Over 30% of U.S. physicians have faced a malpractice claim at some point in their careers, underscoring the importance of robust, reliable coverage. MEDPLI stands as an advocate for doctors, never settling for less than the medical malpractice trifecta:

Premier Coverage

A-Rated Provider

Competitive Rate

In this guide, we outline the top insurance providers of 2025, carefully selected based on AM Best ratings, financial strength, and an unwavering commitment to meeting the unique needs of physicians across all specialties and risk profiles.

How to Evaluate Medical Malpractice Insurance Carriers

Most doctors will have access to multiple top-rated malpractice insurance providers. We recommend thoroughly researching each company’s credit ranking, financial strength, and policy offerings to guide your decision-making process.

When comparing carriers, pay close attention to these three factors:

MEDPLI’s Top 25 Medical Malpractice Insurance Carriers for Doctors & Physicians

Select the carrier you’d like to view.

MEDPLI’s Top 25 MedMal Insurance Carriers

1. The Doctors Company Group

The largest physician-owned malpractice insurance carrier, The Doctors Company (TDC), has a mission to “advance, protect, and reward the practice of good medicine.” With 90,000 members nationwide, TDC operates a loyalty program called The Tribute Plan, which has already paid over $175 Million in rewards to doctors. TDC is the leading carrier in California, Florida, Oregon, and Virginia.

2. MedPro Group

Now owned by financial powerhouse Berkshire Hathaway, MedPro Group is the oldest and largest malpractice insurance carrier with over 300,000 clients. Since 1899, they have handled over half a million claims with a 90% national trial win rate, and 80% were closed without payment. MedPro is the leading medical malpractice insurance carrier in TX, NY, OH, PA, NJ, IN, KY, and other states.

3. Coverys Group

Coverys is a group of carriers including ProSelect Insurance Company, ProMutual Group Inc., Preferred Professional Insurance Company, Medical Professional Mutual Insurance Company, Healthcare Underwriters Group, Inc., Coverys Specialty Insurance Company, and Coverys, RRG, Inc. The group writes medical professional liability insurance in most states and is the leading carrier in MI, NH, ND & RI.

4. Curi Group/MMIC

In 2023, Curi Holdings merged with Constellation Insurance Companies. Combined, the Curi/Constellation group serves more than 50,000 healthcare providers and organizations nationwide with their holistic approach and benefit-driven solutions.

5. MagMutual Group

Owned and led by Policy Owners, Atlanta-based Magmutual is Georgia’s top malpractice insurance carrier, covering more than 40,000 physicians and healthcare organizations nationwide. Policy Owners have received over $400M in financial rewards since inception and have access to a 24/7 physician-staffed emergency hotline, online CME courses, and a peer support program for litigation-related stress management.

How much does medical malpractice insurance cost in your state?

6. Admiral Insurance Company

Admiral Insurance Company provides insurance on a non-admitted basis in most states. It specializes in serving doctors and medical practices with challenging or unique risk profiles that are typically outside of underwriting guidelines for admitted carriers. In 2023, Insurance Business America named Admiral, a 5-Star Professional Liability winner for excellence in Professional Liability underwriting.

7. COPIC Group

Founded by doctors, COPIC is the leading carrier in Colorado and writes admitted malpractice coverage in the Rocky Mountain and Midwest regions, though RRG coverage is available nationwide. COPIC serves 23,000+ physicians and 330+ medical facilities and hospitals, which have received $12.5M in profit sharing since inception.

8. Applied Medico Legal Solutions (AMS RRG)

AMS RRG is currently registered in all 50 states plus DC and offers malpractice insurance solutions for almost every specialty. A Risk Retention Group (RRG) is a member-owned liability insurance company. Because members control their liability programs, rates are often lower, and coverage is often broader.

9. Texas Medical Liability Trust (TMLT) / Lone Star Alliance RRG

TMLT has been a significant malpractice insurer in Texas, covering over 20,000 policyholders. While TMLT only provides coverage in Texas, Lone Star Alliance RRG provides flexible coverage to physicians and surgeons nationwide. Together, these companies protect over 37,000 healthcare professionals in 49 states.

10. Liberty Mutual Group/ Ironshore

Operating in 27 countries, Liberty Mutual Group boasts more than $325 Million in written premiums for medical professional liability insurance. Ironshore is dedicated to the wholesale market, offering specialty solutions for complex, unique risks.

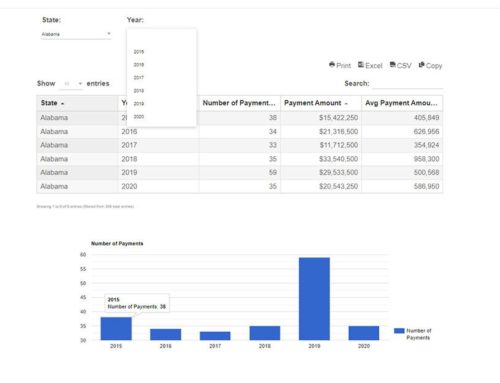

In the top 5 states, the 2023 average total for medical malpractice payments was $332,570,530.

| State | Year | Number of Payments | Payment Amount | Average Payment Amount |

|---|---|---|---|---|

| New York | 2023 | 1,002 | $587,904,250 | $586,730 |

| Pennsylvania | 2023 | 581 | $298,035,000 | $512,969 |

| Florida | 2023 | 844 | $283,913,700 | $336,390 |

| California | 2023 | 659 | $266,045,450 | $403,710 |

| Illinois | 2023 | 325 | $226,954,250 | $698,320 |

How does your state compare? Review custom charts with this free tool.

11. Hudson Insurance Group

Hudson Insurance Group furnishes medical malpractice insurance underwritten on a non-admitted claims-made basis. HIG maintains a broad risk appetite and aggressive claim defense philosophy that aims to settle indefensible cases quickly or proactively fight defensible cases.

12. Great American Insurance Group

Great American Insurance Group provides non-admitted property and casualty products. Serving the wholesale brokerage market, Great American offers customized coverage and caters to a broad range of risk profiles.

13. Evanston Insurance Company (Markel Group)

A member of the Markel Corporation, Evanston accepts unique risk profiles and provides coverage on a non-admitted basis for individual doctors, clinics, and other groups in all 50 states, D.C., Guam, Puerto Rico & U.S. Virgin Islands.

14. ProAssurance Group/Norcal

Initially formed by Alabama physicians, ProAssurance Group has a long financial stability and growth history, including the 2020 acquisition of top-ten carrier Norcal. ProAssurance insures doctors and surgeons of all specialties and even offers a specialized program called the Ob-Gyn Risk Alliance (OBRA).

15. Aspen Insurance Group

Based in North Dakota, Aspen is a surplus lines insurance carrier that supports clients through two primary segments: insurance and reinsurance. By leveraging third-party capital through Aspen Capital Markets, Aspen gained operational leverage and reported $7.7 billion in gross loss reserves in 2022.

16. ISMIE Mutual Insurance Company

Physician-led and based in Chicago, ISMIE has dominated the Illinois medical liability market for 40+ years and maintains a 92% trial win rate. ISMIE provides flexible coverage solutions and personalized risk management to doctors, hospital systems, and healthcare facilities in all 50 states, DC, & US Virgin Islands.

17. Lloyd’s of London (Certain Underwriters Only)

Lloyd’s of London is the world’s leading insurance and reinsurance marketplace, an active force in the US insurance market for 100+ years. Doctors can secure coverage from Lloyd’s through a broker or a cover holder, Lloyd’s term for an approved firm.

18. PRMS/Fair American Insurance and Reinsurance Co (FAIRCO)

PRMS/FAIRCO offers occurrence and claims-made coverage for psychiatric individual and group practices, including telepsychiatry and forensic services. PRMS provides risk management resources with in-house claims and litigation experts.

Have a question?

Get fast answers from a U.S.-based MEDPLI agent today.

Call 1-800-969-1339 or Contact Us.

21. LAMMICO

With an emphasis on aggressive legal defense, LAMMICO closes about 90% of cases without indemnity payment and offers true consent to settle clauses. Founded in Louisiana, LAMMICO now serves over 8,200 healthcare professionals in 11 states throughout the Southeast region, including the recent additions of AL & MO.

22. Medical Assurance Company of Mississippi (MACM)

Founded by the Mississippi State Medical Association, MACM is Mississippi’s largest physician-owned medical malpractice provider. With almost 3,000 active policies, it has more policies than all other carriers writing in the state combined.

24. Physicians Insurance

Seattle-based Physicians Insurance is the largest malpractice insurance carrier in Washington. A mutual company initially founded by the Washington State Medical Association (WSMA), it now serves more than 8,500 Member-owners in AK, ID, OR, WA, and WY and operates nationally through MedChoice RRG.

25. Core Specialty Insurance Group

Core Specialty provides specialized healthcare liability products directly or through reinsurance. Its non-admitted capabilities are available through a partnership with StarStone Specialty Insurance Company. Core considers all physician specialties and offers policy limits of up to $5M.

Find the Right Policy for Your Specific Practice

While online research into a provider’s AM Best rating and financial strength are essential first steps, a reputable broker that specializes in medical malpractice insurance can elevate your search with provider-specific context and expertise, tailoring efforts to align with your liability profile. With analytical support and negotiation management, a worthy broker ensures you get the best coverage at the best price.

At MEDPLI, we help doctors and physicians get the exact coverage they need from the best available A-rated medical malpractice insurance carrier. We pride ourselves on low rates and exceptional customer service.

To speak with a knowledgeable malpractice insurance broker committed to serving your best interests, email info@medpli.com or call our Illinois office at 800-969-1339.

With premiums and indemnity payouts on the rise, MEDPLI is your best ally.

Don’t settle for inadequate coverage or exorbitant rates.