Top 5 Malpractice Insurance Carriers in Connecticut

We recommend carriers with an AM Best “A” or higher rating. An A-rating indicates financial strength, long-term solvency, and an established history of protecting Connecticut physicians.

2025 Connecticut Malpractice Insurance Rates by Specialty

These rate estimates are for informational purposes only and are based on the CT standard limits of $1,000,000 for Each Claim / $3,000,000 Aggregate per year in coverage.

Quotes require a completed application and underwriter approval. Contact us for a custom estimate if you don’t see your specialty.

| Specialty | 2025 Annual Premium |

2025 Tail Premium |

|---|---|---|

| Anesthesiology | $23,000 | $46,000 |

| Cardiovascular Disease– Minor Surgery | $24,000 | $48,000 |

| Dermatology– No Surgery | $10,000 | $20,000 |

| Emergency Medicine | $38,000 | $76,000 |

| Family Practice– No Surgery | $16,000 | $32,000 |

| Gastroenterology– No Surgery | $20,000 | $40,000 |

| General Practice– No Surgery | $16,000 | $32,000 |

| General Surgery | $65,000 | $130,000 |

| Internal Medicine– No Surgery | $16,000 | $32,000 |

| Neurology– No Surgery | $20,000 | $40,000 |

| Obstetrics and Gynecology– Major Surgery | $89,000 | $178,000 |

| Occupational Medicine | $10,000 | $20,000 |

| Ophthalmology– No Surgery | $10,000 | $20,000 |

| Orthopedic Surgery– No Spine | $52,000 | $104,000 |

| Pathology– No Surgery | $10,000 | $20,000 |

| Pediatrics– No Surgery | $16,000 | $32,000 |

| Pulmonary Disease– No Surgery | $18,000 | $36,000 |

| Psychiatry | $10,000 | $20,000 |

| Radiology – Diagnostic | $23,000 | $46,000 |

Have a question? Get fast answers from a U.S.-based MEDPLI agent. Call 1-800-969-1339 or email info@medpli.com.

Connecticut Medical Malpractice Payouts From 2015-2023

Types of Professional Liability Insurance for Connecticut Physicians

Physicians in Connecticut can choose between these two primary types of medical malpractice insurance:

- Provides coverage for incidents that occurred during the policy period IF the claim is filed while the policy is still active. If a claim is filed after the policy ends, that claim is NOT covered.

- Typically, it offers lower premiums at the start of the policy, but rates increase yearly as the policy matures.

- Physicians need to obtain tail insurance coverage when a claims-made policy ends to ensure protection against future claims related to incidents that occurred during the policy period. Tail insurance premiums require a one-time cash payment equal to approximately 200% of the claims-made policy annual premium.

- Provides coverage for incidents that occurred during the policy period, regardless of when a claim is reported to the carrier.

- Typically, it offers more costly premiums at the start of the policy, but the rate stays constant for the entire policy length.

- Physicians do not need tail coverage when an occurrence policy ends.

In 2023, Connecticut physicians were held liable for 107 medical malpractice payouts.

- Average Payout: $745,373

- Total Payout: $79,755,000

(Source: National Practitioner Data Bank)

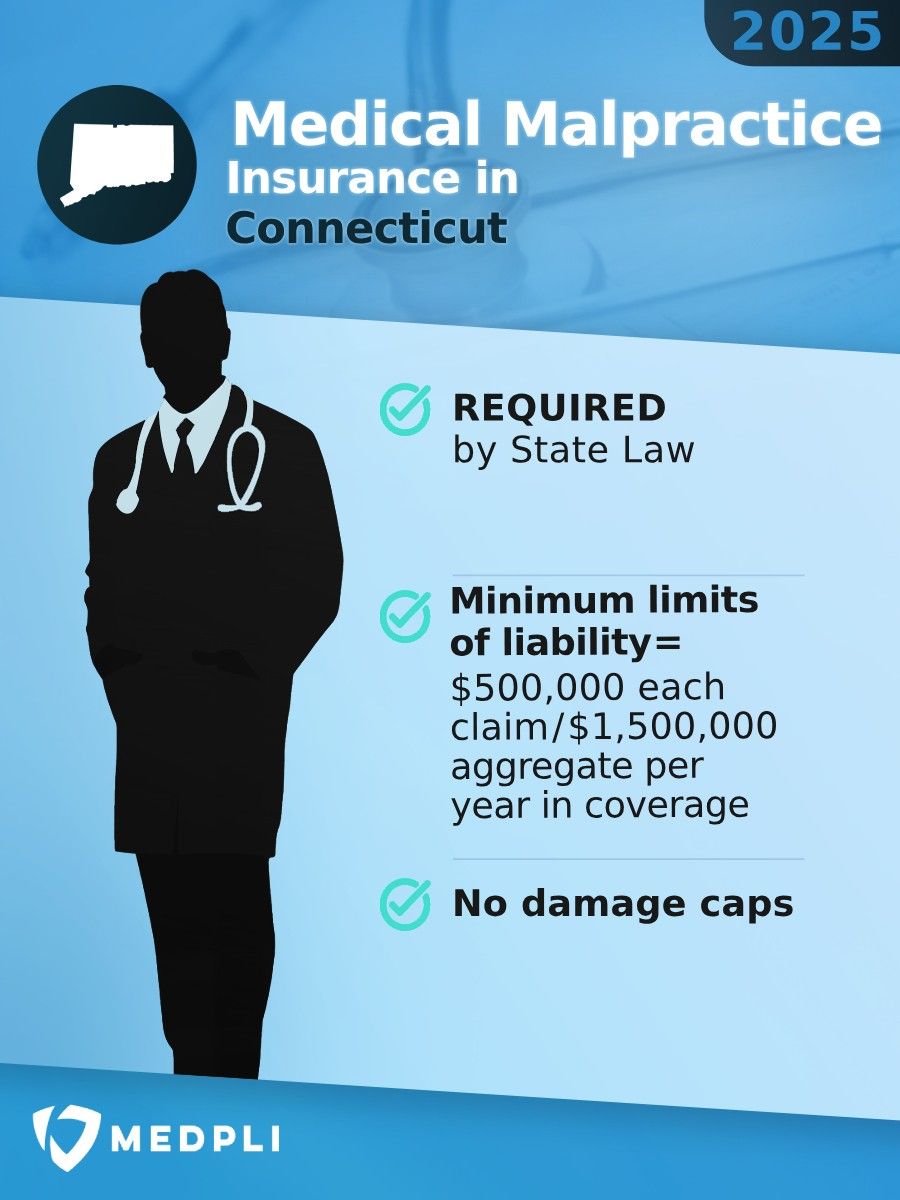

Does Connecticut Have Damage Caps for Medical Malpractice Lawsuits?

No, Connecticut state law does not limit economic or non-economic damages for medical malpractice lawsuits. A jury determines the appropriate compensation amounts based on the case specifics and the principle of modified comparative fault, meaning that a plaintiff’s compensation can be reduced by the percentage of his/her fault in connection to the injury. For instance, when a plaintiff is found responsible for 20% of the fault, he/she only receives 80% of the total damages.

Connecticut Statute of Limitations for Medical Malpractice Claims

In Connecticut, an action for medical malpractice damages must be filed within:

- Two years of the injury or discovery of the injury, but

- No more than 3 years after injury, regardless of discovery date.

Unlike many other states, Connecticut does not provide minors with an exception to the statutes of limitations or repose.

Why Connecticut Doctors Partner with MEDPLI

We exclusively broker medical malpractice insurance, focusing daily on making the professional liability process less burdensome and expensive for doctors.

With MEDPLI, Connecticut physicians:

MEDPLI helps doctors in every specialty.

Whether you’re an ENT in Hartford or a Neurosurgeon in New Haven, MEDPLI will provide you with premier coverage at a competitive rate. Call 800-969-1339 or Request a Quote.

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

See 2026 California medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

GUIDE: Overview of New York medical malpractice insurance rates by specialty, top carriers, payout statistics, and state regulations. Get a custom quote here.

Medical malpractice insurance specialist Max Schloemann recommends the top liability insurance companies for doctors in 2026. Learn how to compare carriers here.

Explore 2026 Illinois medical malpractice insurance costs, top A-rated insurers, payout trends & the latest state regulations. Get your free quote today.