Georgia Neurosurgeons Are Pioneering Advanced Procedures

Twenty of Georgia’s top-ranked neurosurgeons practice in Atlanta, according to healthcare research firm Castle Connolly in its “Top Doctors” resource for patients seeking best-in-class healthcare. Georgia is also a destination for advanced neurosurgical procedures, such as cervical artificial disc replacement and stereotactic radiosurgery.

However, these and other neurosurgical innovations are highly complex procedures that carry some risk of iatrogenic patient injuries and complications.

That’s why Georgia neurosurgeons need robust medical malpractice insurance.

As your only trusted broker, MEDPLI will help you find the right coverage at the best rate in Georgia.

Get A Quote

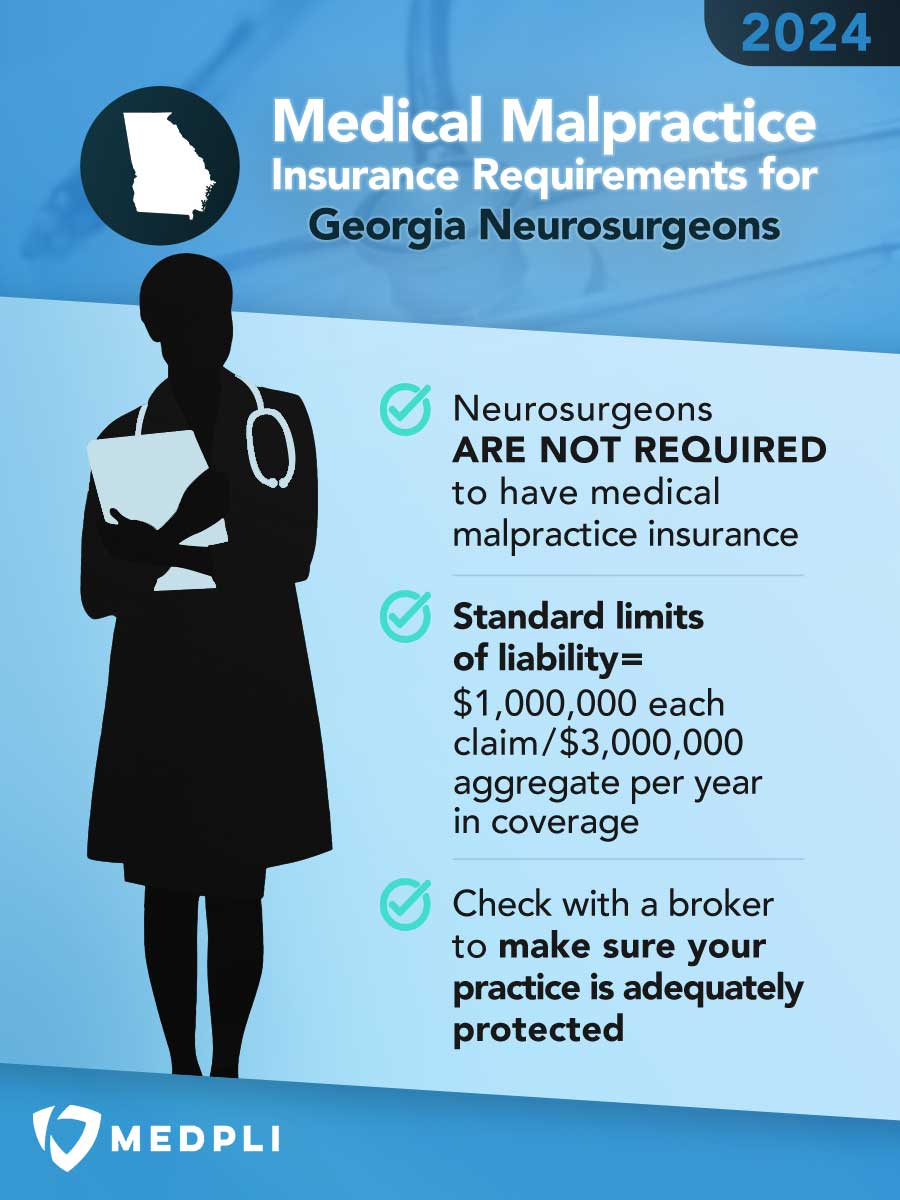

Medical Malpractice Insurance Requirements for Georgia Neurosurgeons

Georgia neurosurgeons are not legally required to carry medical malpractice insurance. The standard limits of liability in Georgia are $1,000,000 Each Claim / $3,000,000 Aggregate per year in coverage.

Cost of Medical Malpractice Insurance for Georgia Neurosurgeons

Each insurance carrier uses its own proprietary methods of setting the cost of medical malpractice insurance for neurosurgeons. Carriers consider factors such as practice location, surgical specialty, and past claims history.

The following are approximate medical malpractice insurance premium rates for neurosurgeons across all Georgia areas:

| Specialty | Approximate Claims Made Rate | Approximate Tail Rate | Approximate Occurrence Rate |

|---|---|---|---|

| Neurosurgery | $80,000 | $160,000 | $90,000 |

*Using the GA standard limits of $1,000,000 Each Claim / $3,000,000 Aggregate per year in coverage

Actual pricing will vary depending on your experience, claims history, and overall risk profile. The above estimates do not include discounts. Be sure to ask your MEDPLI insurance broker to seek all possible discounts you might qualify for.

Types of Professional Liability Insurance for Georgia Neurosurgeons

Here is a brief overview of the most common types of medical malpractice insurance for neurosurgeons in Georgia:

1. Claims Made Insurance

Claims-made malpractice insurance provides coverage if the policy is in effect both when the incident took place AND when the claim is filed. If a claim is filed after the end of the policy date, the claim is NOT covered. With a claims-made policy you need tail malpractice insurance, which is a separately purchased insurance policy or endorsement, to make sure you have full protection. Learn more about claims-made insurance here. Claims-made insurance policies “step up” as they mature, so the first year rate is lower than subsequent years.

2. Occurrence Insurance

Occurrence malpractice insurance provides coverage for incidents that occurred during the policy year, regardless of when a claim is reported to the carrier. Occurrence policies are more costly at the start of the policy, but the rate does not “step up”, and there is no need for tail coverage when the policy ends.

3. Tail Insurance

Since most malpractice insurance policies are underwritten on a claims-made basis, you will be exposed to a lawsuit if a former patient files a claim against you and you do not secure tail coverage. When you are preparing to leave your employer, you should seek tail coverage options with an independent broker like MEDPLI. Tail insurance covers you for a specific time period. The new employer’s policy is not going to cover you for prior acts of a former practice, hence tail coverage is needed. Read more about tail malpractice insurance.

Let a MEDPLI Broker Help You Choose the Best Policy for Your Practice

Every medical specialist’s situation is unique, so we recommend a conversation with a MEDPLI insurance broker to discuss the unique needs of your Georgia practice. Your MEDPLI insurance broker will explain the benefits and limitations of each type of medical malpractice insurance plan to ensure you get the right type and amount of coverage for your neurosurgery specialty.

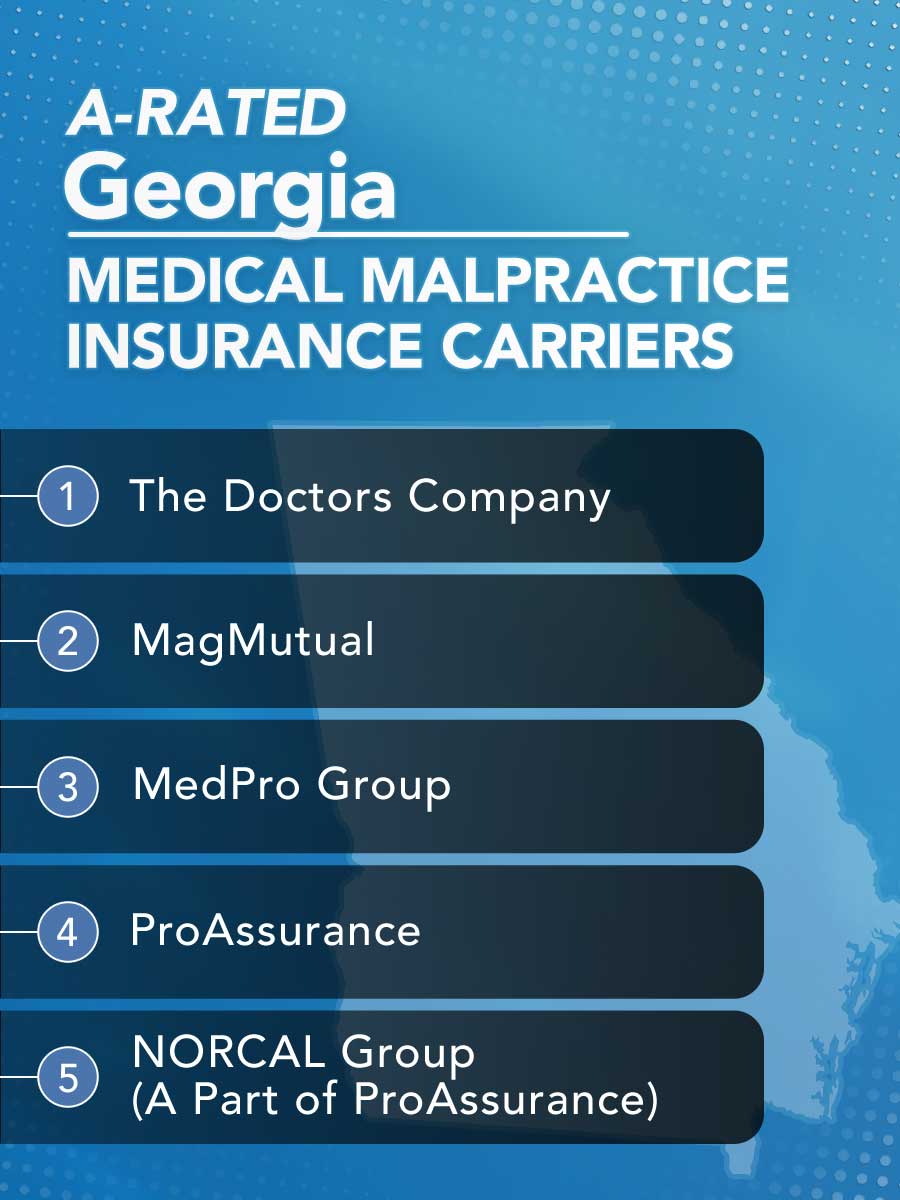

Get Quotes from A-rated Carriers Serving Georgia Neurosurgeons

MEDPLI insurance brokers will seek quotes from medical malpractice insurance from carriers rated “A” by A.M. Best for their long-term financial solvency and robust legal support of policyholders. Some of the top carriers for Georgia neurosurgeons include:

Why Neurosurgeons Are Classified as High Risk by Medical Malpractice Insurance Companies

Medical malpractice insurance underwriters classify neurosurgery as a high-risk because of the potential for patient outcomes with severe permanent injury or death. Statistics published in an article in The Journal of Neurosurgery indicate that nearly 20% of all practicing neurosurgeons in the U.S. are named as defendants in malpractice lawsuits each year.

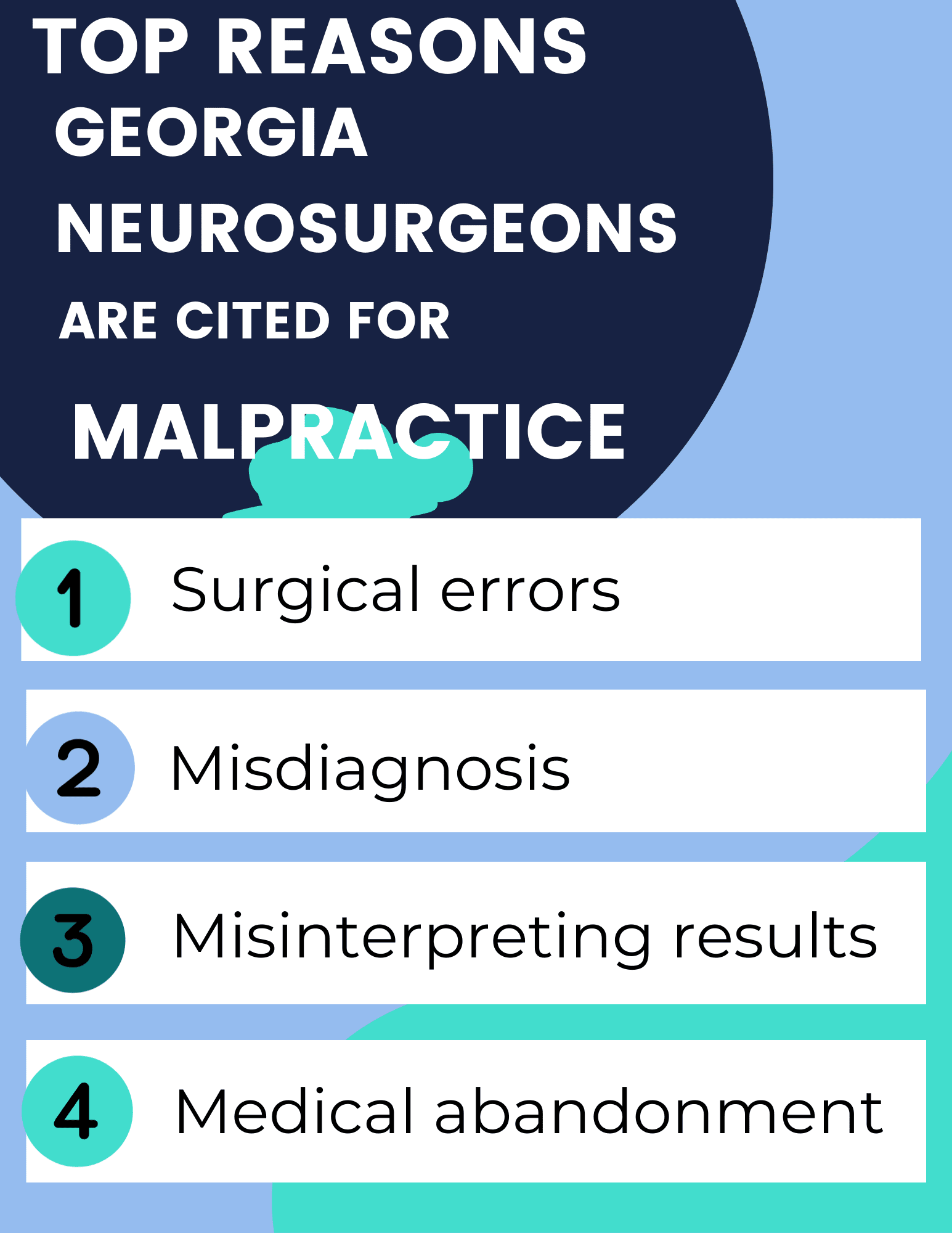

Top Reasons Why Georgia Neurosurgeons are Sued

According to a review of neurosurgery medical malpractice claims data by “A” rated malpractice insurance carrier MedPro Group , more than half of the cases cited allegations of patient injuries including pain, nerve damage, mobility loss, and the need for additional surgery related to these specific procedures:

In addition, some of the most often cited allegations in Georgia’s neurosurgery medical malpractice cases include:

Neurosurgeons can reduce their risk of a malpractice lawsuit by implementing a comprehensive risk management strategy. For tips on fine tuning your risk management strategy, check out our Neurosurgeons Guide To Managing Malpractice Risk.

Georgia’s Medical Malpractice Insurance Legislation

Consulting with a MEDPLI insurance broker who understands the complexities of Georgia’s medical malpractice laws will ensure that your neurosurgery practice is protected with the right amount of coverage.

Georgia’s Damage Caps on Medical Malpractice Lawsuits

Georgia law does not place a limit on economic damages recoverable from a medical malpractice claim, including compensation for healthcare costs, rehabilitation, ongoing medical care, lost wages, lost earning capacity, and other economic losses.

However, Georgia law still caps non-economic damages in medical malpractice cases at $250,000. In rare cases, if the claimant can show that the medical professional “acted with egregious negligence or intentional malice”, the court has the ability to raise the non-economic damage limit.

Georgia’s Statute of Limitations for Medical Malpractice Claims

Generally, the amount of time a person has to file a medical malpractice lawsuit is two years. In some instances, that time can be extended:

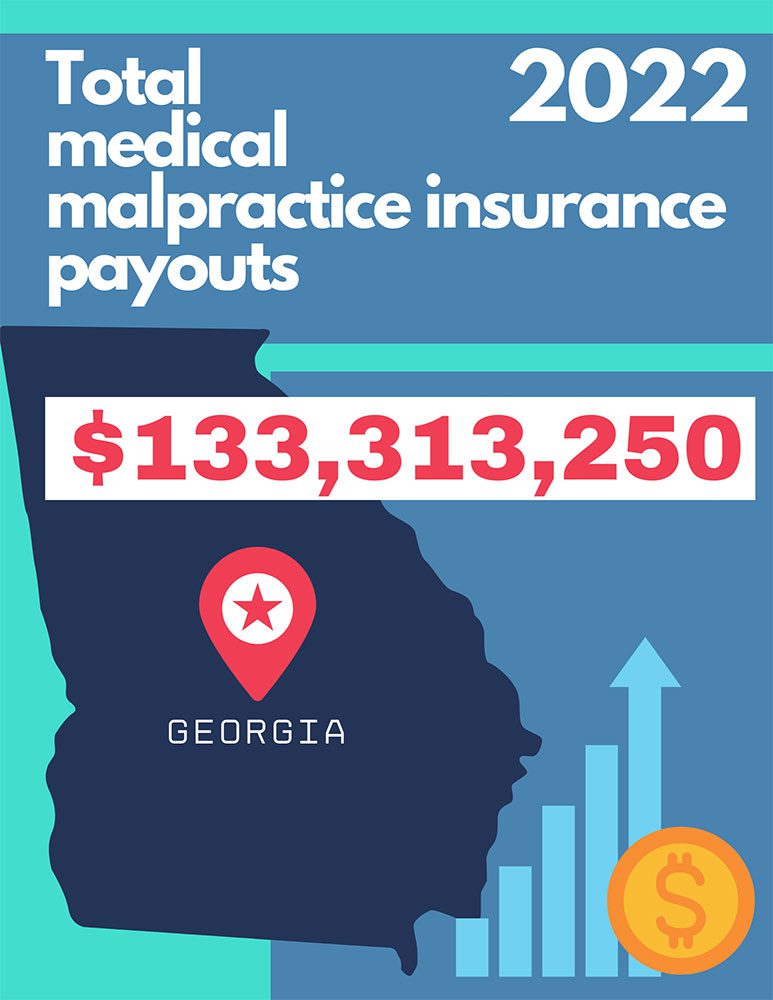

Neurosurgery Medical Malpractice Outcomes in Georgia

With no cap on economic damages, and a $250,000 cap on non-economic damages, neurosurgeons in Georgia are more vulnerable to personal financial loss if they don’t have strong medical malpractice coverage.

The total medical malpractice payout in Georgia was $133,313,250 in 2022.

The following examples of Georgia medical malpractice lawsuits found in favor of the plaintiff, or paid as a settlement, show the critical need for neurosurgeons to have robust liability coverage:

Jury Awards $4.5 Million

A Georgia jury found in favor of a patient who suffered worse and unrelenting back pain after surgery for implementation of a spinal cord stimulator device. The plaintiff alleged that the surgeon had implanted the device incorrectly, resulting in erosion of the lead anchors.

$2.2 Million Settlement

A 52-year-old patient suffered post-surgery permanent quadriplegia after an unsuccessful anterior cervical discectomy and fusion procedure. The plaintiff alleged that the surgeon was negligent in failing to order an emergency MRI to determine the cause of the paralysis, and failing to perform an emergency decompression surgery.

How MEDPLI Brokers Help Neurosurgeons Save time and Money on Medical Malpractice Insurance

Working with MEDPLI as your trusted broker takes the guesswork and effort out of trying to get the right coverage at the best rate on your own. We help you save time and money by:

MEDPLI insurance brokers are ready to help you navigate the complexities of Georgia’s medical malpractice laws and secure the right amount of coverage for your neurosurgery practice. From submitting your application, obtaining the best rates for new policies and renewals from “A” rated carriers, and more, MEDPLI is the only medical malpractice insurance broker you’ll need.