Top 6 Medical Malpractice Insurance Carriers in Kansas

We recommend carriers with an AM Best “A” or higher rating. An A-rating indicates financial strength, long-term solvency, and an established history of protecting Kansas physicians.

- The Doctors Company

- MedPro

- Coverys

- KAMMCO

- CURI

- ProAssurance

2025 Kansas Malpractice Insurance Rates by Specialty

These rate estimates are for informational purposes only and are based on the Kansas standard limits of $500,000 per claim and $1,500,000 aggregate per year in coverage. The Kansas Health Care Stabilization Fund (HCSF) surcharge is in addition to these estimates.

Quotes require a completed application and approval from the underwriter. Contact us for a custom estimate if you don’t see your specialty.

| Specialty | 2025 Annual Premium |

2025 Tail Premium |

|---|---|---|

| Anesthesiology | $20,000 | $40,000 |

| Cardiovascular Disease– Minor Surgery | $21,000 | $42,000 |

| Dermatology– No Surgery | $8,000 | $16,000 |

| Emergency Medicine | $30,000 | $60,000 |

| Family Practice– No Surgery | $11,000 | $22,000 |

| Gastroenterology– No Surgery | $15,000 | $30,000 |

| General Practice– No Surgery | $11,000 | $22,000 |

| General Surgery | $35,000 | $70,000 |

| Internal Medicine– No Surgery | $11,000 | $22,000 |

| Neurology– No Surgery | $12,000 | $24,000 |

| Obstetrics and Gynecology– Major Surgery | $48,000 | $96,000 |

| Occupational Medicine | $8,000 | $16,000 |

| Ophthalmology– No Surgery | $8,000 | $16,000 |

| Orthopedic Surgery– No Spine | $35,000 | $70,000 |

| Pathology– No Surgery | $9,000 | $18,000 |

| Pediatrics– No Surgery | $10,000 | $20,000 |

| Pulmonary Disease– No Surgery | $15,000 | $30,000 |

| Psychiatry | $8,000 | $16,000 |

| Radiology – Diagnostic | $20,000 | $40,000 |

Kansas Medical Malpractice Payouts From 2015-2024

The Hidden Link Between Weather Disasters and Rising Malpractice Insurance Rates

When tornadoes, hailstorms, and other severe weather events hit, the damage isn’t just physical; it drives up insurance costs statewide. As extreme weather events become more frequent, insurers are raising rates to cover the growing risks. But the impact goes beyond homeowners insurance; businesses, especially medical professionals, also feel the squeeze.

Why Are Insurance Rates Rising?

How Kansas’s Medical Malpractice Rates Are Impacted

While malpractice premiums in Kansas rose more slowly in 2024, physicians in the state faced steep increases in previous years. At the same time, Kansas homeowners already pay the third highest share of their income for insurance due to the state’s location in Tornado Alley. As property insurance costs continue to climb and reinsurers distribute those risks across markets, Kansas physicians should brace for potential future increases in malpractice premiums.

Severe weather isn’t just a coastal problem; it’s reshaping insurance costs for everyone.

Types of Professional Liability Insurance for Kansas Physicians

Types of Professional Liability Insurance for Kansas Physicians

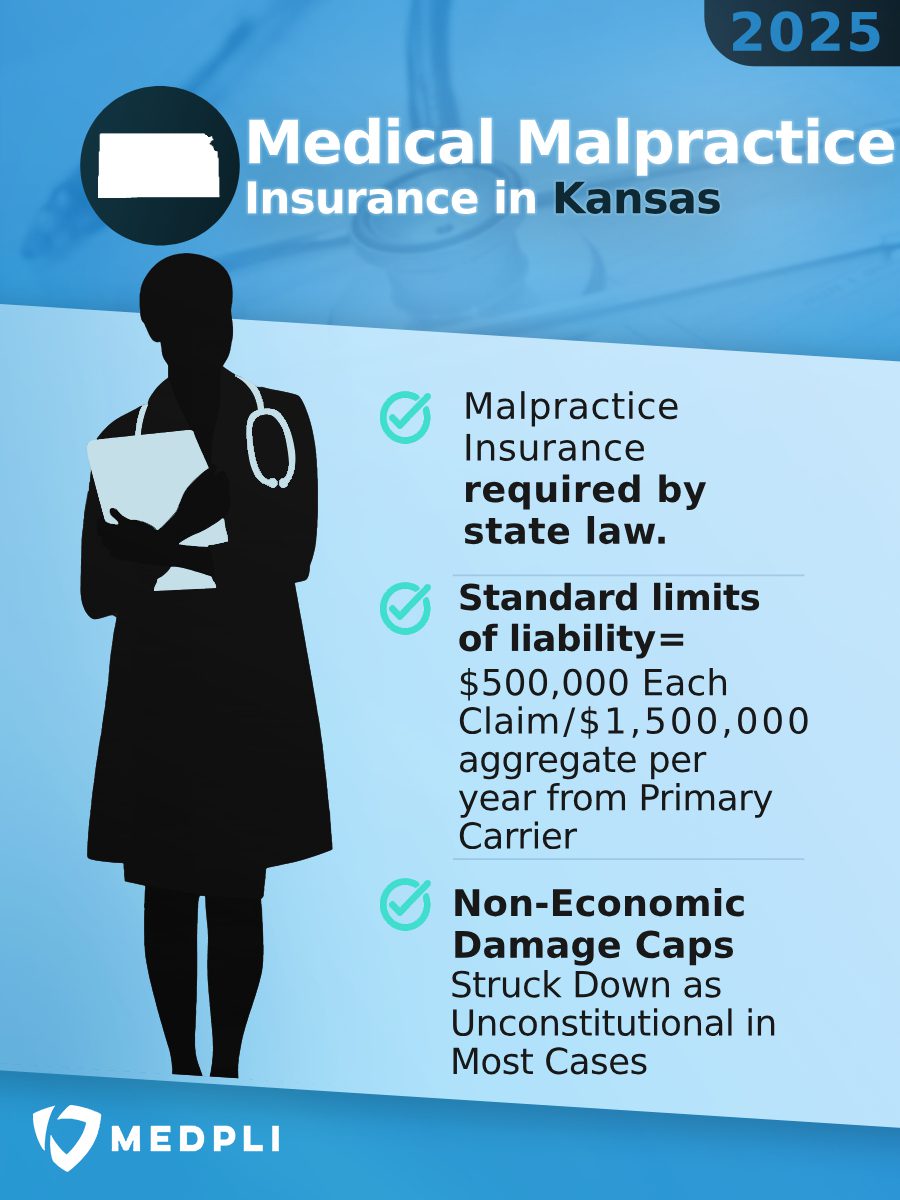

In most cases, K.S.A. 40-3402 requires doctors in Kansas to carry a claims-made insurance policy through a state-approved provider, with minimum limits of $500,000 per claim and $1,500,000 annual aggregate coverage. Without this basic coverage, physicians cannot maintain active licensure or practice in the state.

- Provides coverage for incidents that occurred during the policy period, IF the claim is filed while the policy is still active. If a claim is filed after the policy ends, that claim is NOT covered.

- Typically, it offers lower premiums at the start of the policy, but rates increase yearly as the policy matures.

- Tail insurance coverage when a claims-made policy ends to ensure protection against future claims related to incidents that occurred during the policy period.

Some healthcare providers choose occurrence policies instead of claims-made coverage, including:

- Medical residents who aren’t covered by Kansas’s self-insurance law, K.S.A. 40-3414(d).

- Out-of-state providers working under a locum tenens (temporary) contract in Kansas.

- Provides coverage for incidents that occurred during the policy period, regardless of when a claim is reported to the carrier.

- Typically, it offers more costly premiums at the start of the policy, but the rate stays constant throughout the policy’s duration.

- Physicians do not need tail coverage when an occurrence policy ends.

3. Additional Required Coverage: Patient Compensation Fund (PCF)

In addition to standard malpractice insurance, physicians in Kansas are required to pay a surcharge to participate in the Health Care Stabilization Fund (HCSF).

Created by the Kansas Legislature in 1976 under the Health Care Provider Insurance Availability Act, the HCSF provides extra coverage beyond the basic insurance limits. It also includes free tail coverage for eligible providers.

- Resident physicians who comply with Fund requirements are covered for services provided both within Kansas and outside the state.

- Non-resident physicians who comply are only covered for services performed within the state of Kansas.

In 2024, Kansas physicians were held liable for 196 medical malpractice payouts.

- Average Payout: $230,036

- Total Payout: $45,087,250

(Source: National Practitioner Data Bank)

Does Kansas Have Damage Caps for Medical Malpractice Lawsuits?

The landscape of damage caps in Kansas is nuanced. While Kansas Statute 60-19a02 technically states a non-economic damage cap of $350,000, the Kansas Supreme Court deemed the damage cap illegal in the 2019 Kansas Supreme Court Case of Hilburn v. Enerpipe Ltd., and it’s thus unenforceable.

Key Rules

- No Cap on Economic Damages: Kansas law does not limit the amount a jury can award for economic damages, including medical expenses and lost wages.

- Wrongful Death: Wrongful death cases are subject to separate damage caps. The current non-economic cap for wrongful death is $250,000.

Kansas Statute of Limitations for Medical Malpractice Claims

According to K.S.A. 60-513, a medical malpractice claim in Kansas must be filed within 2 years of the date of injury or misconduct occurred, or within two years of when the injury was discovered, if it wasn’t reasonably noticeable at the time. However, there are a few essential rules and exceptions to this timeline.

- Statute of Repose

Regardless of when the injury is discovered, a medical malpractice claim cannot be filed more than four years after the date of the alleged act of malpractice. - Legal Disability Exception

If the plaintiff is under a legal disability, such as being a minor, mentally incapacitated, or imprisoned and without access to court,they have one year from the time the disability is removed to file a claim. In these cases, the statute of repose is extended to 8 years from the date of the alleged malpractice.

Is Kansas a Physician-Friendly Place to Practice?

Kansas offers several key advantages that make it an appealing state for physicians, including:

However, Kansas also faces significant challenges. The state continues to grapple with a physician shortage, which increases workloads and raises the risk of burnout. While the cost of living is relatively low, physician compensation tends to be lower as well. And as malpractice premiums rise, the affordability of practicing in Kansas may decline.

To navigate these challenges, Kansas physicians should consider partnering with a knowledgeable malpractice insurance broker. MEDPLI helps doctors secure the right coverage at the best available rates, providing peace of mind in an evolving malpractice landscape.

Kansas Doctors Partner with MEDPLI

We exclusively broker medical malpractice insurance, focusing daily on making the professional liability process less burdensome and expensive for doctors.

With MEDPLI, Kansas physicians:

MEDPLI helps doctors in every specialty.

Whether you’re a Neurologist in Wichita or a Med Spa Owner in Lawrence, MEDPLI will find you premier coverage at a competitive rate.

Call 800-969-1339 or Request a Quote.

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

See 2026 Tennessee medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

Read 2026 Colorado medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

See 2026 Maryland medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

Compare 2026 Florida medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.