Medical Malpractice Insurance: Claims-Made vs. Occurrence Coverage

This guide explains the key differences between occurrence and claims-made coverage, offering context to help you determine which option is best for you and your practice.

Get a Quote

Table of Contents

- 1. What is the Main Difference Between Occurrence and Claims-Made Insurance?

- 2. Do Occurrence and Claims-Made Policies Offer Different Benefits?

- 3. Case Study: A New York Neurosurgeon Moves to Florida

- 4. Which Type of Coverage is More Affordable?

- 5. Occurrence Policy Cost Estimates

- 6. Claims-Made Policy Cost Estimates

- 7. Why Are Occurrence & Claims-Made Policies Priced Differently?

- 8. Do All Physicians Qualify for Occurrence and Claims-Made Policies?

- 9. How Do Limits of Coverage Apply for Occurrence vs Claims-Made Insurance?

- 10. Pros & Cons of Occurrence vs. Claims-Made Medical Malpractice Insurance

- 11. How Do Limits of Coverage Apply for Occurrence vs Claims-Made Insurance?

- 12. Why Physicians Work with MEDPLI to Secure Medical Malpractice Insurance

- About the Author

- Latest from the Medical Malpractice Insurance Blog

- 7 Essential Insights for MedSpa Malpractice Insurance

- 2025 Physician’s Guide to Tail Insurance

- 2025 New Hampshire Medical Malpractice Insurance Buying Guide

- Top 25 Medical Malpractice Insurance Carriers for Doctors in 2025

1. What is the Main Difference Between Occurrence and Claims-Made Insurance?

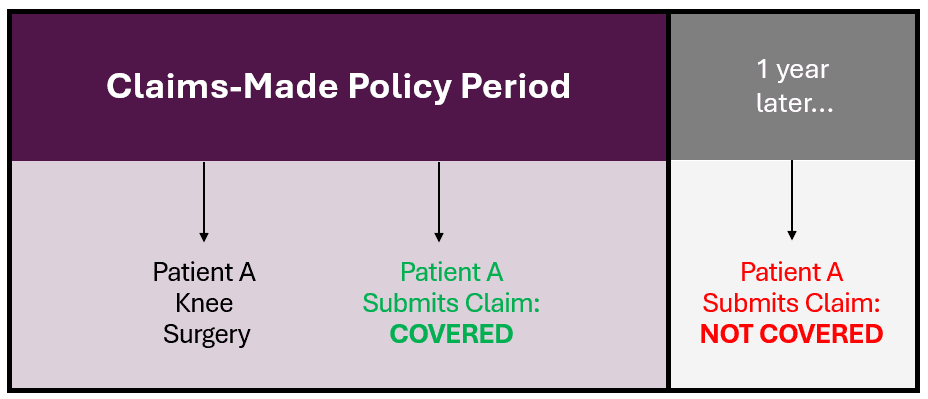

With claims-made coverage, the physician is covered for malpractice claims when both the patient care and claim submission fall within the policy period.

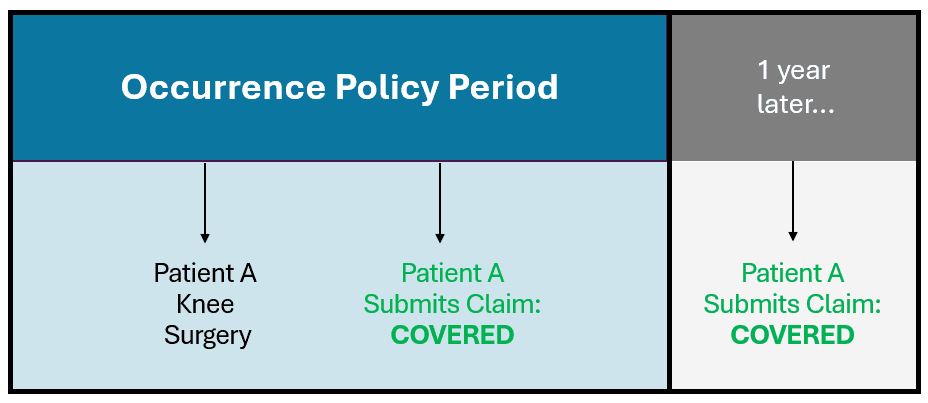

With occurrence coverage, the physician is covered for all malpractice claims related to patient care that took place during the policy period, regardless of when the claim is submitted.

2. Do Occurrence and Claims-Made Policies Offer Different Benefits?

As you decide between an occurrence or claims-made policy, it is important to understand how each policy type differs in regards to coverage, reporting requirements and rate structure.

These differences include:

| Policy Feature | Claims-Made Policy | Occurrence Policy |

|---|---|---|

| Coverage Period | Covers claims made during the policy period, IF the incident occurred after the retroactive date. | Covers any claim that is submitted within the policy period, regardless of incident date. |

| Retroactive Date | No coverage for incidents prior to the retroactive date. | N/A – Incident date does not impact coverage. |

| Claims Reporting | Claims must be reported during the policy period. | Claims can be reported at any time, even after the policy period ends. |

| Limits of Liability | Yes | Yes |

| Premiums | Lower premiums for the first several years; significant increases over time. | Higher premiums; no increases. |

| Tail Coverage | Necessary for protection against claims that might be reported after the policy period ends. | N/A |

3. Case Study: A New York Neurosurgeon Moves to Florida

Dr. Jones is a neurosurgeon in New York practicing under the protection of a medical malpractice policy from Insurance Company A. She decides to ditch cold winters and establish a private practice in Florida, securing new coverage from Insurance Company B.

Two years later, a patient from New York files a malpractice claim.

Is Dr. Jones protected? That depends on the type of policy she purchased in NYC:

Option 1: New York Occurrence Policy

With an occurrence policy, Dr. Jones would still be covered because the patient received treatment within the policy period. Therefore, Insurance Company A maintains financial liability for the claim even though it was submitted long after the move to Florida.

Option 2: New York Claims-Made Policy

With a claims-made policy, Insurance Company A would only cover the claim if Dr. Jones had purchased tail coverage within the policy’s opt-in period, usually 30 days after the original policy ends. If she moved to Florida without a tail, Insurance Company A would be under no obligation to cover the claim.

Similarly, Insurance Company B would not cover the claim unless Dr. Jones had included prior acts coverage (aka nose coverage) as an add-on to the new claims-made policy she chose for the Florida practice.

4. Which Type of Coverage is More Affordable?

The total cost of a malpractice insurance policy will vary based on a number of factors, including location, medical specialty, types of procedures provided, and the physician’s individual prior claims history.

The type of policy also impacts the pricing structure:

5. Occurrence Policy Cost Estimates

Specialty | Location | Year 1 | Year 2 | Year 3 | Year 4 | Total |

Orthopedic Surgeon | Miami, FL | $80,000 | $80,000 | $80,000 | $80,000 | $320,000 |

Neurosurgeon | Los Angeles, CA | $60,000 | $60,000 | $60,000 | $60,000 | $240,000 |

Plastic Surgeon | Atlanta, GA | $50,000 | $50,000 | $50,000 | $50,000 | $200,000 |

General Surgeon | Pittsburgh, PA | $45,000 | $45,000 | $45,000 | $45,000 | $180,000 |

Anesthesiologist | Chicago, IL | $35,000 | $35,000 | $35,000 | $35,000 | $140,000 |

OB/GYN | Austin, TX | $40,000 | $40,000 | $40,000 | $40,000 | $160,000 |

6. Claims-Made Policy Cost Estimates

Specialty | Location | Year 1 | Year 2 | Year 3 | Year 4 | Tail | Total |

Orthopedic Surgeon | Miami, FL | $22,000 | $44,000 | $58,000 | $65,000 | $130,000 | $319,000 |

Neurosurgeon | Los Angeles, CA | $18,000 | $35,000 | $48,000 | $55,000 | $110,000 | $266,000 |

Plastic Surgeon | Atlanta, GA | $17,000 | $34,000 | $42,000 | $45,000 | $90,000 | $228,000 |

General Surgeon | Pittsburgh, PA | $15,000 | $30,000 | $37,000 | $40,000 | $80,000 | $202,000 |

Anesthesiologist | Chicago, IL | $12,000 | $24,000 | $30,000 | $33,000 | $60,000 | $160,000 |

OB/GYN | Austin, TX | $14,000 | $28,000 | $33,000 | $35,000 | $70,000 | $180,000 |

7. Why Are Occurrence & Claims-Made Policies Priced Differently?

Prior to the first major malpractice insurance crisis of the 1970s, nearly all doctors were covered by occurrence form policies, but that changed when a massive increase in malpractice lawsuits resulted in larger than anticipated claim payouts, causing many carriers to lose solvency.

In consequence, insurance companies pivoted towards offering claims-made policies which allowed them to increase rates annually to offset rising costs associated with the market and prior acts period.

Claims-made rates are more fluid because carriers can more accurately set premiums to reflect the risk profile of a finite coverage period. Occurrence rates, on the other hand, are higher and more concrete because carriers need to address the unknown risk profile associated with the broader coverage terms of an occurrence policy.

While occurrence coverage buyers pay more up front, they also mitigate the risk for future rate increases if/when America’s legal climate or market conditions begin to trend unfavorably for insurance carriers.

8. Do All Physicians Qualify for Occurrence and Claims-Made Policies?

Not all doctors will qualify for occurrence coverage. While both policy types can technically cover the same range of medical care and procedures, insurance carriers are unable to offer occurrence coverage to certain practice risk profiles. High-risk profile providers, like neurosurgeons or OBGYNS, will often be limited to claims-made policies.

9. How Do Limits of Coverage Apply for Occurrence vs Claims-Made Insurance?

There are fundamental differences in how the limits of coverage are applied to occurrence vs claims-made policies:

10. Pros & Cons of Occurrence vs. Claims-Made Medical Malpractice Insurance

Both policy types have strengths and can offer protection against the financial burden of medical malpractice claims. Consider how occurrence vs claims-made coverage aligns with your business needs and personal circumstances.

An experienced broker can help you analyze and prioritize the policy features that are of most importance to you, including:

The following examples of New Jersey medical malpractice lawsuits found in favor of the plaintiff, or paid as a settlement, show the critical need for orthopedic surgeons to have strong liability coverage:

Features | Occurrence Policy | Claims-Made Policy |

Provides liability coverage for doctors in the event of a lawsuit | ||

Protects doctors from attorney's fees | ||

Protects doctors from monetary damages awarded to a plantiff | ||

Fixed, flat cost for premium across the length of the policy | ||

No need to purchase tail insurance | ||

Premium prices are subject to less volatility | ||

More total coverage with policy limits | ||

Can easily switch from one policy to another | ||

Most affordable at the outset | ||

More accurately prices the premium to the current risk | ||

Attractive option for doctors in the last 5 years before retirement | ||

Widely available for all medical practice profiles | ||

Changes to current coverage or policy limits apply to past years | ||

Need to purchase tail insurance |

11. How Do Limits of Coverage Apply for Occurrence vs Claims-Made Insurance?

There are fundamental differences in how the limits of coverage are applied to occurrence vs claims-made policies:

12. Why Physicians Work with MEDPLI to Secure Medical Malpractice Insurance

MEDPLI is the doctor’s broker. Our mission is to make the malpractice insurance process less painful and expensive for doctors.

MEDPLI medical malpractice insurance brokers can help you find the right coverage from top carriers– at the best rates. Call us at 800-969-1339, email info@medpli.com, or fill out a contact request form today.

*The information in this post is for informational purposes only and is not intended to diagnose or treat your situation. Seek a consultation from an experienced medical malpractice insurance broker for assistance with your unique situation.

GET QUOTE

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

Protect Your MedSpa: 7 Expert Tips for Medical Malpractice Insurance Coverage. Learn what to look for and how to avoid costly claims.

GUIDE: Get tail insurance insights from MEDPLI's expert medical malpractice brokers. Find FAQs and tips for affordable, A-rated coverage. Learn more here.

GUIDE: Read here for New Hampshire’s medical malpractice insurance rates by specialty, top carriers, payout trends & state laws. Get a custom quote here.

Medical malpractice insurance specialist Max Schloemann recommends the top liability insurance companies for doctors in 2025. Learn how to compare carriers here.