New Jersey Leads the Nation in Bariatric Surgery

According to a study by the American Society for Metabolic & Bariatric Surgery (ASMBS), New Jersey ranked as the number-one state with the highest overall utilization of bariatric surgery to treat obesity.

With obesity affecting 29% of the population in the Northeastern U.S., New Jersey bariatric surgeons are in high demand. However, complex bariatric surgeries carry a high risk of serious intraoperative patient injuries and post-operative complications.

That’s why New Jersey bariatric surgeons need robust medical malpractice insurance.

As your only trusted broker, MEDPLI will help you find the right coverage at the best rate in New Jersey.

Get A Quote

Medical Malpractice Insurance Requirements for New Jersey Bariatric Surgeons

By law, New Jersey bariatric surgeons are required to maintain a minimum amount of medical malpractice insurance coverage. The standard limits of liability in New Jersey are $1,000,000 Each Claim / $3,000,000 Aggregate per year in coverage.

However, bariatric surgery is considered a high-risk specialty, so bariatric surgeons may want to consider purchasing a policy with higher limits of liability to be adequately protected if sued for malpractice.

This is where working with an independent broker like MEDPLI can be particularly beneficial. We specialize in malpractice insurance for bariatric surgeons – our insurance brokers will learn about your particular practice’s needs and can help advise your decision about excess coverage.

Cost of Medical Malpractice Insurance for New Jersey Bariatric Surgeons

To calculate the cost of medical malpractice insurance for a bariatric surgeon, each insurance carrier uses its own proprietary methods of setting rates. Factors that affect the price of insurance include practice location, surgical specialty, and past claims history.

The following are approximate medical malpractice insurance premium rates for bariatric surgeons across all New Jersey areas:

| Specialty | Approximate Claims Made Rate | Approximate Tail Rate | Approximate Occurrence Rate |

|---|---|---|---|

| Bariatric Surgery | $90,000 | $180,000 | $110,000 |

*Using the NJ standard limits of $1,000,000 Each Claim / $3,000,000 Aggregate per year in coverage

Types of Professional Liability Insurance for New Jersey Bariatric Surgeons

There are three main types of medical malpractice insurance policies for New Jersey bariatric surgeons: claims made, occurrence, and tail. Below you’ll find a brief overview of each option.

1. Claims Made Insurance

Claims-made malpractice insurance provides coverage if the policy is in effect both when the incident took place AND when the claim is filed. If a claim is filed after the end of the policy date, the claim is NOT covered. With a claims-made policy, you need tail malpractice insurance, which is a separately purchased insurance policy or endorsement, to make sure you have full protection.

2. Occurrence Insurance

Occurrence malpractice insurance provides coverage for incidents that occurred during the policy year, regardless of when a claim is reported to the carrier. Occurrence policies are more costly at the start of the policy, but the rate generally stays the same for the length of the policy, and there is no need for tail coverage when the policy ends.

3. Tail Insurance

Since most malpractice insurance policies are underwritten on a claims-made basis, you will be exposed to a lawsuit if a former patient files a claim against you and you do not secure tail coverage.

Tail insurance covers you for a specific time period. Your new employer’s policy is not going to cover you for prior acts of a former practice, hence tail coverage is needed.

When you are preparing to leave your employer, they may offer you the option to purchase tail insurance through your current carrier. While convenient, this policy is usually more expensive than if you seek tail coverage options elsewhere.

An independent broker like MEDPLI knows that during this time of transition, you have a lot on your plate. Our friendly brokers do all of the work for you to find you a tail policy at a great price.

Let a MEDPLI Broker Help You Choose the Best Policy for Your Practice

Every surgeon’s situation is unique, so we recommend a conversation with a MEDPLI insurance broker to gain an understanding of your unique scenario.

Your MEDPLI insurance broker will explain the benefits and limitations of each type of medical malpractice insurance to ensure you get the right type and amount of coverage for your bariatric specialty.

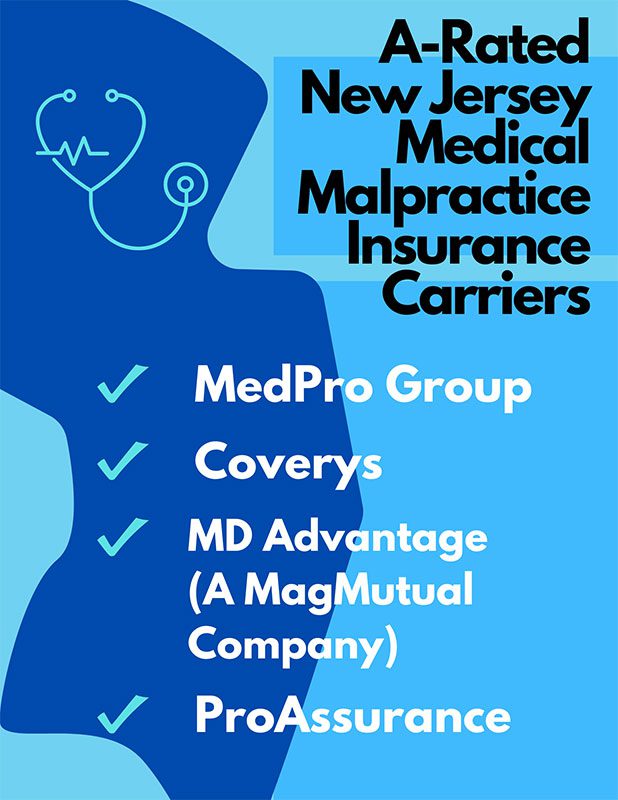

Get Quotes from A-Rated Carriers Serving New Jersey Bariatric Surgeons

MEDPLI insurance brokers will obtain quotes from medical malpractice insurance from carriers rated “A” by A.M. Best for their long-term financial solvency and robust legal support of policyholders. The top carriers in New Jersey include:

Why Bariatric Surgeons Are Classified as High Risk by Medical Malpractice Insurance Companies

When it comes to malpractice insurance, being classified as high risk generally means that the cost of medical malpractice insurance will be higher for bariatric surgeons than other lower-risk specialties.

Medical malpractice insurance underwriters classify bariatric surgery as a high-risk specialty because of the surgical side effects and complications that commonly lead to allegations of malpractice.

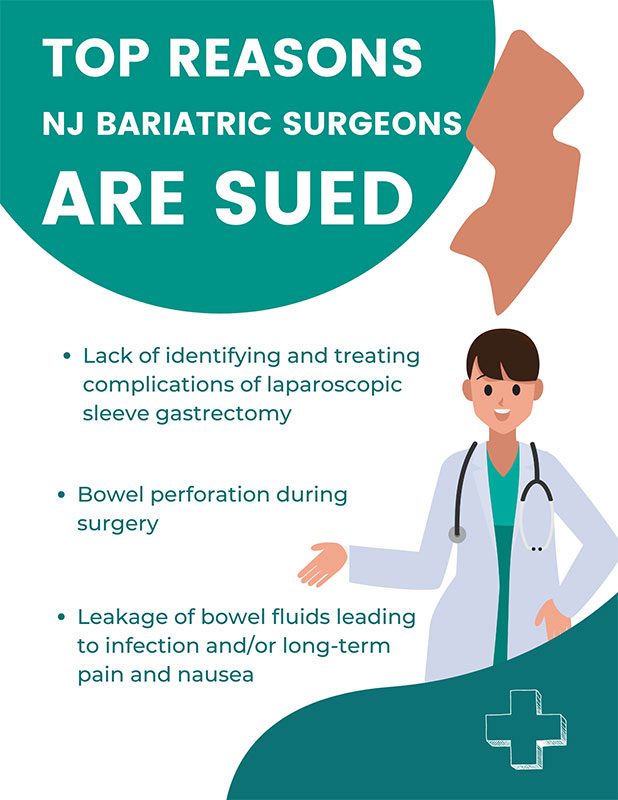

Top Reasons Why New Jersey Bariatric Surgeons Are Sued

A review of malpractice claims data by “A” rated malpractice insurance carrier MedPro Group found that improper surgical performance, poor management of surgical patients, diagnostic errors, and poor doctor/patient communication contributed to the risks of bariatric surgery, including:

And according to a 2022 closed claim registry report by the ASMBS, New Jersey bariatric surgeons have been sued for malpractice most often for the following reasons:

One of the most important ways that any surgeon can reduce their risk of a lawsuit is by implementing a comprehensive risk management strategy to proactively prevent claims.

New Jersey’s Medical Malpractice Insurance Legislation

Consulting with a MEDPLI insurance broker who understands the complexities of New Jersey’s medical malpractice laws will ensure that your bariatric practice is protected with the right amount of medical malpractice insurance coverage.

New Jersey’s Damage Caps on Medical Malpractice Lawsuits

In 2023 there are no caps on payouts for economic and non-economic damages in medical malpractice lawsuits. In any injury case, punitive damages are limited to $350,000 or five times the amount of compensatory damages, whichever is greater. However, punitive damages are rare partly because they require proof that the defendant acted with “actual malice” or a “wanton and willful disregard” toward injury.

New Jersey’s Statute of Limitations for Medical Malpractice Claims

According to state law, the conditions for filing a medical malpractice lawsuit in New Jersey in 2023 are:

Bariatric Surgeon Medical Malpractice Outcomes in New Jersey

With no caps on economic and non-economic damages in New Jersey, bariatric surgeons are more vulnerable to personal financial loss if they have inadequate medical malpractice coverage.

In 2022, the total medical malpractice payout in New Jersey was $146,784,000.

The following examples of New Jersey medical malpractice lawsuits found in favor of the plaintiff, or paid as a settlement, show the critical need for bariatric surgeons to have more than adequate liability coverage:

Jury Awards $1.1 Million to Bariatric Surgery Patient

A male patient died from a blood clot that traveled to his lung four days after gastric bypass surgery. The malpractice claim alleged that the bariatric surgeon failed to provide sufficient blood-thinning drugs after surgery, failed to perform follow-up tests after an inconclusive ultrasound, and discharged the patient prematurely. The jury awarded $1.1 million to the patient’s estate.

Bariatric Surgery Case Settled for $2.2 million

A 60-year-old male patient suffered a perforated esophagus during gastric band surgery. After being rushed to a nearby hospital for a thoracotomy, he suffered complications of renal failure, sepsis, and acute respiratory distress. This resulted in nerve damage to the patient’s feet, impaired short-term memory, and difficulty eating and drinking. The patient lost his job and was unable to find new work because of his physical and mental conditions.

Even the Best Bariatric Surgeons In New Jersey Need Protection From Malpractice Lawsuits

Most surgeons face at least one medical malpractice lawsuit brought forth by a patient throughout their career, so it’s essential to be covered when it happens to you. In addition to damages awarded to the plaintiff, having medical malpractice insurance assures that your legal costs will be covered regardless of whether the case is won or lost.

How MEDPLI Brokers Help Bariatric Surgeons Save Time and Money on Medical Malpractice Insurance

Although previously among the highest in the country, New Jersey’s medical malpractice insurance rates have become more stable and affordable. However, working with MEDPLI as your only trusted broker takes the guesswork and effort out of trying to get the right coverage at the best rate on your own. We help you save time and money by:

MEDPLI insurance brokers are ready to help you navigate the complexities of New Jersey’s medical malpractice laws and secure the right amount of coverage for your bariatric surgical practice. From submitting your application, obtaining the best rates for new policies and renewals from “A” rated carriers and more, MEDPLI is the only medical malpractice insurance broker you’ll ever need.