When given the choice between occurrence and claims-made malpractice insurance policies, it’s critical that doctors understand the benefits and limitations of each option. This guide explains the differences between occurrence and claims-made malpractice insurance and will help you decide which choice is right for you.

What is the Main Difference Between an Occurrence vs Claims-Made Malpractice Policy?

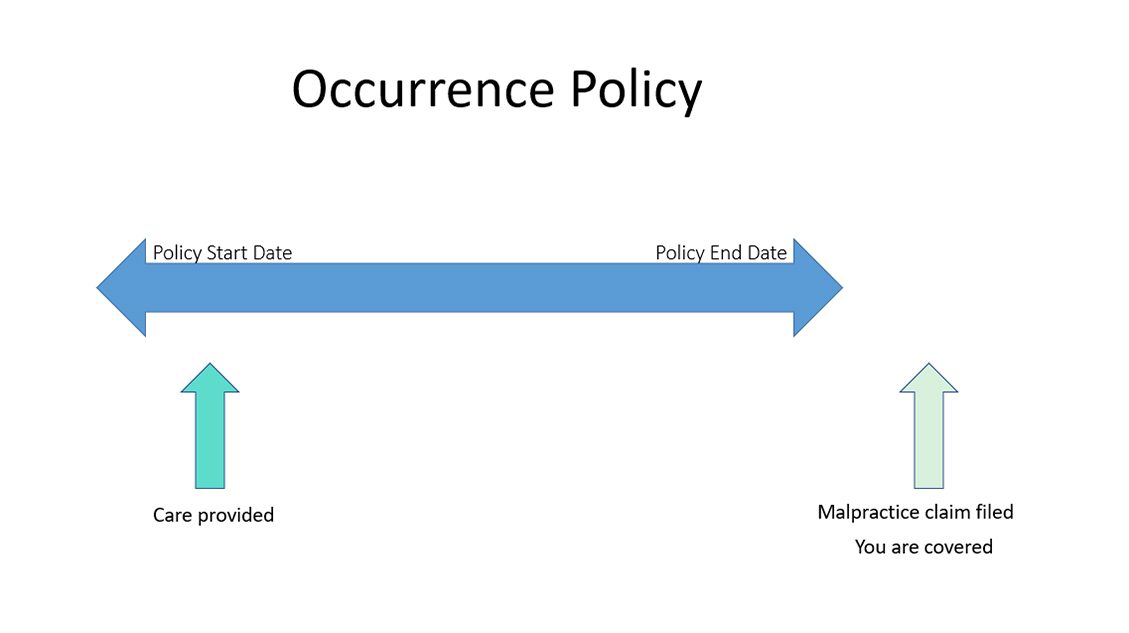

Occurrence malpractice insurance provides coverage for incidents that occurred during the policy year, regardless of when a claim is reported to the carrier.

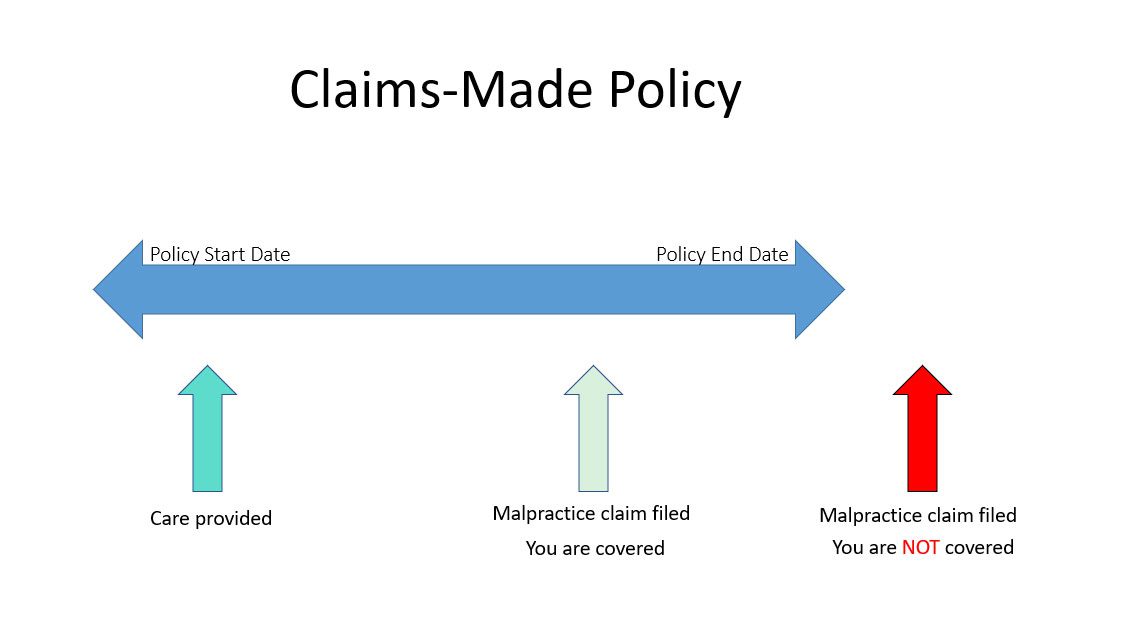

Claims-made malpractice insurance provides coverage if the policy is in effect both when the incident took place AND when the claim is filed. If a claim is filed after the end of the policy date, the claim is NOT covered. With a claims-made policy you need tail insurance, which is a separately purchased insurance policy or endorsement, to make sure you have full protection. Tail insurance may be purchased from the incumbent carrier, which is referred to as an Extended Reporting Period Endorsement. Or, you may find that a Standalone Tail Policy from a different carrier better suits your needs and budget.

For example, let’s say you’re a neurosurgeon practicing in New York with an occurrence policy from Insurance Carrier A. You decide to leave the practice and set up in Florida. Two years later, a patient in New York files a malpractice claim against you. With an occurrence policy, Insurance Carrier A is going to cover that claim, even if you have a new insurance carrier.

With a claims-made policy, if the malpractice claim is filed after you’ve left the New York practice, Insurance Carrier A will not cover the claim unless you’ve purchased tail coverage within the opt-in period (often 30 days from the policy expiration). Your new insurance carrier in Florida will only cover claims related to the Florida practice, unless you’ve purchased claims-made coverage with prior acts (including the prior New York exposure).

To ensure the cost of the claim in New York, you must:

The cost of tail insurance is usually around 200-250% of your expiring claims-made premium, and is paid as a one-time fee at the end of a claims-made policy. If you forgo buying tail coverage, you need to ensure the nose coverage on the new policy covers your prior acts exposure from the prior job. Purchasing nose coverage is not a standalone policy – it is an element of the new claims-made policy and is stated in your policy as a Retroactive Date.

What are the Costs of Occurrence vs Claims-Made Malpractice Policies?

The cost of each type of policy varies by a number of factors, including location, specialty, procedures provided, and prior claims history. Typically, claims-made policies cost less at the start of the policy, and rates rise each year as the policy matures. Occurrence policies are more costly at the start of the policy, but the rate stays the same for the length of the policy, and there is no need for tail coverage when the policy ends, thus no surprise additional cost.

When selecting a claims-made policy, your rate is dependent on multiple variables and is set yearly by the insurance company. In general, you should expect your premium to double from the first year to the second year, then continue to rise in overall price until the policy matures after 4-5 years. With a claims-made policy, you’ll also need to factor in the price of tail insurance, which MUST be purchased when a physician changes jobs or insurance carriers.

Occurrence Policy Cost Estimates

Specialty | Location | Year 1 | Year 2 | Year 3 | Year 4 | Total |

Orthopedic Surgeon | Miami, FL | $80,000 | $80,000 | $80,000 | $80,000 | $320,000 |

Neurosurgeon | Los Angeles, CA | $60,000 | $60,000 | $60,000 | $60,000 | $240,000 |

Plastic Surgeon | Atlanta, GA | $50,000 | $50,000 | $50,000 | $50,000 | $200,000 |

General Surgeon | Pittsburgh, PA | $45,000 | $45,000 | $45,000 | $45,000 | $180,000 |

Anesthesiologist | Chicago, IL | $35,000 | $35,000 | $35,000 | $35,000 | $140,000 |

OB/GYN | Austin, TX | $40,000 | $40,000 | $40,000 | $40,000 | $160,000 |

Claims -Made Policy Cost Estimates

Specialty | Location | Year 1 | Year 2 | Year 3 | Year 4 | Tail | Total |

Orthopedic Surgeon | Miami, FL | $22,000 | $44,000 | $58,000 | $65,000 | $130,000 | $319,000 |

Neurosurgeon | Los Angeles, CA | $18,000 | $35,000 | $48,000 | $55,000 | $110,000 | $266,000 |

Plastic Surgeon | Atlanta, GA | $17,000 | $34,000 | $42,000 | $45,000 | $90,000 | $228,000 |

General Surgeon | Pittsburgh, PA | $15,000 | $30,000 | $37,000 | $40,000 | $80,000 | $202,000 |

Anesthesiologist | Chicago, IL | $12,000 | $24,000 | $30,000 | $33,000 | $60,000 | $160,000 |

OB/GYN | Austin, TX | $14,000 | $28,000 | $33,000 | $35,000 | $70,000 | $180,000 |

Why is There a Difference in Price Between Occurrence vs Claims-Made Premiums?

Occurrence rates are more concrete, whereas claims-made rates are more fluid. Claims-made coverage allows carriers to more accurately match price to risk for the time period being covered. While occurrence coverage buyers know they are paying more up front, they are able to mitigate drastic rate increases in times of difficult market conditions, since they do not need to cover tail retroactively.

Prior to the first major malpractice insurance crisis of the 1970s, nearly all doctors were covered by occurrence form policies. When a massive increase in malpractice lawsuits resulted in larger than anticipated claim payouts, many carriers had trouble remaining solvent. To address this, many liability insurance companies switched from offering occurrence policies to claims-made policies. Claims-made policies allow liability insurance companies to increase rates yearly (using proprietary methodologies) to offset any rising costs associated with fluctuations in the market and the prior acts period.

Because the legal climate in America fluctuates, future rates cannot be accurately predicted beyond 12 months at a time. Today’s rates may be significantly different within a few years. Since rates are continuously subject to change, a medical malpractice insurance broker is a good friend for physicians to keep through the years.

Are There Differences in Coverage for Certain Types of Medical Care?

There is no difference in the type of medical care or procedures that are covered under occurrence vs claims-made malpractice policies, but not all doctors will qualify for occurrence coverage. Since insurance carriers are not able to offer occurrence to certain practice profiles, there are many types of practices that only have claims-made coverage options. No matter which option you choose, the best way to make sure that you are adequately insured is by providing your underwriters with a comprehensive list of the professional services you provide and the procedures your practice performs.

Are There Differences in the Limits of Coverage for Occurrence vs Claims-Made Malpractice Insurance?

It’s important to note that there are differences in how the limits of coverage are applied to occurrence vs claims-made policies. If you have a standard policy of $1 million per occurrence/ $3 million per annual aggregate with an occurrence policy, those coverage limits apply to each year of the policy. However, with a claims-made policy, the $1 million/$3 million limits apply to your entire prior acts period – so if your retroactive date is 10 years old, you are covering that entire 10 year period with the $1 million / $3 million limits. This is another reason occurrence form coverage is more expensive.

Can I Switch Between Occurrence and Claims-Made Malpractice Policies?

It’s easier to switch from an occurrence policy to a claims-made policy than vice versa, due to the cost of tail coverage. If you have a claims-made policy with rising rates and you decide to switch to an occurrence policy, you will still need to purchase tail insurance. If you have an expensive occurrence policy and want to switch to claims-made to save money, you can do so easily without having to purchase tail. Of course, the rate you pay in the first year of claims-made coverage does not reflect prior acts coverage, so the rate starts low and will increase over the next 4-5 years.

Features | Occurrence Policy | Claims-Made Policy |

Provides liability coverage for doctors in the event of a lawsuit | ||

Protects doctors from attorney's fees | ||

Protects doctors from monetary damages awarded to a plantiff | ||

Fixed, flat cost for premium across the length of the policy | ||

No need to purchase tail insurance | ||

Premium prices are subject to less volatility | ||

More total coverage with policy limits | ||

Can easily switch from one policy to another | ||

Most affordable at the outset | ||

More accurately prices the premium to the current risk | ||

Attractive option for doctors in the last 5 years before retirement | ||

Widely available for all medical practice profiles | ||

Changes to current coverage or policy limits apply to past years | ||

Need to purchase tail insurance |

Purchasing malpractice insurance is much like any other business decision – it’s important to know how to best protect the investment you’ve dedicated years and thousands of dollars to. Since every physician, surgeon, or practice owner’s insurance needs are different, the most efficient and cost-effective way to find a policy that’s right for you is to speak with an independent insurance broker. They’ll be able to partner with you to provide a list of all of your malpractice insurance options from the top-rated carriers in your state and answer any questions that are specific to your unique situation.

MEDPLI provides medical malpractice insurance expertise to doctors across the country. Our brokers save you time and money by shopping the insurance marketplace for you, finding the best rates available from A-rated insurance carriers. Contact us to get started on a free quote tailored to your needs.

*The information in this post is for informational purposes only and is not intended to diagnose or treat your situation. Seek a consultation from an experienced medical malpractice insurance broker for assistance with your unique situation.