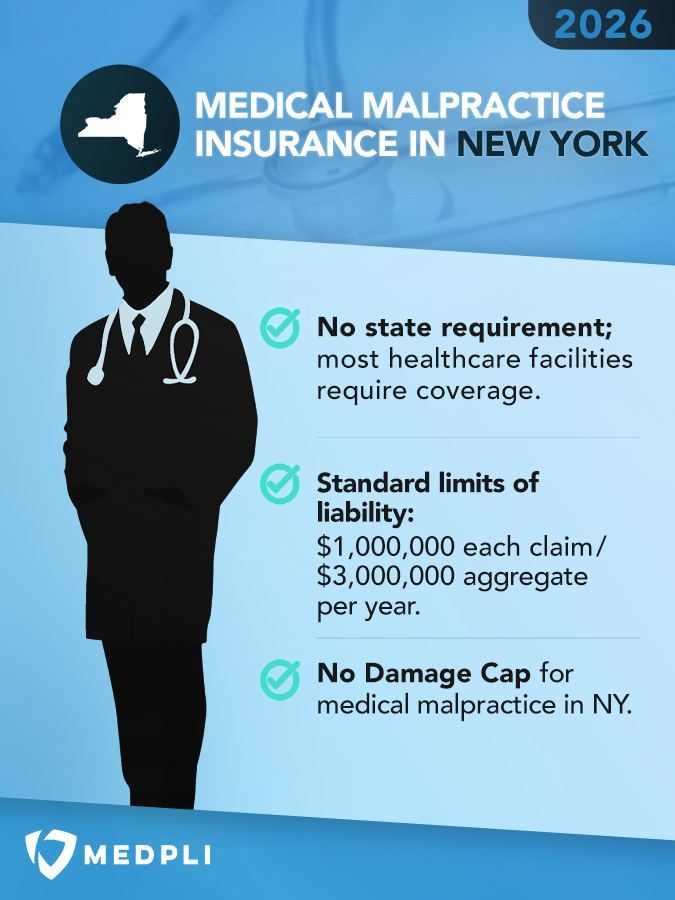

New York doctors face increasing liability risks and rising insurance costs in 2026. Use this resource to compare carriers, understand your risk, and secure the right protection for your practice.

Table of Contents

- Top 4 Malpractice Insurance Companies in New York

- Medical Malpractice Insurance Costs in New York by Specialty

- Average Medical Malpractice Payouts in New York State From 2015-2024

- Types of Professional Liability Insurance for New York Physicians

- Does New York Have Damage Caps for Medical Malpractice?

- Statute of Limitations on Medical Malpractice in New York State

- New York Physicians & Surgeons Partner with MEDPLI

- New York Medical Malpractice Insurance FAQ

- Get Your Quote for Medical Malpractice Insurance in New York State

Top 4 Malpractice Insurance Companies in New York

We recommend carriers with an AM Best rating of “A” or higher. An A-rating indicates financial strength, long-term solvency, and an established history of protecting New York physicians.

New York physicians have three admitted carrier options and several alternative RRG options for medical malpractice insurance:

Admitted Carriers:

The last-resort coverage option for physicians who cannot secure standard insurance

Alternative RRG Options Include:

Medical Malpractice Insurance Costs in New York by Specialty

Medical Malpractice Insurance Costs in New York by Specialty

These rate estimates are for informational purposes only and are based on the NY standard limits of $1,000,000 per claim/$3,000,000 aggregate per year.

Quotes require a completed application and underwriter approval. Contact us for a custom estimate if you don’t see your specialty.

Average Annual Premiums for Medical Malpractice Insurance

in New York by Specialty

(2026 data, $1M/$3M coverage)

| Specialty | 2026 Annual Premium |

2026 Tail Premium |

|---|---|---|

| Anesthesiology | $56,100 | $112,200 |

| Cardiovascular Disease– Minor Surgery | $40,800 | $81,600 |

| Dermatology– No Surgery | $20,400 | $40,800 |

| Emergency Medicine | $61,200 | $122,400 |

| Family Practice– No Surgery | $29,580 | $59,160 |

| Gastroenterology– No Surgery | $40,800 | $81,600 |

| General Practice– No Surgery | $30,600 | $61,200 |

| General Surgery | $112,200 | $224,400 |

| Internal Medicine– No Surgery | $29,580 | $59,160 |

| Neurology– No Surgery | $35,700 | $71,400 |

| Obstetrics and Gynecology– Major Surgery | $173,400 | $346,800 |

| Occupational Medicine | $19,380 | $38,760 |

| Ophthalmology– No Surgery | $19,380 | $38,760 |

| Orthopedic Surgery– No Spine | $107,100 | $214,200 |

| Pathology– No Surgery | $19,380 | $38,760 |

| Pediatrics– No Surgery | $28,560 | $57,120 |

| Pulmonary Disease– No Surgery | $40,800 | $81,600 |

| Psychiatry | $18,360 | $36,720 |

| Radiology – Diagnostic | $56,100 | $112,200 |

*Note: These rates are approximate, and each individual has unique factors that can affect their premium.

Have a question? Get fast answers from a U.S.-based MEDPLI agent. Call 1-800-969-1339 or email info@medpli.com.

Average Medical Malpractice Payouts in New York State From 2015-2024

In 2024, New York physicians were held liable for 1,369 medical malpractice payouts.

- Average Payout: $451,314

- Total Payout: $617,849,000

(Source: National Practitioner Data Bank)

Types of Professional Liability Insurance for New York Physicians

As a physician practicing in New York, understanding the various types of professional liability insurance available is crucial for safeguarding your medical practice. In 2026, the primary types of medical malpractice insurance policies for New York physicians include:

- Provides coverage for incidents that occurred during the policy period IF the claim is filed while the policy is still active. If a claim is filed after the policy ends, that claim is NOT covered.

- Typically, it offers lower premiums at the start of the policy, but rates increase yearly as the policy matures.

- Physicians must obtain tail insurance coverage when a claims-made policy ends to ensure protection against future claims related to incidents that occurred during the policy period. Tail insurance premiums require a one-time cash payment equal to approximately 200% of the claims-made policy’s annual premium.

- Provides coverage for incidents that occurred during the policy period, regardless of when a claim is reported to the carrier.

- Typically, it offers higher premiums at the start of the policy, but the rate remains constant throughout the policy’s duration.

- Physicians do not need tail coverage when an occurrence policy ends.

Does New York Have Damage Caps for Medical Malpractice?

As of 2025, New York does not cap damages in medical malpractice lawsuits. This means plaintiffs can seek full compensation for economic and non-economic damages without statutory limitations.

While some states have enacted legislation to limit recoveries in medical malpractice cases, New York has consistently maintained a stance that allows juries to award damages they deem appropriate in each case.

Statute of Limitations on Medical Malpractice in New York State

In the state of New York, the statute of limitations for medical malpractice claims is generally two years and six months (30 months) from the date of the alleged malpractice or the end of continuous treatment for the same condition.

Exceptions:

- Foreign Objects: If a foreign object is left inside a patient’s body, the patient has one year from the date of discovery to file a claim.

- Failure to Diagnose Cancer or Malignant Tumors: Under “Lavern’s Law,” patients have two years and six months from the date they knew or should have known about the misdiagnosis to file a claim, with an overall limit of seven years from the date of the alleged malpractice.

- Minors: The statute of limitations for patients under 18 is tolled until they reach adulthood. They can file a claim within two years and six months of turning 18, but not more than 10 years from the date of the alleged malpractice.

- Wrong Death: If the malpractice results in death, a wrongful death claim must be filed within two years from the date of death.

Physicians must be aware of these time frames to protect their legal rights.

Canceled or Non-Renewed? MEDPLI Is Your Best Ally.

Average Savings

5-Star Reviews

Doctors Served

New York Physicians & Surgeons Partner with MEDPLI

We exclusively broker medical malpractice insurance, focusing daily on making the professional liability process less burdensome and expensive for doctors.

With MEDPLI, New York physicians:

New York Medical Malpractice Insurance FAQ

Premiums vary by specialty. For example, Dermatology (no surgery) averages $20,400, General Surgery averages $112,200, and OB/GYN with major surgery can reach $173,400 annually. These estimates reflect New York’s standard $1M/$3M limits, and tail premiums are typically about 200% of the annual premium.

No. As of 2025, New York does not impose caps on economic or non-economic damages in medical malpractice cases. Plaintiffs may seek full compensation, and juries determine the appropriate award without statutory limitations.

New York’s general statute of limitations is 2 years and 6 months from the malpractice date or the end of continuous treatment. Key exceptions include:

- Foreign objects: 1 year from discovery

- Cancer misdiagnosis (Lavern’s Law): 2 years and 6 months from when the patient knew or should have known, up to 7 years total

- Minors: Until age 18, then 2 years and 6 months to file (max 10 years from malpractice)

- Wrongful death: 2 years from the date of death

Get Your Quote for Medical Malpractice Insurance in New York State

A MEDPLI policy will offer unparalleled coverage at a reasonable price, no matter where you practice, whether you’re a cardiologist in Buffalo or a neurosurgeon in Manhattan.

Call 800-969-1339 or Request a Quote.

Get A Quote

Get a fast quote for medical malpractice insurance.

About the Author

Max Schloemann is a medical malpractice insurance broker helping physicians and surgeons secure Medical Professional Liability coverage. A Magna Cum Laude graduate of Southern Illinois University’s College of Business, he was named Outstanding Management Senior.

Max began his career in 2008 at an industry-leading firm and founded MEDPLI in 2017 to guide private practice doctors and physicians in transition through the complexities of malpractice insurance.

Outside of work, Max, his wife Kristen (a Physician Assistant), and their four kids enjoy the outdoors and attending the kids’ sporting events. For malpractice insurance questions, you can contact Max here.

Latest from the Medical Malpractice Insurance Blog

See 2026 Tennessee medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

Read 2026 Colorado medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

See 2026 Maryland medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.

Compare 2026 Florida medical malpractice insurance rates by specialty, carriers, payouts, and regulations. Get your custom MEDPLI quote today.