New Jersey Has Steady Demand for OB/GYNs

New Jersey OB/GYNs practicing in the highly populated metropolitan area of New York, Newark, and Jersey City stay busy and in demand. That demand will increase as New Jersey and other U.S. states face a shortage of OB/GYNs over the next 10 years, according to a 2019 report by the American College of Obstetricians and Gynecologists.

While opportunities are plentiful for New Jersey OB/GYNs, New Jersey has a litigious reputation. The state ranked fifth in the U.S. for the volume of medical malpractice lawsuits, according to the 2021 Medscape Malpractice Report. Also, OB/GYN was listed among the top five specialties that are sued most often for medical malpractice.

That’s why New Jersey OB/GYNs need robust medical malpractice insurance.

As your only trusted broker, MEDPLI will help you find the right coverage at the best rate in New Jersey.

Get A Quote

If you are a New Jersey OB/GYN in private practice, or planning to open a new practice in New Jersey, use this guide prepared by independent MEDPLI insurance brokers to give you a concise overview of medical malpractice insurance. Then contact a MEDPLI insurance broker to discuss your coverage needs and get a quote.

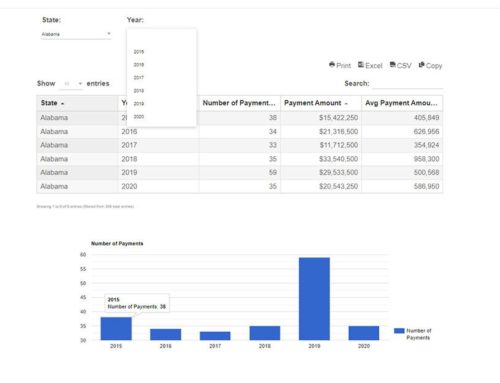

Medical Malpractice Insurance Requirements for New Jersey OB/GYNs

By law, New Jersey OB/GYNs are required to maintain a minimum amount of medical malpractice insurance coverage. The standard limits of liability in New Jersey are $1,000,000 Each Claim / $3,000,000 Aggregate per year in coverage.

MEDPLI strongly recommends securing coverage from an A-rated carrier as the most cost-effective way to protect against devastating financial loss if you are sued for malpractice in New Jersey. As an independent broker, we specialize in medical malpractice insurance for OB/GYNs. We can help you find the best coverage at a great price.

Cost of Medical Malpractice Insurance for New Jersey OB/GYNs

Each insurance carrier uses its own proprietary methods of setting the cost of medical malpractice insurance for OB/GYNs. Carriers consider factors such as practice location, surgical specialty, and past claims history.

The following are approximate medical malpractice insurance premium rates for OB/GYNs across all New Jersey areas:

| Specialty | Approximate Claims Made Rate | Approximate Tail Rate | Approximate Occurrence Rate |

|---|---|---|---|

| OB/GYN | $90,000 | $180,000 | $120,000 |

*Using the NJ standard limits of $1,000,000 Each Claim / $3,000,000 Aggregate per year in coverage

Types of Professional Liability Insurance for New Jersey OB/GYNs

Here is a brief overview of the most common types of medical malpractice insurance for OB/GYNs in New Jersey:

1. Claims Made Insurance

Claims-made malpractice insurance provides coverage if the policy is in effect both when the incident took place AND when the claim is filed. If a claim is filed after the end of the policy date, the claim is NOT covered. With a claims-made policy you need tail malpractice insurance, which is a separately purchased insurance policy or endorsement, to make sure you have full protection.

2. Occurrence Insurance

Occurrence malpractice insurance provides coverage for incidents that occurred during the policy year, regardless of when a claim is reported to the carrier. Occurrence policies are more costly at the start of the policy, but the rate generally stays the same for the length of the policy, and there is no need for tail coverage when the policy ends.

3. Tail Insurance

Since most malpractice insurance policies are underwritten on a claims-made basis, you will be exposed to a lawsuit if a former patient files a claim against you and you do not secure tail coverage. When you are preparing to leave your employer, you should seek tail coverage options with an independent broker like MEDPLI. Tail insurance covers you for a specific time period. The new employer’s policy is not going to cover you for prior acts of a former practice, hence tail coverage is needed. Read more about tail malpractice insurance.

Reach out to an experienced MEDPLI insurance broker who will do all of the work for you to find a tail policy at a great price.

Let a MEDPLI Broker Help You Choose the Best Policy for Your Practice

Every medical specialist’s situation is unique, so we recommend a conversation with a MEDPLI insurance broker to the discuss the unique needs of your New Jersey OB/GYN practice. Your MEDPLI insurance broker will explain the benefits and limitations of each type of medical malpractice insurance to ensure you get the right type and amount of coverage for your OB/GYN specialty.

Get Quotes from A-Rated Carriers Serving New Jersey OB/GYNs

MEDPLI insurance brokers will obtain quotes from medical malpractice insurance from carriers rated “A” by A.M. Best for their long-term financial solvency and robust legal support of policyholders. Some of the top carriers for New Jersey OB/GYNs include:

Why OB/GYNs Are Classified as High Risk by Medical Malpractice Insurance Companies

Medical malpractice insurance underwriters classify OB/GYN as a high-risk because of the potential severe birth injuries, gynecologic surgical errors and complications that commonly lead to allegations of malpractice. Therefore, the cost of medical malpractice insurance will be higher for OB/GYNs compared to other lower-risk specialties.

Top Reasons Why New Jersey OB/GYNs Are Sued

Delay in treating fetal distress was the major allegation in the highest proportion of OB/GYN medical malpractice cases found in favor of the plaintiff, according to a review of claims data by “A” rated malpractice insurance carrier MedPro Group . Additional major allegations and contributing factors to claims included:

In addition to untreated complications leading to maternal or infant death, some of the most often cited allegations in New Jersey OB/GYN medical malpractice cases include:

OB/GYNs can reduce their risk of a malpractice lawsuit by implementing a comprehensive risk management strategy. For tips on fine tuning your risk management strategy, check out our OB/GYN’s Guide To Managing Malpractice Risk.

New Jersey’s Medical Malpractice Insurance Legislation

Consulting with a MEDPLI insurance broker who understands the complexities of New Jersey’s medical malpractice laws will ensure that your OB/GYN practice is protected with the right amount of coverage.

New Jersey’s Damage Caps on Medical Malpractice Lawsuits

There are no caps on payouts for economic and non-economic damages in medical malpractice lawsuits. In any injury case, punitive damages are limited to $350,000 or five times the amount of compensatory damages, whichever is greater. However, punitive damages are rare partly because they require proof that the defendant acted with “actual malice” or a “wanton and willful disregard” toward injury.

New Jersey’s Statute of Limitations for Medical Malpractice Claims

According to state law, the conditions for filing a medical malpractice lawsuit in New Jersey are:

OB/GYN Medical Malpractice Outcomes in New Jersey

With no caps on economic and non-economic damages in New Jersey, OB/GYNs are more vulnerable to personal financial loss if they do not have robust medical malpractice coverage.

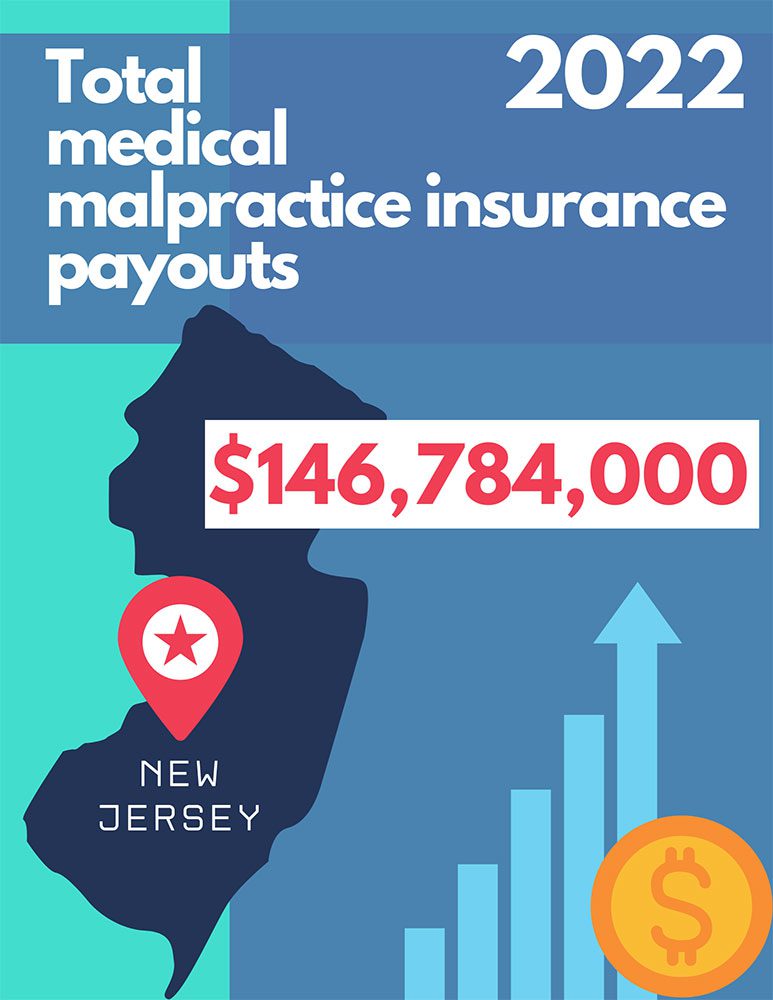

In 2022, the total medical malpractice payout in New Jersey was $146,784,000.

The following examples of New Jersey medical malpractice lawsuits found in favor of the plaintiff, or paid as a settlement, show the critical need for OB/GYNs to have strong liability coverage:

$15 Million Settlement

An infant was born with a curable heart defect that was not treated. The plaintiffs alleged failure to perform necessary heart surgery on the infant, resulting in the infant developing cerebral palsy and suffering a stroke that caused partial vision loss.

Jury Awards $7 Million

Failure to recognize and treat fetal distress and delay in performing a cesarean section were the main allegations in this case. The infant was deprived of oxygen and suffered a brain injury that resulted in cerebral palsy.

Even the Best OB/GYNs In New Jersey Need Protection From Malpractice Lawsuits

Most OB/GYNs face at least one medical malpractice lawsuit brought forth by a patient throughout their career, so it’s essential to be covered when it happens to you. In addition to damages awarded to the plaintiff, having medical malpractice insurance assures that your legal costs will be covered regardless of whether the case is won or lost.

How MEDPLI Brokers Help OB/GYNs Save time and Money on Medical Malpractice Insurance

Working with MEDPLI as your trusted broker takes the guesswork and effort out of trying to get the right coverage at the best rate on your own. We help you save time and money by:

MEDPLI insurance brokers are ready to help you navigate the complexities of New Jersey’s medical malpractice laws and secure the right amount of coverage for your New Jersey practice. From submitting your application, obtaining the best rates for new policies and renewals from “A” rated carriers, and more, MEDPLI is the only medical malpractice insurance broker you’ll need.