Top 6 Medical Malpractice Insurance Carriers in Kentucky

We recommend carriers with an AM Best “A” or higher rating. An A-rating indicates financial strength, long-term solvency, and an established history of protecting Kentucky physicians.

2025 Kentucky Malpractice Insurance Rates by Specialty

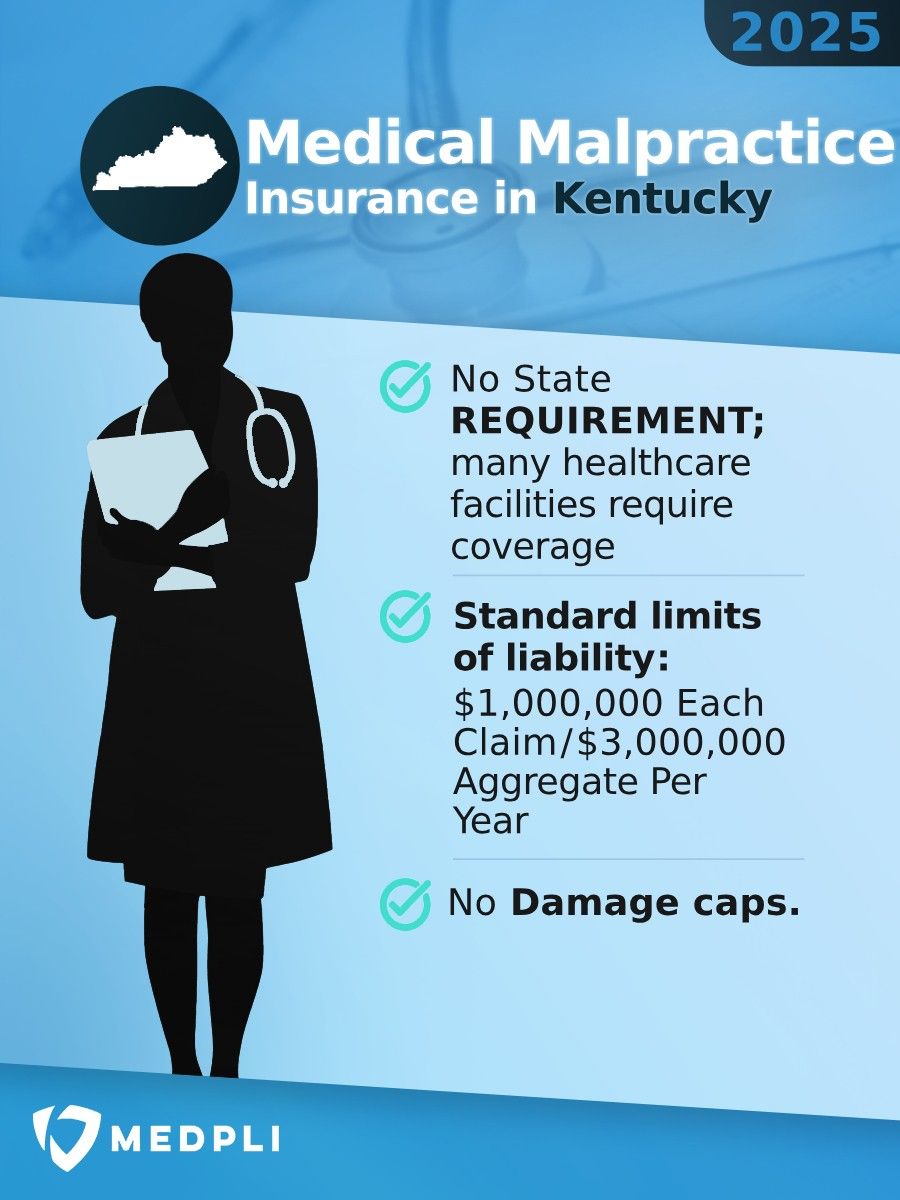

These rate estimates are for informational purposes only and are based on the KY standard limits of $1,000,000 for each Claim / $3,000,000 Aggregate per year in coverage.

Quotes require a completed application and underwriter approval. Contact us for a custom estimate if you don’t see your specialty.

| Specialty | 2025 Annual Premium |

2025 Tail Premium |

|---|---|---|

| Anesthesiology | $28,000 | $56,000 |

| Cardiovascular Disease– Minor Surgery | $27,000 | $54,000 |

| Dermatology– No Surgery | $12,000 | $24,000 |

| Emergency Medicine | $32,000 | $64,000 |

| Family Practice– No Surgery | $16,000 | $32,000 |

| Gastroenterology– No Surgery | $22,000 | $44,000 |

| General Practice– No Surgery | $16,000 | $32,000 |

| General Surgery | $58,000 | $116,000 |

| Internal Medicine– No Surgery | $16,000 | $32,000 |

| Neurology– No Surgery | $20,000 | $40,000 |

| Obstetrics and Gynecology– Major Surgery | $88,000 | $176,000 |

| Occupational Medicine | $9,000 | $18,000 |

| Ophthalmology– No Surgery | $12,000 | $24,000 |

| Orthopedic Surgery– No Spine | $48,000 | $96,000 |

| Pathology– No Surgery | $15,000 | $30,000 |

| Pediatrics– No Surgery | $16,000 | $32,000 |

| Pulmonary Disease– No Surgery | $22,000 | $44,000 |

| Psychiatry | $14,000 | $28,000 |

| Radiology – Diagnostic | $28,000 | $56,000 |

Kentucky Medical Malpractice Payouts From 2015-2024

Rising Home Insurance Rates: The Hidden Impact on Medical Malpractice Costs

When drought, floods, and other severe weather strike Kentucky, the consequences go beyond physical damage. Extreme weather pushes insurance costs higher across the state. As extreme weather grows more frequent, insurers are forced to raise rates to keep pace with rising risks. And it’s not just Kentucky homeowners who are affected; businesses, including medical professionals, are feeling the pressure, too.

Why Are Insurance Rates Rising?

How the Cost of Kentucky’s Medical Malpractice Insurance Is Affected

Reinsurance providers now charge higher premiums and impose stricter payout conditions. In response, primary insurers, including those offering medical malpractice coverage in Kentucky, have increased premiums.

Severe weather isn’t just a coastal problem—it’s impacting insurance costs for everyone.

Types of Professional Liability Insurance for Kentucky Physicians

Types of Professional Liability Insurance for Kentucky Physicians

Doctors in Kentucky can choose between these two primary types of medical malpractice insurance:

- This policy provides coverage for incidents that occurred during the policy period if the claim is filed while the policy is still active. If a claim is filed after the policy ends, it is NOT covered.

- Typically, it offers lower premiums at the start of the policy, but rates increase yearly as the policy matures.

- Physicians must obtain tail insurance coverage when a claims-made policy ends to ensure protection against future claims related to incidents that occurred during the policy period. Tail insurance premiums require a one-time cash payment equal to approximately 200% of the claims-made policy’s annual premium.

- Physicians may purchase nose coverage (or prior acts coverage) instead of tail coverage, which is more comprehensive and expensive. Nose coverage can be purchased through a new carrier to protect physicians from claims before the new policy, back to a specified date.

- Provides coverage for incidents that occurred during the policy period, regardless of when a claim is reported to the carrier.

- Typically, it offers more costly premiums at the start of the policy, but the rate stays constant throughout the policy’s duration.

- Physicians do not need tail coverage when an occurrence policy ends.

In 2024, Kentucky physicians were held liable for 160 medical malpractice payouts.

- Average Payout: $477,089

- Total Payout: $76,334,250

(Source: National Practitioner Data Bank)

Does Kentucky Have Damage Caps for Medical Malpractice Lawsuits?

Unlike many states, Kentucky does not have a damage cap for medical malpractice cases. There is no limit to the economic or non-economic damages a jury can award to a plaintiff.

Key Rules & Considerations

- State Employee Exception: In a lawsuit against a government employee or entity, damages are capped at $200,000 per claim. If multiple claims arise from the same incident, the total cap increases to $350,000.

- Pre-Suit Notice Requirement: When filing a medical malpractice complaint, the plaintiff must also serve a Notice of Claim and a Screening Certificate of Merit. This certificate must include a written statement from a qualified medical expert confirming the breach in the standard of care and a reasonable basis for the lawsuit.

- Pure Comparative Negligence: Kentucky follows the rule of pure comparative negligence. This means a patient can still recover damages even if they were partly at fault. However, the final award will be reduced based on the plaintiff’s percentage of fault.

Key Malpractice Laws in Kentucky

- 1990: Statute of Repose deemed unconstitutional in McCollum v. Sisters of Charity, citing the state constitution’s guaranteed right to “open courts.”

- 2019: Kentucky replaces the review panel requirement (deemed unconstitutional in 2018) with the Certificate of Merit requirement. A Certificate of Merit must be submitted with the complaint that starts the lawsuit.

- 2024: Kentucky becomes the first state to shield healthcare providers from being criminally charged in malpractice suits, except in cases of gross negligence or intentional misconduct.

Kentucky’s recent legislation has balanced patient and physician rights with the availability and quality of healthcare. The 2024 law decriminalizing medical malpractice demonstrates Kentucky’s dedication to protecting physicians.

Kentucky Statute of Limitations for Medical Malpractice Claims

Chapter 413 of the Kentucky Revised Statutes requires malpractice actions to be filed within one year of the discovery of injury. This statute is shorter than those in many other states.

Notable Exceptions

- Fraudulent Concealment: The one-year statute of limitations is paused if intentional fraud or collusion prevents the plaintiff from discovering the injury.

- Unsound Mind: If the plaintiff is mentally incapacitated, for example, due to brain injury or coma, the statute is tolled. The statute starts once the disability is removed.

- Continuous Treatment: If treatment is ongoing with the provider against whom the plaintiff brings a case, the statute does not begin until the treatment ends. Continuity is broken if the patient switches providers, such as transferring from a hospital to a private practice.

- Minors: Kentucky law states that the statute is tolled for injured minors until the plaintiff turns 18.

- Wrongful Death: In wrongful death cases, the statute is tolled until a personal representative is appointed, up to one year from the date of death. This means the claim may be filed up to two years after the injury occurred.

Why Kentucky Doctors Partner with MEDPLI

We exclusively broker medical malpractice insurance, focusing daily on making the professional liability process less burdensome and expensive for doctors.

With MEDPLI, Kentucky physicians:

MEDPLI helps doctors in every specialty.

Whether you’re a neurosurgeon in Louisville or an OB/GYN in Somerset, MEDPLI will provide you with premier coverage at a competitive rate.

Call 800-969-1339 or Request a Quote.