Growing Demand for MedSpa Services Increases Liability

The expanding MedSpa industry means more treatments, more locations, and a higher risk of malpractice claims.

*According to the American MedSpa.*

*According to the American MedSpa.*

*According to the American MedSpa.*

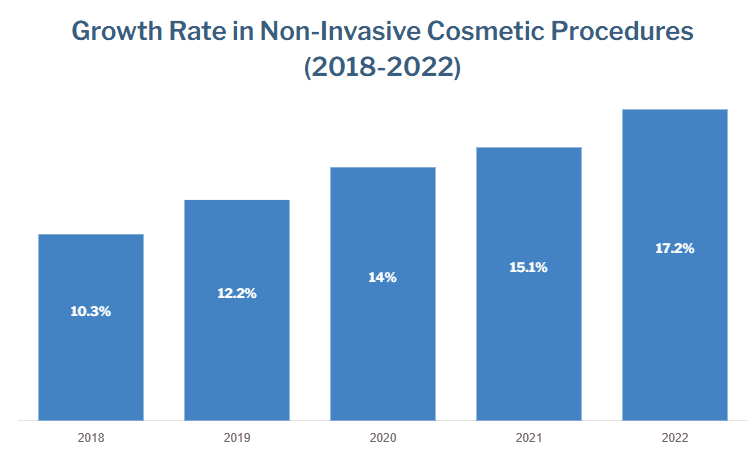

Non-invasive cosmetic procedures have grown steadily in recent years, with double-digit growth every year since 2018 and a record 17.2% jump between 2021 and 2022.

Source: ambwealth

Custom Medical Malpractice Coverage for ALL MedSpa Employees:

Medical Spa Malpractice Claims Often Involve:

Custom Medical Malpractice Coverage for ALL MedSpa Employees:

Medical Spa Malpractice Claims Often Involve:

U.S. States with the Highest Concentration of MedSpas: California (11.5%), New York (10%), Florida (8.8%) and Texas (7.6%).

*According to the American Med Spa Association

How Much Does MedSpa Malpractice Insurance Cost?

While actual premiums will depend on the specific application details and the insurance carrier’s underwriting process, most MedSpa medical malpractice insurance policies range from $5,000 to $15,000. (These estimates are for informational purposes only.)

Medical malpractice insurance rates for medical spas vary greatly based on the business’s unique risk profile and other factors, such as:

Get a Certificate of Insurance in 3 Easy Steps

- 1

Onboarding

We assess your needs and clarify liability requirements for each pending contract. - 2

Application Management

We handle the application process by submitting paperwork to multiple carriers, evaluating quotes, and presenting the best options. - 3

Select a Policy

After you choose a policy, we finalize coverage with the carrier and promptly provide your Certificate(s) of Insurance.

Growing Demand for MedSpa Services Increases Liability

Our brokers customize policy terms according to state-specific codes & requirements

States We Work In:

A Stress-Free Process

Save Time & Money

On average, MEDPLI saves clients over 20% on insurance premiums. We analyze multiple policies and A-rated providers, so you don’t have to.

Healthcare Industry Expertise

We exclusively broker medical malpractice insurance, entirely focused on the coverage needs of healthcare providers.

Local Customer Service

Your dedicated U.S.-based broker is available by phone whenever you have questions.

Ongoing Support

As your MedSpa evolves, we keep you covered with proactive policy consultations & updates.

What MEDPLI Clients Say

“When I started my own practice, I had to deal with transferring my coverage from my work as an independent contractor to my new private practice. MEDPLI helped me navigate all the paperwork and red tape. There are many choices when it comes to malpractice policies and insurance brokers, but if you want an experienced broker that makes it easy to get the right coverage at the best price, then I highly recommend working with MEDPLI.”

“When I needed a new insurance policy for my orthopedic surgery practice in Austin, Texas I contacted MEDPLI. Max and the rest of the team were helpful and knowledgeable. They responded to all of my questions quickly, but most importantly, they were honest and truly had their clients’ best interest in mind. If you’re looking for an experienced independent broker who can find you the most competitive price for malpractice insurance for your practice, I definitely recommend MEDPLI.”

Medical Malpractice Insurance for MedSpas FAQ

With rising premiums and payouts, MEDPLI is your best ally.

Don’t settle for inadequate coverage or unfair rates.