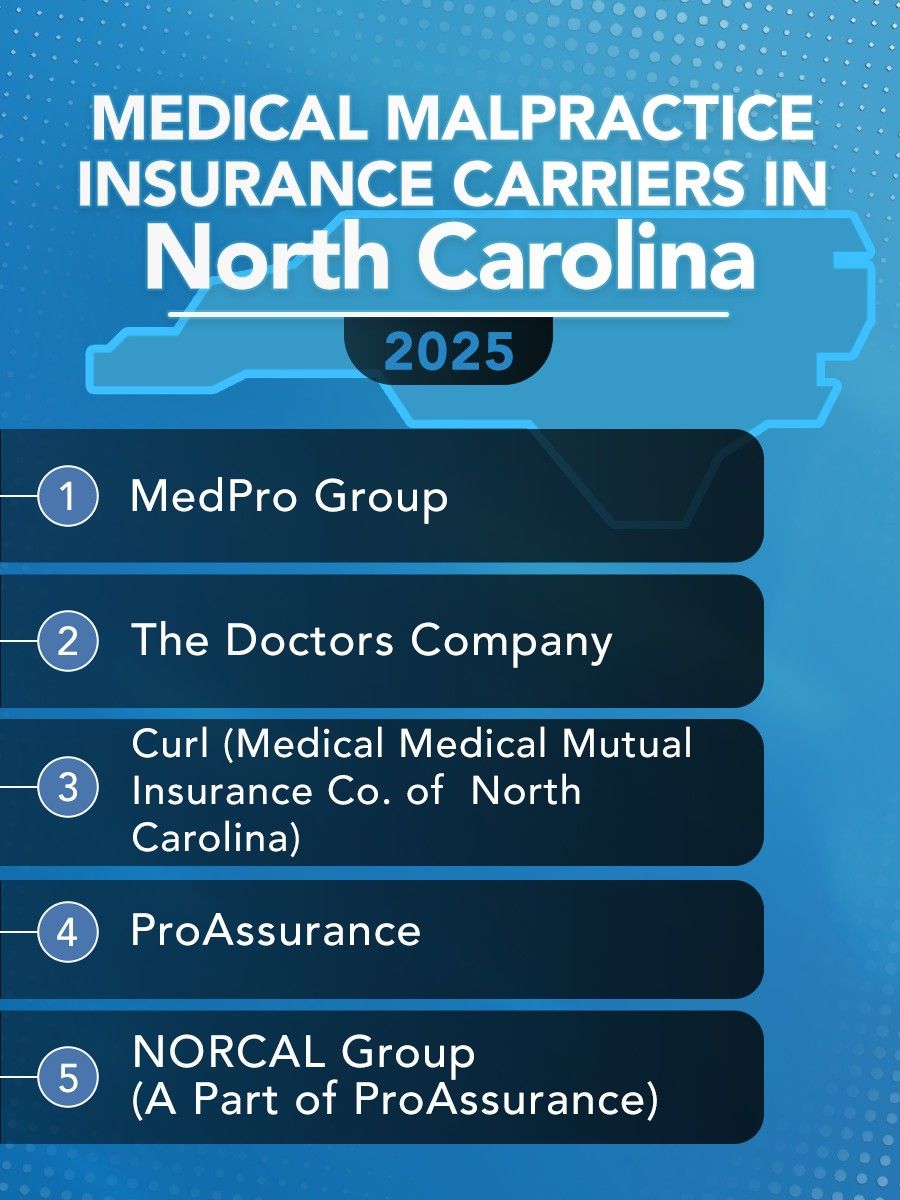

Top 5 Malpractice Insurance Carriers in North Carolina

We recommend carriers with an AM Best “A” or higher rating. An A-rating indicates financial strength, long-term solvency, and an established history of protecting North Carolina physicians.

2025 North Carolina Malpractice Insurance Rates by Specialty

These rate estimates are for informational purposes only and are based on the NC standard limits of $1,000,000 for Each Claim / $3,000,000 Aggregate per year in coverage.

Quotes require a completed application and underwriter approval. Contact us for a custom estimate if you don’t see your specialty.

| Specialty | 2025 Annual Premium |

2025 Tail Premium |

|---|---|---|

| Anesthesiology | $18,000 | $36,000 |

| Cardiovascular Disease– Minor Surgery | $16,000 | $32,000 |

| Dermatology– No Surgery | $9,000 | $18,000 |

| Emergency Medicine | $27,000 | $54,000 |

| Family Practice– No Surgery | $10,000 | $20,000 |

| Gastroenterology– No Surgery | $12,000 | $24,000 |

| General Practice– No Surgery | $10,000 | $20,000 |

| General Surgery | $32,000 | $64,000 |

| Internal Medicine– No Surgery | $10,000 | $20,000 |

| Neurology– No Surgery | $13,000 | $26,000 |

| Obstetrics and Gynecology– Major Surgery | $58,000 | $116,000 |

| Occupational Medicine | $7,000 | $14,000 |

| Ophthalmology– No Surgery | $7,000 | $14,000 |

| Orthopedic Surgery– No Spine | $32,000 | $64,000 |

| Pathology– No Surgery | $7,000 | $14,000 |

| Pediatrics– No Surgery | $10,000 | $20,000 |

| Pulmonary Disease– No Surgery | $13,000 | $26,000 |

| Psychiatry | $5,000 | $10,000 |

| Radiology – Diagnostic | $18,000 | $36,000 |

North Carolina Medical Malpractice Payouts From 2015-2023

Types of Professional Liability Insurance for North Carolina Physicians

Types of Professional Liability Insurance for North Carolina Physicians

Choosing the right professional liability insurance is essential for physicians in North Carolina to protect their practice, reputation, and financial security. Here’s a breakdown of the main coverage types available in 2025:

- Covers claims only if both the alleged incident and the claim occur while the policy is active. If a claim is filed after the policy ends, it won’t be covered unless additional coverage is purchased.

- Premiums start lower but increase over the first few years.

- Since claims can be filed years after an incident, physicians often purchase tail coverage to extend protection after the policy ends. Tail coverage allows claims to be reported after the policy expires, covering incidents that happened while the policy was active.

- Provides coverage for incidents that happen during the policy period, no matter when the claim is reported.

- Compared to claims-made policies, premiums are higher, but rates remain the same throughout the term of the policy.

- Physicians avoid the need to purchase tail coverage, making overall costs easier to manage.

In 2023, North Carolina physicians were held liable for 85 medical malpractice payouts.

- Average Payout: $321,558

- Total Payout: $27,332,500

(Source: National Practitioner Data Bank)

Tort Reform: Does North Carolina Have Damage Caps for Medical Malpractice Lawsuits?

While North Carolina does not have an economic damages cap, North Carolina statute § 90-21.19 imposed a cap of $500,000 cap on non-economic damages in medical malpractice cases and is adjusted for inflation every three years. The limit was set at $656,730 as of January 1, 2023, and the subsequent adjustment is scheduled for January 1, 2026. Non-economic damages include:

- physical and mental pain and suffering

- emotional distress

- loss of enjoyment of life

Notably, there are exceptions to this cap.

Exceptions:

- If a patient suffers disfigurement, loss of use of a body part, permanent injury, or death.

- If the defendant acted with reckless disregard or malice, the cap may be exceeded.

Understanding these caps is essential for North Carolina physicians to assess liability risks and ensure adequate malpractice insurance coverage.

North Carolina Statute of Limitations for Medical Malpractice Claims

In North Carolina, the statute of limitations for medical malpractice claims is generally three years from the date of the alleged malpractice.

Exceptions:

- If the injury wasn’t immediately apparent, the patient has one year from the date the injury was discovered or reasonably should have been discovered to file a claim. However, no claim can be filed more than four years after the date of the alleged malpractice. action can be filed up to two years after the date of discovery.

- If a foreign object (e.g., a surgical instrument) is left inside a patient’s body, the patient has one year from the date of discovery to file a claim, with an absolute deadline of ten years from the date of the procedure.

- If the malpractice occurred before the minor turned 10, they can file a claim up to their 10th birthday.

- If the malpractice occurred after the minor turned 10, they have three years from the date of the alleged malpractice to file a claim.

- If medical malpractice results in death, a wrongful death claim must be filed within two years from the date of death.

Given these variations, it’s crucial to consult with a qualified mnedical malpractice insurance broker to ensure the best coverage and the lowest rates.

Why North Carolina Doctors Partner with MEDPLI

We exclusively broker medical malpractice insurance, focusing daily on making the professional liability process less burdensome and expensive for doctors.

With MEDPLI, North Carolina physicians:

MEDPLI helps doctors in every specialty.

With MEDPLI, you can easily find premier coverage at a competitive price, whether you’re a podiatrist in Charlotte or an OB/GYN in Durham. Call 800-969-1339 or Request a Quote.

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

2026 healthcare policy changes are increasing medical malpractice risk, nuclear verdicts & premiums. Learn what physicians should review. Read here.

Read 2026 New Jersey medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

See 2026 California medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

GUIDE: Overview of New York medical malpractice insurance rates by specialty, top carriers, payout statistics, and state regulations. Get a custom quote here.