Top 5 Medical Malpractice Insurance Carriers in Hawaii

We recommend carriers with an AM Best "A" or higher rating. An A-rating indicates financial strength, long-term solvency, and an established history of protecting Hawaii physicians.

2025 Hawaii Malpractice Insurance Rates by Specialty

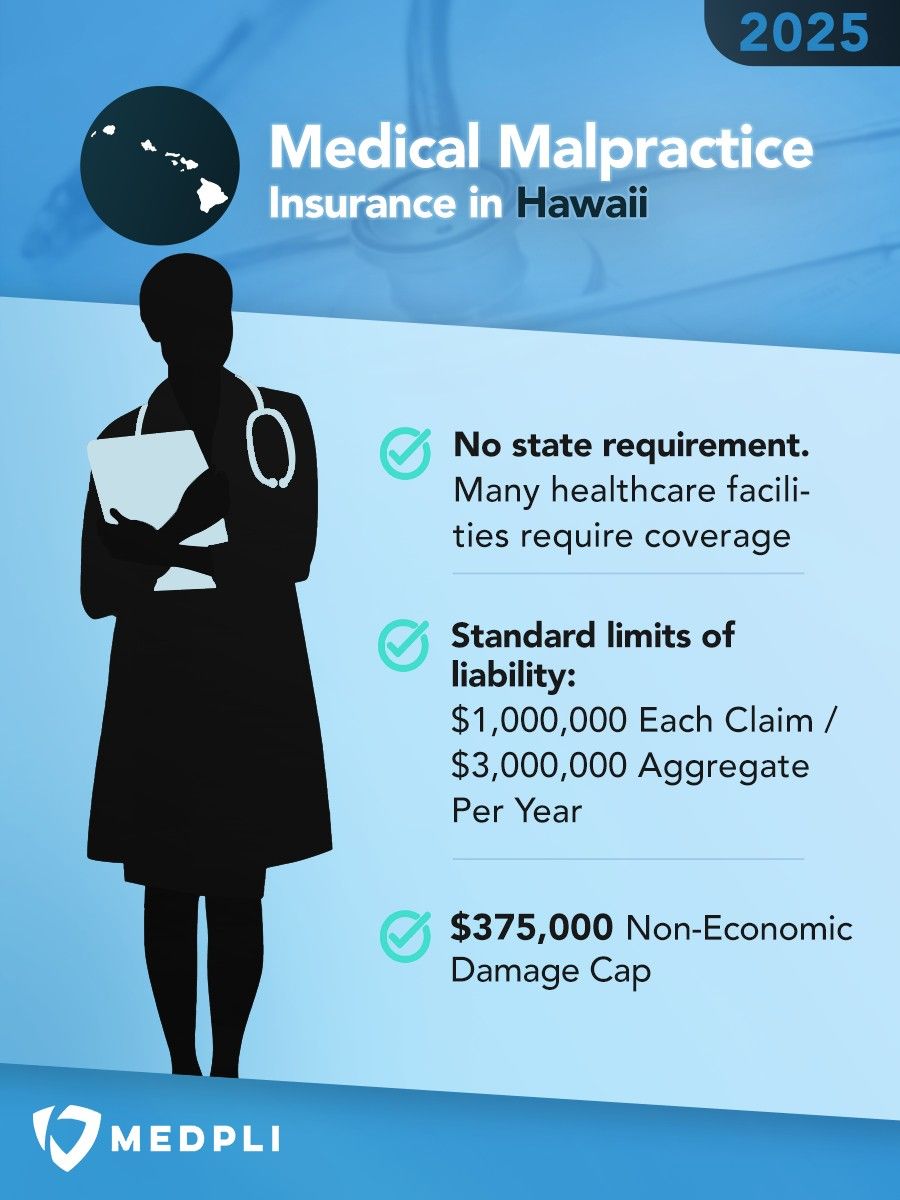

These rate estimates are for informational purposes only and are based on the HI standard limits of $1,000,000 per claim / $3,000,000 aggregate per year in coverage.

Quotes require a completed application and underwriter approval. Contact us for a custom estimate if you don't see your specialty.

| Specialty | 2025 Annual Premium |

2025 Tail Premium |

|---|---|---|

| Anesthesiology | $18,000 | $36,000 |

| Cardiovascular Disease– Minor Surgery | $20,000 | $40,000 |

| Dermatology– No Surgery | $10,000 | $20,000 |

| Emergency Medicine | $30,000 | $60,000 |

| Family Practice– No Surgery | $12,000 | $24,000 |

| Gastroenterology– No Surgery | $15,000 | $30,000 |

| General Practice– No Surgery | $12,000 | $24,000 |

| General Surgery | $40,000 | $80,000 |

| Internal Medicine– No Surgery | $12,000 | $24,000 |

| Neurology– No Surgery | $16,000 | $32,000 |

| Obstetrics and Gynecology– Major Surgery | $75,000 | $150,000 |

| Occupational Medicine | $9,000 | $18,000 |

| Ophthalmology– No Surgery | $9,000 | $18,000 |

| Orthopedic Surgery– No Spine | $40,000 | $80,000 |

| Pathology– No Surgery | $11,000 | $22,000 |

| Pediatrics– No Surgery | $12,000 | $24,000 |

| Pulmonary Disease– No Surgery | $16,000 | $32,000 |

| Psychiatry | $9,000 | $18,000 |

| Radiology – Diagnostic | $15,000 | $30,000 |

Hawaii Medical Malpractice Payouts From 2015-2024

The Hidden Link Between Weather Disasters and Rising Malpractice Insurance Rates

When wildfires, Kona storms, and other severe weather events hit Hawaii, the damage isn't just physical; it drives up insurance costs statewide. As extreme weather events become more frequent, insurers raise rates to cover growing risks. But the impact goes beyond homeowners insurance – businesses, especially medical professionals, also feel the squeeze.

Why Are Insurance Rates Rising?

How Hawaii's Medical Malpractice Rates Are Impacted

Reinsurance providers now charge higher premiums and impose stricter payout conditions. In response, primary insurers, including those offering medical malpractice coverage in Hawaii, have increased premiums.

Severe weather isn't just a coastal problem—it's reshaping insurance costs for everyone.

Types of Professional Liability Insurance for Hawaii Physicians

Types of Professional Liability Insurance for Hawaii Physicians

Doctors in Hawaii can choose between these two primary types of medical malpractice insurance:

- Provides coverage for incidents that occurred during the policy period IF the claim is filed while the policy is still active. If a claim is filed after the policy ends, that claim is NOT covered.

- Typically, it offers lower premiums at the start of the policy, but rates increase yearly as the policy matures.

- Physicians must obtain tail insurance coverage when a claims-made policy ends to ensure protection against future claims related to incidents that occurred during the policy period. Tail insurance premiums require a one-time cash payment equal to approximately 200% of the claims-made policy's annual premium.

- Provides coverage for incidents that occurred during the policy period, regardless of when a claim is reported to the carrier.

- Typically, it offers more costly premiums at the start of the policy, but the rate stays constant throughout the policy's duration.

- Physicians do not need tail coverage when an occurrence policy ends.

In 2024, Hawaii physicians were held liable for 41 medical malpractice payouts.

- Average Payout: $393,963

- Total Payout: $16,152,500

(Source: National Practitioner Data Bank)

Does Hawaii Have Damage Caps for Medical Malpractice Lawsuits?

Chapter 663 of the Hawaii Revised Statutes caps non-economic damages (like pain and suffering), but allows full recovery for financial losses.

Key Rules & Exceptions

-

- Non-Economic Damages Cap: Pain and suffering awards are limited to $375,000, with some exceptions.

- Economic Damages: There is no cap on compensation for actual financial losses, such as medical bills or lost income.

- Intentional Torts: If the malpractice was intentional, the caps does not apply.

- Medical Inquiry and Conciliation Panel (MICP): Before filing a lawsuit, claimants must submit an inquiry to this panel. The MICP notifies the healthcare provider, reviews the evidence, and may recommend settlement or dismissal at any point.

Certificate of Consultation: When submitting the MICP inquiry, the claimant must also provide a certificate confirming they consulted with a physician who agrees the case has merit.

How Hawaii's Malpractice Laws Have Evolved

- 1970s: A nationwide medical malpractice "crisis" led to increased malpractice cases and a surge in insurance costs.

- 1986: Hawaii passes a $375,000 noneconomic damage cap. Joint and several liability abolished.

- 2012: MICP requirement established.

Protecting Physicians: Hawaii's Reforms to Medical Malpractice Law

Though Hawaii has struggled with high malpractice numbers and payout rates, Hawaii has taken action to address the state's "medical malpractice problem."

Physician-focused actions have included:

These actions have aimed to balance patient rights with physician rights, reduce physician burnout and shortages, and address excessive payouts.

Hawaii Statute of Limitations for Medical Malpractice Claims

Hawaii Revised Statutes, Chapter 657-7-3 states that malpractice actions must be filed:

- Within 2 years of when the plaintiff discovered, or should have discovered, the injury.

- But no more than 6 years from the occurrence of the alleged act or negligence causing injury or death.

Exceptions:

- Minors: Minors younger than ten have six years to file a claim from the date of the malpractice, or until their tenth birthday, whichever comes later. This period may be extended in cases involving gross negligence or fraud by a physician or caretaker, or when the injury could not have been reasonably discovered.

- MICP Inquiry: The statute is tolled when the inquiry is filed with the MICP.

- Concealment: The statute is tolled when the defendant knowingly prevented the injury from being discovered.

Hawaiian Doctors Partner with MEDPLI

We exclusively broker medical malpractice insurance, focusing daily on making the professional liability process less burdensome and expensive for doctors.

With MEDPLI, Hawaii physicians:

MEDPLI helps doctors in every specialty.

Whether you're an Orthopedic Surgeon in Honolulu or a MedSpa owner in Kihei, MEDPLI will find you premier coverage at a competitive rate.

Call 800-969-1339 or Request a Quote.

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

GUIDE: Read here for Nevada’s medical malpractice insurance rates by specialty, top carriers, payout trends & state laws. Get a custom quote here.

GUIDE: Read here for Nebraska’s medical malpractice insurance rates by specialty, top carriers, payout trends & state laws. Get a custom quote here.

GUIDE: Discover Minnesota's medical malpractice insurance rates by specialty, top carriers, payout trends & state laws. Get a custom quote today.

GUIDE: Discover Montana’s medical malpractice insurance rates by specialty, top carriers, payout trends & state laws. Get a custom quote today.