Changing Jobs or Retiring From Practice?

Don’t risk gaps in protection or overpaying for coverage. Tail insurance ensures you stay protected from claims filed after your policy ends — and understanding it now can save you thousands later.

MEDPLI is the doctor’s broker. Our mission is to make malpractice insurance less painful, less time-consuming, and more affordable for physicians.

Get A Quote for Tail Insurance

Table of Contents

Tail Coverage Malpractice Insurance

What is Tail Coverage Insurance?

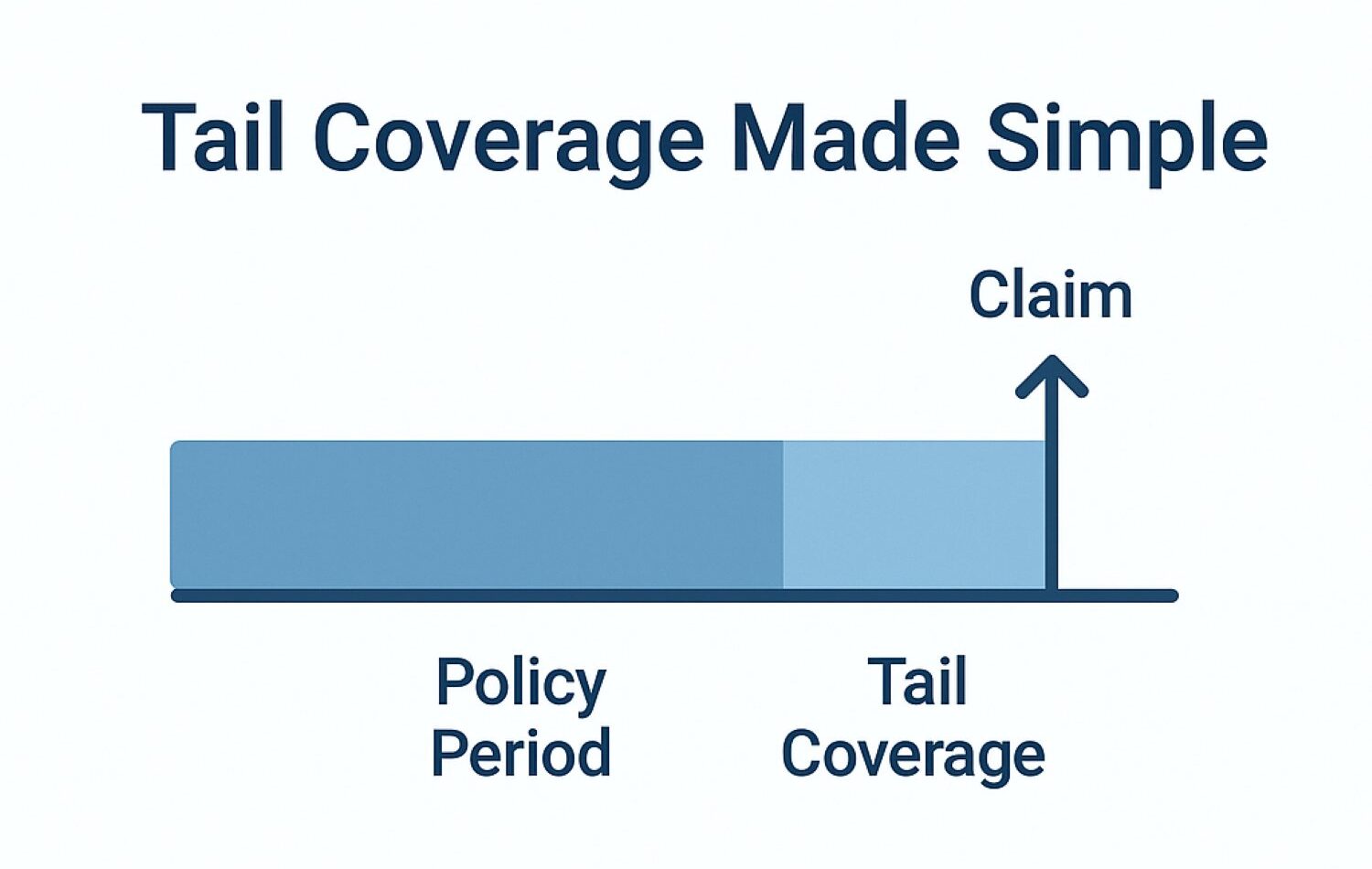

Tail Malpractice Insurance, or Extended Reporting Period (ERP) coverage, extends protection beyond a claims-made policy’s end date. It covers claims filed after the policy expires, provided the incident occurred during the policy period. This ensures continuous protection for professionals even after they stop practicing or switch insurers.

Tail coverage protects you from claims made after your policy ends, for incidents that occurred while it was active.

Read our most common tail coverage questions and expert advice below.

Common Tail Coverage FAQs

When You Need Tail Coverage

Tail insurance protects you from claims made after your claims-made policy ends. It covers incidents that occurred while you were insured but are reported later, after your policy’s cancellation date. Without tail coverage, you’d be personally responsible for any lawsuits or legal costs that arise afterward, which can cost hundreds of thousands of dollars.

Expert Tip: When changing jobs, review your insurance program with an experienced broker who knows how to navigate the fine print and ensure you’re protected.

Tail coverage is necessary in specific situations, primarily for professionals and organizations that use claims-made insurance policies. There are four common instances when it’s needed:

- When You’re Leaving a Claims-Made Policy

- When Switching Insurers or Jobs

- When Retiring or Closing a Practice

- When Contractually Required

Tail insurance covers any financial liability associated with a medical malpractice claim.

This includes:

- Legal fees

- Expert witnesses

- Settlements

- Any damages awarded to the plaintiff

Tail coverage protects doctors against any future claims that have yet to be reported.

Each medical specialty has its own insurance risk profile, which may require specialized tail insurance. A policy must reflect the exact circumstances of a physician’s practice and cover all services provided.

Tail insurance should be secured by the last day of the active claims-made policy. Often, the incumbent carrier offers a 30-day window after the policy lapses for a doctor to exercise the option to buy their tail policy. We recommend that you pursue standalone quotes before accepting an incumbent offer. Starting that process when you decide to change employers will provide more opportunities to compare quotes and secure the best rate.

Expert Tip: If you’re planning to leave your employer or have already done so, reach out to a medical malpractice insurance broker right away. Timing is critical for securing proper coverage.

Without tail insurance coverage, a physician can be financially liable for future claims from patient care that occurred during the lapsed claims-made policy period. This liability can range from thousands to millions of dollars, based on the severity of the claim.

Expert Tip: Use our Medical Malpractice Payouts By State Tool to get a sense of what the medical malpractice payout landscape is like in different states.

Tail coverage term lengths range from 1 year to unlimited. Standard terms are for 2, 3, and 5 years.

Expert tip: Choose tail coverage that extends beyond your state’s malpractice claim statute of limitations. Most physicians prefer unlimited-term policies for lasting protection, even if shorter options cost less.

Comparing Tail Coverage Alternatives and What They Include

Managing coverage transitions can be complicated, especially when it comes to protecting yourself after a claims-made policy ends. Tail coverage is the most common solution, but it isn’t the only one.

Depending on the situation, whether you’re changing employers, switching carriers, or preparing for retirement, there are alternatives that can provide similar protection.

Lets your new insurer cover claims for work you did under your old policy, so you don’t have a gap in protection when you switch insurers. It’s usually moderately priced and often cheaper than buying separate tail coverage.

Covers any incident that happens during the policy period, regardless of when the claim is filed, even years later. It’s a long-term alternative to claims-made coverage, usually costing more upfront but not requiring tail insurance.

A built-in or optional feature of a claims-made policy that lets you report claims for incidents that occurred while the policy was active but are reported after it ends, often providing 30–90 days of free reporting with the option to buy longer extensions.

Some employers provide ongoing liability or tail coverage for former employees, covering past work done under the employer’s policy at no cost to the employee. However, the exact protection depends on the employer’s policy.

Ending a claims-made policy without buying tail or any replacement coverage, leaving you with no protection and full personal responsibility for future claims, is usually only considered at retirement or in rare, low-risk situations and generally not recommended.

Testimonials

“I had an exceptional experience with MEDPLI Insurance Services! Max, the CEO, went above and beyond to address my malpractice tail insurance needs. He provided multiple options, ensuring I found the best coverage at the most competitive price.His professionalism, expertise, and dedication made the entire process seamless and stress-free. I highly recommend MEDPLI for anyone seeking top-notch insurance services!”

“Max is very honest, responsive, and personable. He made my part very easy and did all the legwork to get me the best deal for tail coverage. The option he found that was in my best interest happened to be with my old malpractice company, which did not benefit him in any way, and he had no problem giving me his honest recommendation.

I will definitely be calling him with any future insurance needs.”

“MEDPLI came through for me in a big way when my prior medical malpractice insurer gave me a shockingly high quote for tail coverage and less than a week to find an alternative.

Max and his team were quick, effective, and honest throughout the whole process. They will be my first call in the future.”

Malpractice Tail Coverage Costs & Payment

Tail insurance costs about 200% of your annual premium.

For example, if you pay an annual premium of $40,000, your tail coverage would cost around $80,000. Since rates vary widely by specialty, location, and individual risk factors, we recommend you contact us for a personalized tail evaluation.

Expert Tip: Don’t accept the first quote you’re given; those who work with MEDPLI save an average of 23%.

This depends on the employer and your contract.

If your contract stipulates that you are responsible for paying your tail, you should contact us immediately. If your employer is responsible, just be sure you get proof of coverage in writing before parting ways. For your next job, be sure to factor in the tail’s cost so you’re not surprised by an unforeseen expense.

Yes, but you’ll often pay more than necessary when you buy the plan offered through your employer’s insurance company. Instead, you can hire MEDPLI to shop the standalone tail market for the best deal. We work with “A” rated carriers to deliver the malpractice protection you need at more affordable rates.

Traditional tail coverage premiums generally equate to 200-300% of the expiring annual claims-made policy premium. A physician’s rate also considers geography, specialty, and claims history. Each carrier utilizes a proprietary algorithm to assess these factors, so expect rates to vary widely among carriers.

Malpractice premiums typically correspond with the physician’s specialty and its risk profile. Surgical specialties with the highest-risk profiles pay the highest malpractice premiums. These specialties include:

Because these physicians carry higher base premiums, their tail insurance costs are also significantly higher. Tail coverage often ranges from 200–300% of the annual premium, meaning that high-risk specialties face substantially greater tail expenses when ending or transitioning coverage.

Expert Tip: Choosing the lowest-priced malpractice policy may save money upfront, but it can leave you exposed to significant risks later. There are many variables involved in protecting yourself from future claims including policy type, coverage limits, and reporting.

Working with MEDPLI ensures you understand the fine print, avoid coverage gaps, and select a policy that truly fits your practice, risk profile, and budget.

Yes. Tail insurance can be purchased as a standalone tail policy or from the present carrier as an endorsement (or “add-on”) to an existing claims-made policy. To qualify for Standalone Tail Coverage, you must have your application reviewed and approved by a malpractice insurance carrier underwriter.

MEDPLI will help you get your application reviewed by the top “A” rated carrier underwriters.

You can buy directly from the employer’s carrier. However, to get multiple quotes, you’ll need to work with a malpractice insurance broker who has experience with standalone tail coverage.

Expert Tip: It’s important to note that most insurance carriers do not work directly with doctors. Tail insurance is a subspecialty for medical malpractice providers and requires a specialized broker.

Yes, tail insurance premiums qualify as a business expense for independent contractors and practice owners. For employed doctors, malpractice premiums may be treated as a job-related expense and listed under itemized deductions on Schedule A of Form 1040.

Why Should Physicians Work with MEDPLI to Secure Tail Insurance?

At MEDPLI, our mission is to make the malpractice insurance process less painful, less time-consuming, and more affordable for physicians.

Get Your Malpractice Tail Coverage Quote (& Peace Of Mind)

Don’t let your next career move leave you exposed. Talk to MEDPLI today to secure affordable tail coverage that protects your career and peace of mind.

MEDPLI medical malpractice insurance brokers can help you find the right coverage from top carriers– at the best rates. Call us at 800-969-1339, email info@medpli.com, or fill out a contact request form today.

Disclaimer: This information is provided for educational purposes only. MEDPLI does not provide tax or legal advice. Ask your trusted tax professional for more information specific to your situation.

Get A Quote

Get a fast quote for your tail insurance policy.

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

Read 2026 Ohio medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

Read 2026 Washington medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

GUIDE: Overview of Arizona medical malpractice insurance rates by specialty, top carriers, payout statistics & state regulations. Get a custom quote here.

Read 2026 Pennsylvania’s medical malpractice insurance guide for the latest rates by specialty, top carriers, payouts & state regulations. Get your quote today.