Georgia Faces Rural Shortage of OB/GYNs

Over 580 of Georgia’s 1,363 OB/GYN specialists practice in the Atlanta metro area. However, 82 of Georgia’s 159 counties have none, according to the Georgia Board of Health Care Workforce. Severely limited access to OB/GYN care, especially in rural areas, is one key factor related to Georgia having one of the highest maternal mortality rates in the U.S. (U.S. CDC).

Failure to recognize and treat complications of hypertension, preeclampsia, hemorrhage, and infection are among the common preventable causes of maternal death – as well as common allegations in OB/GYN medical malpractice lawsuits in which the mother, infant, or both are plaintiffs.

That’s why Georgia OB/GYNs need robust medical malpractice insurance.

As your only trusted broker, MEDPLI will help you find the right coverage at the best rate in Georgia.

Get A Quote

If you are a Georgia OB/GYN specialist in private practice, or planning to open a new practice in Georgia, use this guide prepared by independent MEDPLI insurance brokers to give you a concise overview of medical malpractice insurance. Then contact a MEDPLI insurance broker to discuss your coverage needs and get a quote.

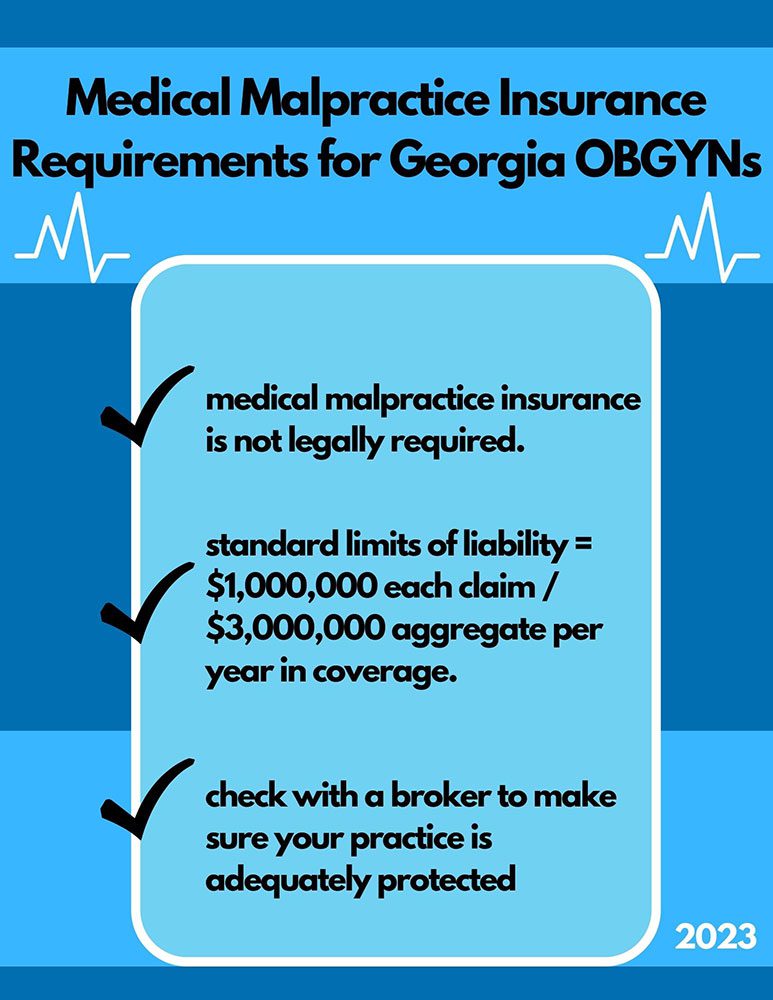

Medical Malpractice Insurance Requirements for Georgia OB/GYN Specialists

Georgia OB/GYN specialists are not legally required to carry medical malpractice insurance. The standard limits of liability in Georgia are $1,000,000 Each Claim / $3,000,000 Aggregate per year in coverage.

OB/GYN is considered a high-risk specialty, so you should make sure your coverage features are favorable to be adequately protected if sued for malpractice.

MEDPLI strongly recommends securing coverage from an A-rated carrier as the most cost-effective way to protect against devastating financial loss if you are sued for malpractice in Georgia. As an independent broker, we specialize in medical malpractice insurance for OB/GYN specialists. We can help you find the best coverage at a great price.

Cost of Medical Malpractice Insurance for Georgia OB/GYN Specialists

Each insurance carrier uses its own proprietary methods of setting the cost of medical malpractice insurance for OB/GYNs. Carriers consider factors such as practice location, surgical specialty, and past claims history.

The following are approximate medical malpractice insurance premium rates for OB/GYNs across all Georgia areas:

| Specialty | Approximate Claims Made Rate | Approximate Tail Rate | Approximate Occurrence Rate |

|---|---|---|---|

| OB/GYN | $70,000 | $140,000 | $80,000 |

*Using the GA standard limits of $1,000,000 Each Claim / $3,000,000 Aggregate per year in coverage

Actual pricing will vary depending on your experience, claims history, and overall risk profile. The above estimates do not include discounts. Be sure to ask your MEDPLI insurance broker to seek all possible discounts you might qualify for.

Types of Professional Liability Insurance for Georgia OB/GYN Specialists

Here is a brief overview of the most common types of medical malpractice insurance for OB/GYN specialists in Georgia:

1. Claims Made Insurance

Claims-made malpractice insurance provides coverage if the policy is in effect both when the incident took place AND when the claim is filed. If a claim is filed after the end of the policy date, the claim is NOT covered. With a claims-made policy, you need tail malpractice insurance, which is a separately purchased insurance policy or endorsement, to make sure you have full protection.

2. Occurrence Insurance

Occurrence malpractice insurance provides coverage for incidents that occurred during the policy year, regardless of when a claim is reported to the carrier. Occurrence policies are more costly at the start of the policy, but the rate generally stays the same for the length of the policy, and there is no need for tail coverage when the policy ends.

3. Tail Insurance

Since most malpractice insurance policies are underwritten on a claims-made basis, you will be exposed to a lawsuit if a former patient files a claim against you and you do not secure tail coverage. When you are preparing to leave your employer, you should seek tail coverage options with an independent broker like MEDPLI. Tail insurance covers you for a specific time period. The new employer’s policy is not going to cover you for prior acts of a former practice, hence tail coverage is needed.

Reach out to an experienced MEDPLI insurance broker who will get to work for you to find a tail policy at a great price.

Let a MEDPLI Broker Help You Choose the Best Policy for Your Practice

Every Obstetrician’s situation is unique, so we recommend a conversation with a MEDPLI insurance broker to discuss the unique needs of your Georgia practice. Your MEDPLI insurance broker will explain the benefits and limitations of each type of medical malpractice insurance plan to ensure you get the right type and amount of coverage for your OB/GYN specialty.

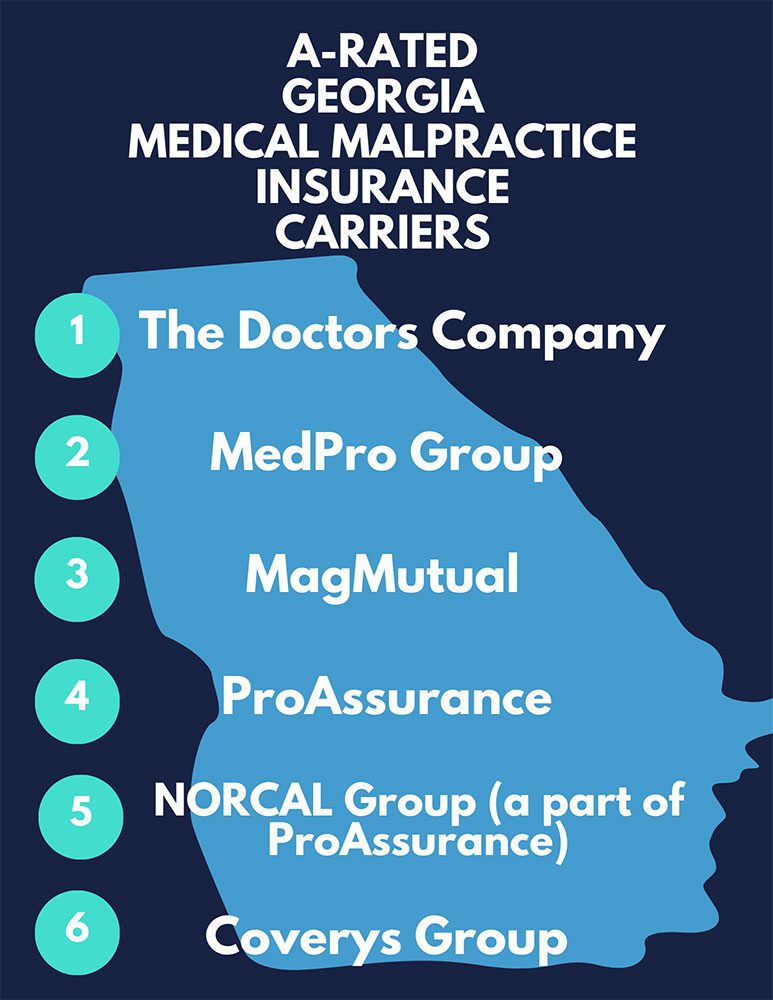

Get Quotes from A-rated Carriers Serving Georgia OB/GYN Specialists

MEDPLI insurance brokers will seek quotes from medical malpractice insurance from carriers rated “A” by A.M. Best for their long-term financial solvency and robust legal support of policyholders. Some of the top carriers for Georgia OB/GYN specialists include:

Why OB/GYN Specialists Are Classified as High Risk by Medical Malpractice Insurance Companies

Medical malpractice insurance underwriters classify OB/GYN as high-risk because of the potential for severe birth injuries, gynecologic surgical errors and complications that commonly lead to allegations of malpractice. Therefore, the cost of medical malpractice insurance will be higher for OB/GYNs compared to other lower-risk specialties.

Top Reasons Why Georgia OB/GYN Specialists are Sued

Delay in treating fetal distress was the major allegation in the highest proportion of OB/GYN medical malpractice cases found in favor of the plaintiff, according to a review of claims data by “A” rated malpractice insurance carrier MedPro Group . Additional major allegations and contributing factors to claims included:

In addition to untreated complications leading to maternal or infant death, some of the most often cited allegations in Georgia OB/GYN medical malpractice cases include failure of early detection and treatment, or misdiagnosis of:

OB/GYN specialists can reduce their risk of a malpractice lawsuit by implementing a comprehensive risk management strategy. For tips on fine-tuning your risk management strategy, check out our OB/GYN’s Guide To Managing Malpractice Risk.

Georgia’s Medical Malpractice Insurance Legislation

Consulting with a MEDPLI insurance broker who understands the complexities of Georgia’s medical malpractice laws will ensure that your OB/GYN practice is protected with the right amount of coverage.

Georgia’s Damage Caps on Medical Malpractice Lawsuits

Georgia law does not place a limit on economic damages recoverable from a medical malpractice claim, including compensation for healthcare costs, rehabilitation, ongoing medical care, lost wages, lost earning capacity, and other economic losses.

However, Georgia law still caps non-economic damages in medical malpractice cases at $250,000. In rare cases, if the claimant can show that the medical professional “acted with egregious negligence or intentional malice”, the court has the ability to raise the non-economic damage limit.

Georgia’s Statute of Limitations for Medical Malpractice Claims

Generally, the amount of time a person has to file a medical malpractice lawsuit is two years. In some instances, that time can be extended:

OB/GYN Medical Malpractice Outcomes in Georgia

With no cap on economic damages, and a $250,000 cap on non-economic damages, OB/GYN specialists in Georgia are more vulnerable to personal financial loss if they don’t have adequate medical malpractice coverage.

The total medical malpractice payout in Georgia was $133,313,250 in 2022.

The following examples of Georgia medical malpractice lawsuits found in favor of the plaintiff, or paid as a settlement, show the critical need for OB/GYNs to have more than adequate liability coverage:

Jury Awards OB/GYN Patient $30 Million

A Georgia jury found in favor of mother and infant plaintiffs who sought damages for delay in performing an emergency C-section and failure to monitor the baby for fetal distress. The mother suffered an amniotic fluid embolism and required a hysterectomy following the emergency C-section. The infant was born with severe brain damage.

$2.1 Million Settlement in OB/GYN Case

The female plaintiff alleged that the OB/GYN physician was negligent in failing to correctly interpret and respond to abnormal Pap smear results, which delayed the timely diagnosis and treatment of her cancer.

Even the Best OB/GYNs In Georgia Need Protection From Malpractice Lawsuits

Most OB/GYNs face at least one medical malpractice lawsuit brought forth by a patient throughout their career, so it’s essential to be covered when it happens to you. In addition to damages awarded to the plaintiff, having medical malpractice insurance assures that your legal costs will be covered regardless of whether the case is won or lost.

How MEDPLI Brokers Help OB/GYN Specialists Save Time and Money on Medical Malpractice Insurance

Working with MEDPLI as your trusted broker takes the guesswork and effort out of trying to get the right coverage at the best rate on your own. We help you save time and money by:

MEDPLI insurance brokers are ready to help you navigate the complexities of Georgia’s medical malpractice laws and secure the right amount of malpractice coverage for your OB/GYN practice. From submitting your application, obtaining the best rates for new policies and renewals from “A” rated carriers, and more, MEDPLI is the only medical malpractice insurance broker you’ll need.

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

Protect Your MedSpa: 7 Expert Tips for Medical Malpractice Insurance Coverage. Learn what to look for and how to avoid costly claims.

GUIDE: Get tail insurance insights from MEDPLI's expert medical malpractice brokers. Find FAQs and tips for affordable, A-rated coverage. Learn more here.

GUIDE: Read here for New Hampshire’s medical malpractice insurance rates by specialty, top carriers, payout trends & state laws. Get a custom quote here.

Medical malpractice insurance specialist Max Schloemann recommends the top liability insurance companies for doctors in 2025. Learn how to compare carriers here.