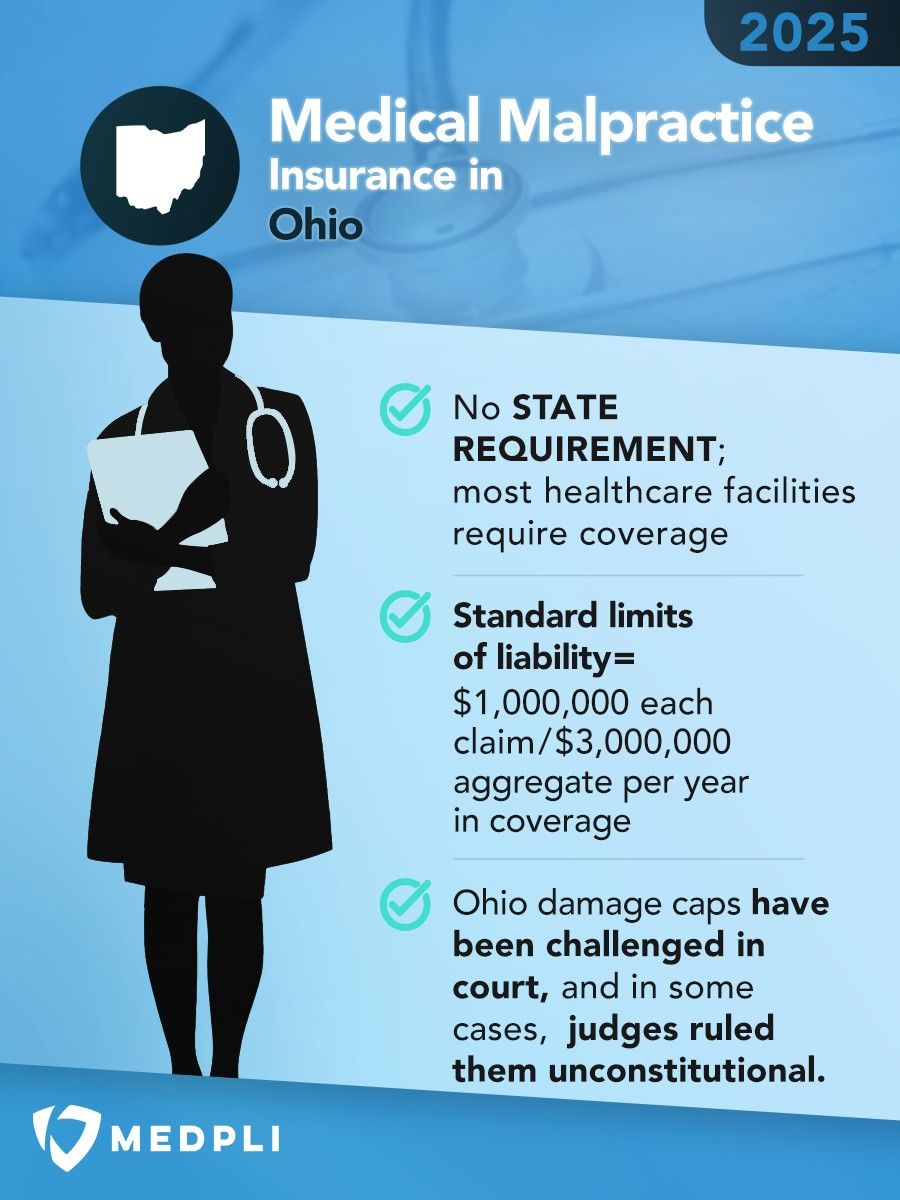

2025 Ohio Malpractice Insurance Rates by Specialty

These rate estimates are for informational purposes only and are based on the OH standard limits of $1,000,000 for Each Claim / $3,000,000 Aggregate per year in coverage.

Quotes require a completed application and underwriter approval. Contact us for a custom estimate if you don’t see your specialty.

| Specialty | 2025 Annual Premium |

2025 Tail Premium |

|---|---|---|

| Anesthesiology | $35,000 | $70,000 |

| Cardiovascular Disease– Minor Surgery | $34,000 | $68,000 |

| Dermatology– No Surgery | $15,000 | $30,000 |

| Emergency Medicine | $40,000 | $80,000 |

| Family Practice– No Surgery | $18,000 | $36,000 |

| Gastroenterology– No Surgery | $27,000 | $54,000 |

| General Practice– No Surgery | $18,000 | $36,000 |

| General Surgery | $63,000 | $126,000 |

| Internal Medicine– No Surgery | $18,000 | $36,000 |

| Neurology– No Surgery | $22,000 | $44,000 |

| Obstetrics and Gynecology– Major Surgery | $84,000 | $168,000 |

| Occupational Medicine | $12,000 | $24,000 |

| Ophthalmology– No Surgery | $14,000 | $28,000 |

| Orthopedic Surgery– No Spine | $62,000 | $124,000 |

| Pathology– No Surgery | $14,000 | $28,000 |

| Pediatrics– No Surgery | $18,000 | $36,000 |

| Pulmonary Disease– No Surgery | $34,000 | $68,000 |

| Psychiatry | $9,000 | $18,000 |

| Radiology – Diagnostic | $35,000 | $70,000 |

Ohio Medical Malpractice Payouts From 2015-2023

Types of Professional Liability Insurance for Ohio Physicians

Types of Professional Liability Insurance for Ohio Physicians

Choosing the right liability insurance is essential for Ohio physicians to protect their careers and practices – especially since rates in this state have dramatically increased over the last few years. In 2025, physicians can select from two types of coverage, each designed to address specific risks.

- Covers claims only IF BOTH the incident and the resulting claim occur while the policy is active. If the policy is canceled or switched, coverage stops.

- Typically less expensive at the start but increases over time.

- Physicians must obtain tail insurance coverage when a claims-made policy ends to ensure protection against future claims related to incidents that occurred during the policy period. Tail coverage can be costly, sometimes up to 200% of the annual premium.

- Covers incidents that happen DURING the policy period, regardless of when the claim is filed.

- Generally more expensive upfront than claims-made policies, but it offers long-term security, and the premiums remain steady over time.

- No need for tail coverage — protection remains even if the policy is canceled or changed.

In 2023, Ohio physicians were held liable for 121 medical malpractice payouts.

- Average Payout: $532,210

- Total Payout: $64,397,500

(Source: National Practitioner Data Bank)

Tort Reform: Does Ohio Have Damage Caps for Medical Malpractice Lawsuits?

Ohio imposes caps on non-economic damages in medical malpractice lawsuits. These caps are designed to limit compensation for intangible losses such as pain and suffering, emotional distress, and loss of enjoyment of life.

2025 Non-Economic Damage Caps:

- Non-Catastrophic Injury: $250,000 or three times the amount of economic damages, whichever is greater, but not exceeding $350,000 per plaintiff.

- Catastrophic Injury: $500,000 per plaintiff

Ohio’s damage caps have been challenged in court, and in some cases, judges have ruled them unconstitutional—especially for plaintiffs with severe, life-altering injuries. However, Ohio does not cap economic damages, meaning there is no limit on compensation for medical expenses, lost wages, and other financial losses.

Ohio Statute of Limitations for Medical Malpractice Claims

In Ohio, understanding the time frames for filing medical malpractice claims is crucial for both patients and healthcare providers. The state enforces specific statutes that dictate these deadlines.

- One year from the date the injury was discovered, or reasonably should have been discovered, or from the end of the patient-physician relationship, whichever occurs later.

- No claim can be initiated more than 4 years after the alleged act of negligence, regardless of the discovery date.

Exceptions:

- For patients under 18, the one-year statute begins upon reaching adulthood, effectively allowing until their 19th birthday to file a claim.

- If a foreign object is left inside a patient’s body, the one-year period starts upon discovery, even if this occurs beyond the standard time frames.

- In cases where medical negligence leads to death, a wrongful death claim must be filed within two years from the date of death.

Adhering to these statutes is essential, as filing outside these time frames can result in the dismissal of the claim. Consulting with legal counsel promptly can help ensure compliance with Ohio’s specific requirements.

Why Ohio Doctors Partner with MEDPLI

We exclusively broker medical malpractice insurance, focusing daily on making the professional liability process less burdensome and expensive for doctors.

With MEDPLI, Ohio physicians:

MEDPLI helps doctors in every specialty.

At MEDPLI, we find you premier coverage at competitive rates, whether you’re a Columbus-based PCP or a dermatologist in Dayton. Call 800-969-1339 or Request a Quote.